Economic commentary provided by Alberta Central Chief Economist Charles St-Arnaud.

Bottom line

Today’s release of the monthly GDP suggests that the Canadian economy started the year strong. As such, the strength in January and February is pointing to growth in the first quarter of 2023 at around 3% q-o-q ar., far from a contraction. This follows a period of weakness in the last quarter of 2022, as higher interest rates took a toll on rate-sensitive sectors.

Interestingly, sectors linked to consumer discretionary spending, namely retail trade, accommodation and food services, arts, entertainment and recreation, show strength. This is despite a loss in purchasing power due to high inflation and rising debt-service cost. This suggests that household spending is holding much better than initially expected, likely as a result of the strong labour market.

The resilience of the Canadian economy is likely to complicate the Bank of Canada’s job of bringing inflation back to its target. The Bank of Canada signalled at its latest meeting that it would keep its policy rate unchanged for some time to better assess the impact of previous rate hikes on the economy and inflation. However, with growth likely close to 3%, excess demand in the economy is growing, adding to inflationary pressures and raising the likelihood that further rate hikes will be necessary. Similarly, the tight labour market is supporting strong wage growth. However, the banking woes in the US and Europe suggest caution is warranted.

The Bank of Canada is likely at a crucial juncture and facing a significant dilemma. The central bank may have to choose between fighting inflation and hiking interest rates again or focusing on financial stability and keeping rates on hold.

For Alberta, the details available in the report suggest that economic activity outperformed the rest of the country in January due to a rebound in activity in the oil and gas sector. High energy prices have been a tailwind to the Alberta economy this year, but not as much as in the past (see Where’s the boom? How the impact of oil on Alberta may have permanently weakened).

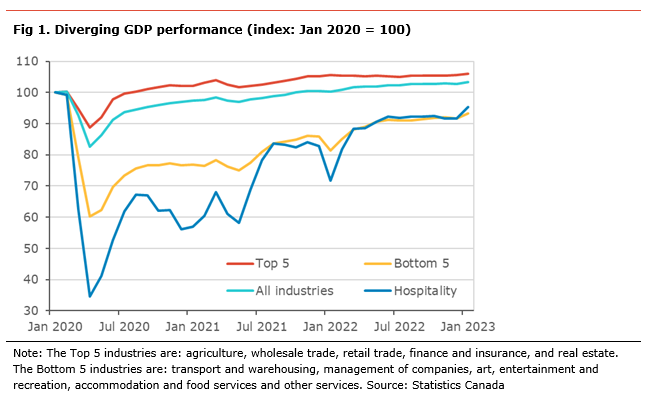

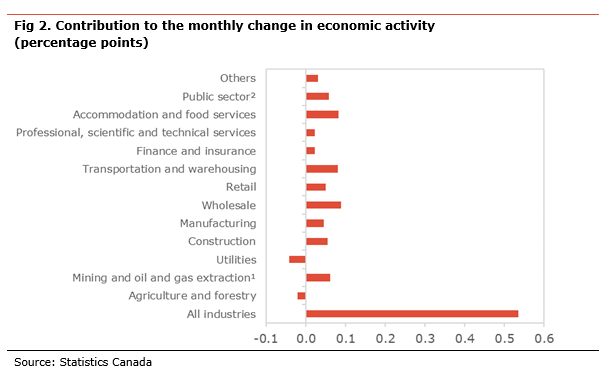

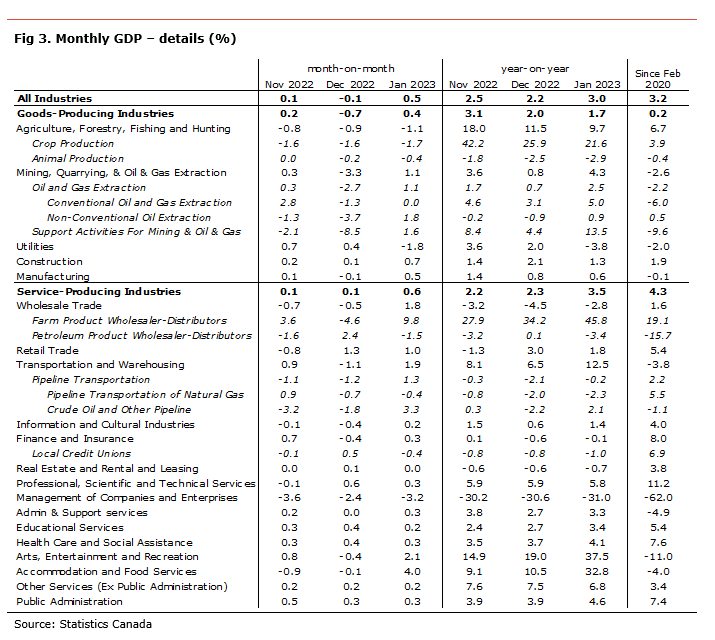

The monthly GDP rose by 0.5% m-o-m in January (+2.3% y-o-y). The details show that 17 out of 20 industrial sectors posted gains on the month. Despite the overall economy being 3.2 percentage points above its pre-pandemic level, 8 out of 20 industrial sectors still have economic activity below their pre-pandemic levels, namely natural resource extraction, utilities, manufacturing, transportation and warehousing, management of companies, administration and support services, arts, entertainment and recreation, and accommodation and food services.

Statistics Canada’s preliminary estimate suggests GDP for February rose 0.3% m-o-m. This suggests that growth in the first quarter of 2023 could be strong at around 3% q-o-q ar. depending on the strength in March. This would be the strongest quarterly growth since 2022Q2 and does not suggest that a recession is imminent.

The goods-producing side of the economy increased by 0.4% m-o-m in January. There was a sharp rebound in activity in natural resource extraction (+1.1% m-o-m), especially oil production, while activity in construction (+0.7% m-o-m) and manufacturing (+0.5$ m-o-m) was also robust. These increases were partly offset by declines in utilities (-1.8% m-o-m) and agriculture (-1.1% m-o-m).

The services-producing side of the economy rose 0.6% in January, the strongest since May 2022. The increase in activity was fairly broad-based, led by wholesale (+1.8% m-o-m), transportation and warehousing (+1.9% m-o-m), and accommodation and food services (+4.0% m-o-m). Management of companies (-3.2% m-o-m) was the only service industry showing a contraction.

For Alberta, there is no specific data in the report. However, we can make an assessment based on activity in some key industries specific to Alberta. The level of activity in the oil and gas sector, especially oil sands and support activities, increased sharply on the month. A decline in crop production has likely acted as a drag on growth. An increase in pipeline activity, especially gas pipeline, due to higher activity in oil pipelines, has provided further support. Overall, this means that the province’s economy likely outperformed the rest of the country in November.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.