Economic insight provided by Alberta Central Chief Economist Charles St-Arnaud.

Bottom line

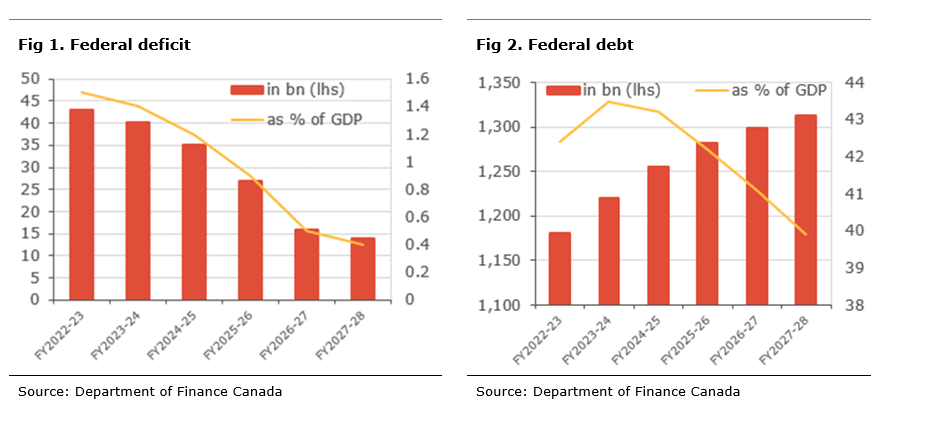

The 2023 Budget can be summarized as: bigger deficits in the coming years with no plans to balance the fiscal books. As such, the deficit for FY2023-24 is expected to reach $40.1bn (1.4% of GDP), about $10bn bigger than expected in the Fall Economic Statement. Almost half of the deficit increase is due to increased spending and the other half to the expected slower economic growth in 2023. Moreover, while declining gradually, the deficit estimates have been revised higher over the whole projection period. The upward revisions are even bigger when compared to last year’s Budget, suggesting a concerning trend despite remaining small relative to the size of the economy. In total, the federal government commits about $13bn in new spending in the current FY2022-23, $4.8bn in FY2023-24, $4.7bn in FY2024-25, for a total of new spending of about $43bn between now and FY2027-28.

The Budget also shows that the budgetary balance remains in deficit throughout the projection period, with a deficit of $14bn expected in FY2027-28 compared to a small surplus of $4.5bn in the Fall Economic Statement. As a result of the wider deficit, the federal debt is also expected to be higher at 43.5% of GDP in FY2023-24 and is also revised higher throughout the projection period but remains on a gradual declining trend. Moreover, the cost of servicing the debt relative to revenue is at its highest since 2012.

The lack of commitment to balancing the books and a wider deficit throughout the projection period is concerning, as it suggests that fiscal prudence may be slipping away. The continued increase in spending is a slippery slope, with the decline in the debt-to-GDP likely providing a false sense of comfort. Moreover, the pandemic has shown that an adverse economic shock can change fiscal trends rapidly. As such, there is a need to rebuild some fiscal capacity to respond to a negative shock by having a balanced budget and a faster reduction in the debt level to allow fiscal policy to respond better to shocks.

While the increase in spending in the Budget is modest, about 0.2% of GDP, it comes at a time when the Bank of Canada is trying to control inflation. The central bank already expressed some mild concerns in their latest minutes of its policy deliberations that government spending increased faster than potential. Hence, spending is growing fast and contributing to boost the demand side of the economy. While the increase in spending is unlikely to justify further monetary policy tightening, it somewhat hinders the BoC’s effort to bring back inflation to target.

For Alberta, the main focus will be on the measure to support investment to lower carbon emissions. The new tax credit for clean electricity is likely to support investment in wind and solar energy, gas-fired plants with carbon capture, and other sectors linked to electricity production. However, some are likely to be disappointed by the lack of enhancement to the tax credit for carbon capture, utilization and sequestration. This is likely to put further pressure on the provincial government to develop a complementary program.

Canada’s Finance Minister, Chrystia Freeland, released the 2023 Budget, showing an expected deficit of $43.0bn for the current fiscal year and of $40.1bn for FY2023-24. Moreover, the fiscal projection shows no plan to balance the fiscal book on the projection horizon. As a comparison, in the Fall Economic Statement (FES), the deficits were expected to be $36.4bn and $30.6bn in FY2022-23 and FY2023-24, respectively.

The higher deficits are partly the result of weaker nominal GDP growth and new spending measures, with new measures accounting for about half of the deficit. As such, new measures announced in the Budget are adding $4.8bn and $4.7bn to the deficit in FY2023-24 and FY2024-25, after adding $13bn in the current fiscal period.

The fiscal deficit is expected to narrow gradually to reach $14bn in FY2027-18. This is a big contrast to the FES, when a $4.5bn surplus was expected. The reversal to a negative balance is due to both lower nominal GDP and increased new measures.

The level of federal debt is expected to have reached $1,180.7bn or 42.2% of GDP in FY2023-24. This is higher than in the FES because of the higher deficit this fiscal year. While the debt-to-GDP ratio is expected to decline over the projection period, it remains higher than in the Fall update, with the debt-to-GDP ratio expected at 39.9% in FY2027-28 compared to 37.3% previously.

As a result of the increase in the debt level and continued higher interest rates, the public debt changes are expected to rise to 1.6% of GDP in FY2023-24. Relative to revenues, public debt charges are expected to represent almost 10% of revenues in FY-2023-24. This means that for each dollar of fiscal revenue, 10 cents need to be used to service the public debt. While this is lower than in the 1990s when it reached 37% of revenues, it is the highest since 2012, when debt-to-GDP was closer to 30% of GDP, but interest rates were lower.

The main focus of the Budget are the following:

- Affordability.

- The Budget contains a number of measures to improve affordability in the country. The main announcement on that front is the Grocery Rebate, which will provide targeted inflation relief to 11 million eligible households. This measure will take the form of a one-time GST credit. The cost of this measure is expected to be $2.5bn.

- The Federal government is also putting measures to crack down on “Junk Fees”, which include higher telecom roaming charges, event and concert fees, excessive baggage fees, and unjustified shipping and freight fees. Another measure has been a commitment from credit card companies, namely Visa and Mastercard, to lower the fees they charge small businesses.

- Healthcare. In total, the government is committing $30bn in new spending in this category.

- The government plans to provide an additional $198.3bn over the next ten years to healthcare. This includes the recently announced additional Canada Health Transfer.

- The Budget also includes $13.0bn over the next five years and $4.4bn ongoing to implement the Canadian Dental Care Plan, covering uninsured Canadians with an annual family income of less than $90,000.

- Low carbon future. The measures contained in the Budget are based on key principles: 1) we cannot regulate our way to net zero, 2) carbon pricing is a cornerstone our the policies to reach net zero, 3) capital expenditures will be key, as the country needs about $100bn in investment a year. Refundable tax credits remain the backbone of the government strategy.

- Introduction of a 15% refundable tax credit to support and accelerate investment in clean electricity. This included non-emitting electricity generation systems, abated natural gas electricity-fired electricity generation, stationary electricity storage systems, and equipment for the transmission of electricity between provinces and territories. This tax credit is open to private and public entities, including Crown corporations, Indigenous communities, pension funds, etc. The measured cost is expected to be $35bn.

- The Clean Hydrogen Investment Tax Credit announced in the 2022 Fall Economic Statement will be set between 15% and 40% depending on carbon intensity. This tax credit would cover both “blue” and “green” hydrogen production. However, given their residual emission, “blue hydrogen” projects are likely to receive a lower tax credit, according to comments from a government official.

- Budget 2023 also expands the Carbon Capture, Utilization, and Storage Tax Credit to cover some additional equipment.

- The Clean Technology Investment Tax Credit is expanded to include eligible geothermal energy systems, supporting the development of the technology.

- Improve the financing of investment in low-carbon solutions with the aim of crowding in private sector money. Canada Infrastructure Bank will invest at least $20bn to support the building of major clean electricity and clean growth infrastructure projects.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.