Economic insight provided by Alberta Central Chief Economist Charles St-Arnaud

Bottom line

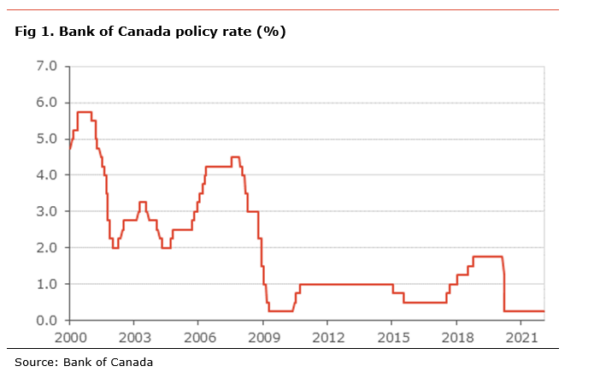

As we expected, the Bank of Canada (BoC) increased its policy rate by 25 basis points (bp) to 0.50% and continued the “reinvestment phase” of its quantitative easing program. The central bank also mentioned that further rate hikes will be needed and that the end of the reinvestment phase of the quantitative program (QE) will be considered at a later date.

What is clear in the BoC Statement is that risks to inflation have increased since the January meeting. The invasion of Ukraine has led to a sharp rise in commodity prices and could potentially exacerbate some of the supply chain issues, leading to further supply-induced inflationary pressures. In addition, the BoC notes that the Canadian economy looks more solid than previously thought.

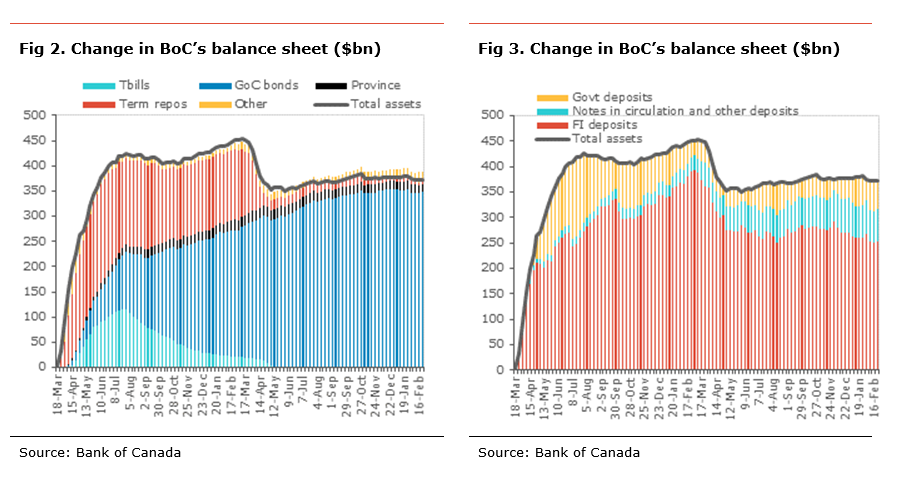

Overall, today’s BoC decision supports our view that we should see further rate increases at the April and June meeting, bringing the policy rate level to 1.00% by the summer and ending the year at 1.25%. As for the balance sheet, the BoC has expressed a preference for using rate hikes rather than reducing the balance sheet size (QT) to remove the policy stimulus. With this in mind, we wouldn’t be surprised if a decision regarding the end of the reinvestment phase of QE only comes after another round or two of rate hikes.

As widely expected, the BoC increased its policy rate by 25 basis points (bp) to 0.50%. In terms of forward guidance, the Governing Council also “expects interest rates will need to rise further”, signalling that more rate increases are to be expected in coming meetings.

The BoC also announced that it will continue the reinvestment phase of its QE programme, meaning that the size of its balance sheet will remain constant. This was in line with our expectations, but some market participants expected the announcement of a reduction in the size of the balance sheet or quantitative tightening (QT). The BoC provides the guidance that it will consider “to end the reinvestment phase and allow its holdings of Government of Canada bonds to begin to shrink” at a later date and that QT will be used to complement rate increases.

The BoC continues to see that “The timing and pace of further increases in the policy rate, and the start of QT, will be guided by the Bank’s ongoing assessment of the economy and its commitment to achieving the 2% inflation target.”

The BoC makes states that the invasion of Ukraine by Russia is a new source of uncertainty on both inflation and global growth. The risk is that the sharp rise in commodity prices and new supply chain disruptions could further fuel supply-induced inflationary pressures while causing a headwind to global growth.

The Boc notes that the global economy is evolving broadly in line with its most recent forecast, while the Canadian economy looks more robust than previously projected. As such, the BoC notes that despite a setback due to the Omicron variant, the “rebound from Omicron now appears to be well in train.”

The BoC continues to view the elevated inflation due to persistent global supply constraints and notes a broadening in price increases. The Bank continues to note that a large part of the inflationary pressures is due to a supply shock, citing poor harvests, higher transportation costs and the invasion of Ukraine as sources of upward pressures on prices. As a result, the BoC now expects inflation “to be higher in the near term than projected in January”, “increasing the risk that longer-run inflation expectations could drift upwards.”

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.