Economic commentary provided by Alberta Central Chief Economist Charles St-Arnaud. This report includes regional details for Alberta.

Bottom line

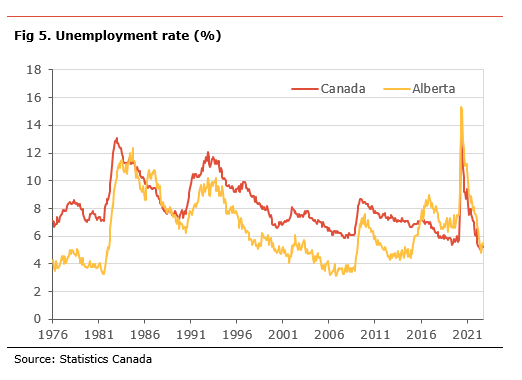

Today’s Labour Force Survey data suggest the labour market in Canada continues to move sideways. The decline in the unemployment rate continues to signal that the labour market remains very tight despite some easing in recent months, something the Bank of Canada is monitoring closely.

Comments from Governor Macklem this week made it clear that the BoC believes further increases in the policy rates are needed and a stalled labour market is unlikely to change that. As we have explained on numerous occasions, the Bank of Canada needs to slow growth and create some excess capacity in the economy to fight inflation. This will likely lead to a rise in the unemployment rate and to job losses. With that in mind, a weakening of the labour market should be expected in the coming months.

We believe the anemic labour market is unlikely to sway the Bank of Canada, as the central bank remains focused on inflation. As such, the outlook for the policy rate remains dependent on incoming inflation numbers. We continue to believe that the BoC will hike its policy rate by 50bp in October.

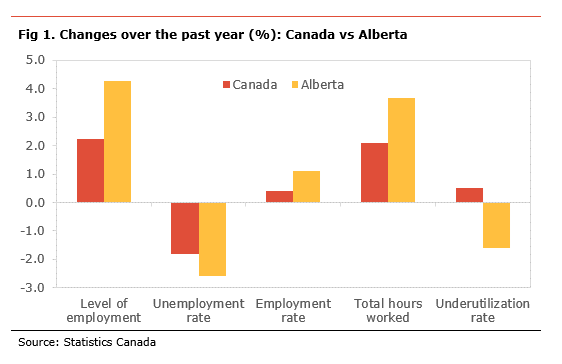

Alberta also saw a small increase in employment in September. However, the unemployment rate rose slightly to 5.5%, as more workers returned to the labour market. Over the past year, Alberta’s labour market has outperformed the rest of the country. However, it is important to note that the low unemployment rate is partly the result of workers having left the labour market, as shown by the participation rate remaining below its pre-pandemic level. As such, if the participation rate was the same as before the pandemic, the unemployment rate in the province would be much higher at 7.2%.

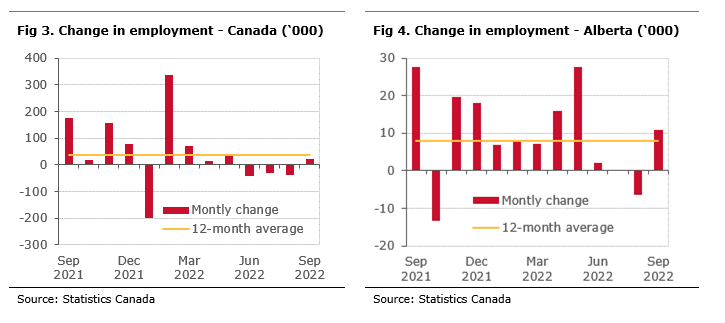

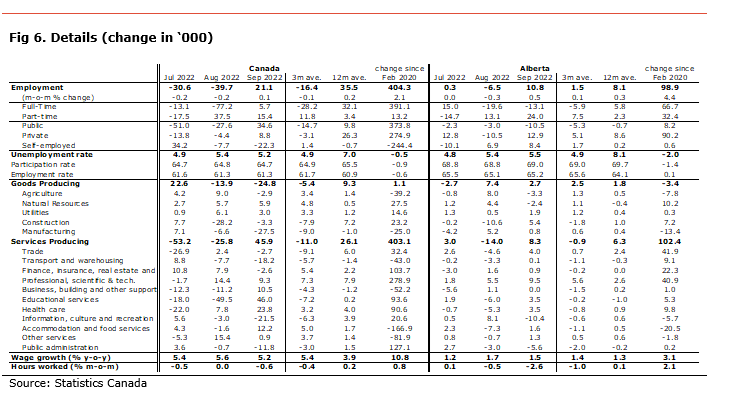

Employment rose by 21.1k in September, after three consecutive months of decline with a cumulative job loss of 113.5k. With the increase in employment, the unemployment rate decreased to 5.2%. The decline was also the result of a reduction in the participation rate to 64.7% from 64.8%. The participation is 0.9 percentage points (pp) lower than before the pandemic, as workers left the labour force. If the participation was the same as before the pandemic, the unemployment rate would be 6.1%. The employment rate, the share of the population holding a job, remained unchanged at 61.3%, still below its pre-COVID level.

The details show that the job gains in September were in both full-time (+5.7k) and part-time jobs (+15.4k). In addition, the rise in employment was mainly in the public sector (+35k) and private sector jobs (+9k), while there was a decline in self-employed (-22k).

On an industrial level, the increase in employment was concentrated in the service sector (+46k), while there was a decline in the goods-producing sector (-25k).

The details in the good-producing sector show that most of the job losses were in manufacturing (-27.5k). There were also some small declines in construction (-3k) and agriculture (-3k). Those declines were partly offset by gains in natural resources (+6k) and utilities (+3k).

The gain in the service industry was mainly in education (+46k, reversing the weakness in August), health care (+24k), accommodation and food (+12k) and business, building and other support services (+11k). These gains were partly offset by losses in information, culture and recreation (-21.5k), transport and warehousing (-18k), and public administration (-12k).

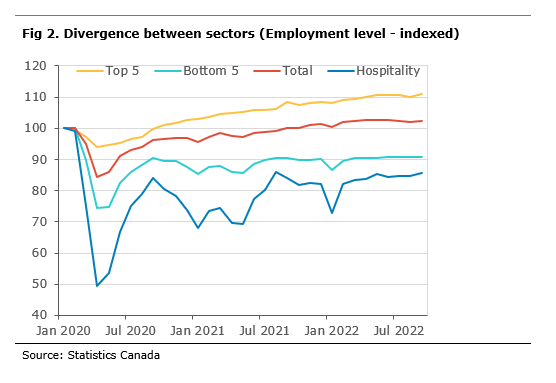

Despite the overall level of employment being above its pre-COVID level, only 10 out of 16 industries have a level of employment above its pre-pandemic level. The lagging sectors are: agriculture, manufacturing, transport and warehousing, business, building and other support services, accommodation and food services, and other services. Employment in the accommodation and food services is still about 15% below its pre-COVID-19 level, the worst-performing industry.

In Alberta, employment increased by 10.8k in September, reversing the decline seen in August. Despite the gain in employment, the unemployment rate rose to 5.5% from 5.4%. This is the result of an increase in the participation rate to 69.0% from 68.8%. The participation rate in the province is still 1.4 percentage points (pp) below its pre-pandemic level suggesting many workers are remaining on the sidelines. If the participation rate was at the same level as before the pandemic, the unemployment rate in the province would be 7.2%. The employment rate, the share of the population holding a job, edged higher to 65.2% from 65.1%, on par with its pre-pandemic level.

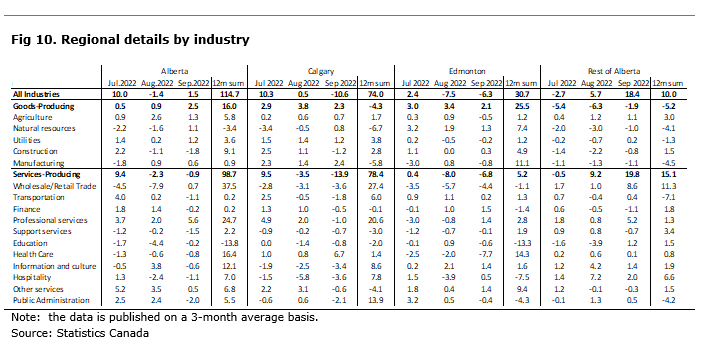

The job gains in Alberta were in both the goods-producing sector (+3k) and the service sector (+8k). The gains in the goods-producing industry were in construction (+5k), utilities (+2k) and manufacturing (+1k). These gains were partly offset by a sizeable decline in agriculture (-3k) and natural resources (-2k).

The job performance in the service sector was mixed. Most sectors saw job gains, with the exception of information, culture and recreation (-10k) and public administration (-6k). The increase in employment was led by professional, scientific and technical (+9.5k), trade (+4k), education (+3.5k) and health care (+3.5k).

Despite overall employment being above its pre-COVID level, only 11 out of 16 industries have a level of employment above its pre-pandemic level. The lagging industries are: agriculture, manufacturing, information, culture and recreation, accommodation and food services, and other services. Employment in the accommodation and food services sector, the worst-hit industry, remains about 20% below its pre-COVID-19 level. Employment in the manufacturing sector is more than 10% below its pre-covid level, significantly underperforming the rest of the country.

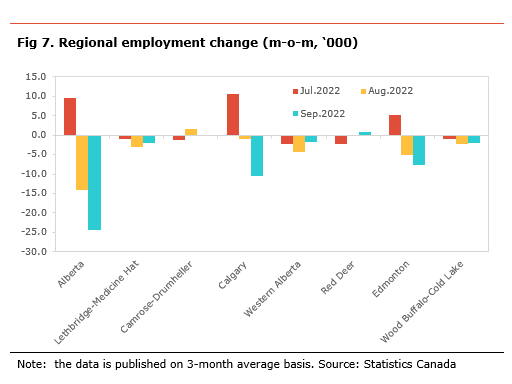

On a regional basis[1], the data is published on a three-month average basis (see table below). Over the past three months, the province lost 24.4k jobs, with employment declining in all regions except for Red Deer (+1.5k). The decline in employment was mainly seen in Calgary (-10.4k), Edmonton (-7.7k), Lethbridge-Medicine Hat (-2.1k), and Wood Buffalo-Cold Lake (-2.0k).

Compared to the pre-pandemic levels, Calgary (+9.6%) and Edmonton (+5.8%) are the only regions where employment is higher. In comparison, employment in Wood Buffalo-Cold Lake (-5.6%), Camrose-Drumheller (-4.6%), and Red Deer (-2.9%) are still well below their pre-covid level.

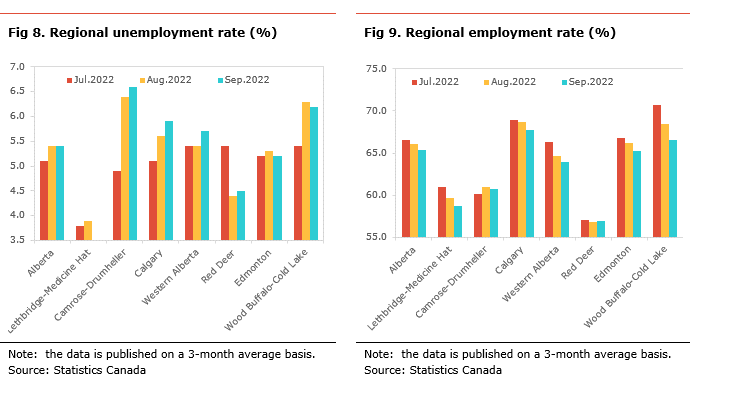

The unemployment rate for the province was unchanged at 5.4%, but the regional performance was mixed. The unemployment rate increased in Western Alberta (+0.3pp), Calgary (+0.3pp) and Camrose-Drumheller (+0.2pp), while it declined in Lethbridge-Medicine Hat (-0.6pp).

The unemployment rate is the highest in Camrose-Drumheller (6.6%), Wood Buffalo-Cold Lake (6.2%), and Calgary (5.9%). It is the lowest in Lethbridge-Medicine Hat (3.3%), Red Deer (4.5%), and Edmonton (5.2%).

The employment rate for Alberta declined to 65.3% from 66.0%. The deterioration was broad-based. The employment rate decreased the most in Wood Buffalo-Cold Lake (-1.9pp), Calgary (-1.0pp), Edmonton (-0.9pp) and Lethbridge-Medicine Hat (-0.9pp). The only regions where the employment rate is above its pre-covid one are Calgary (+2.8pp) and Edmonton (+0.4pp).

[1] All the numbers are expressed as three-month average of the non-seasonally adjusted number.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.