Economic commentary provided by Alberta Central Chief Economist Charles St-Arnaud

Key takeaways

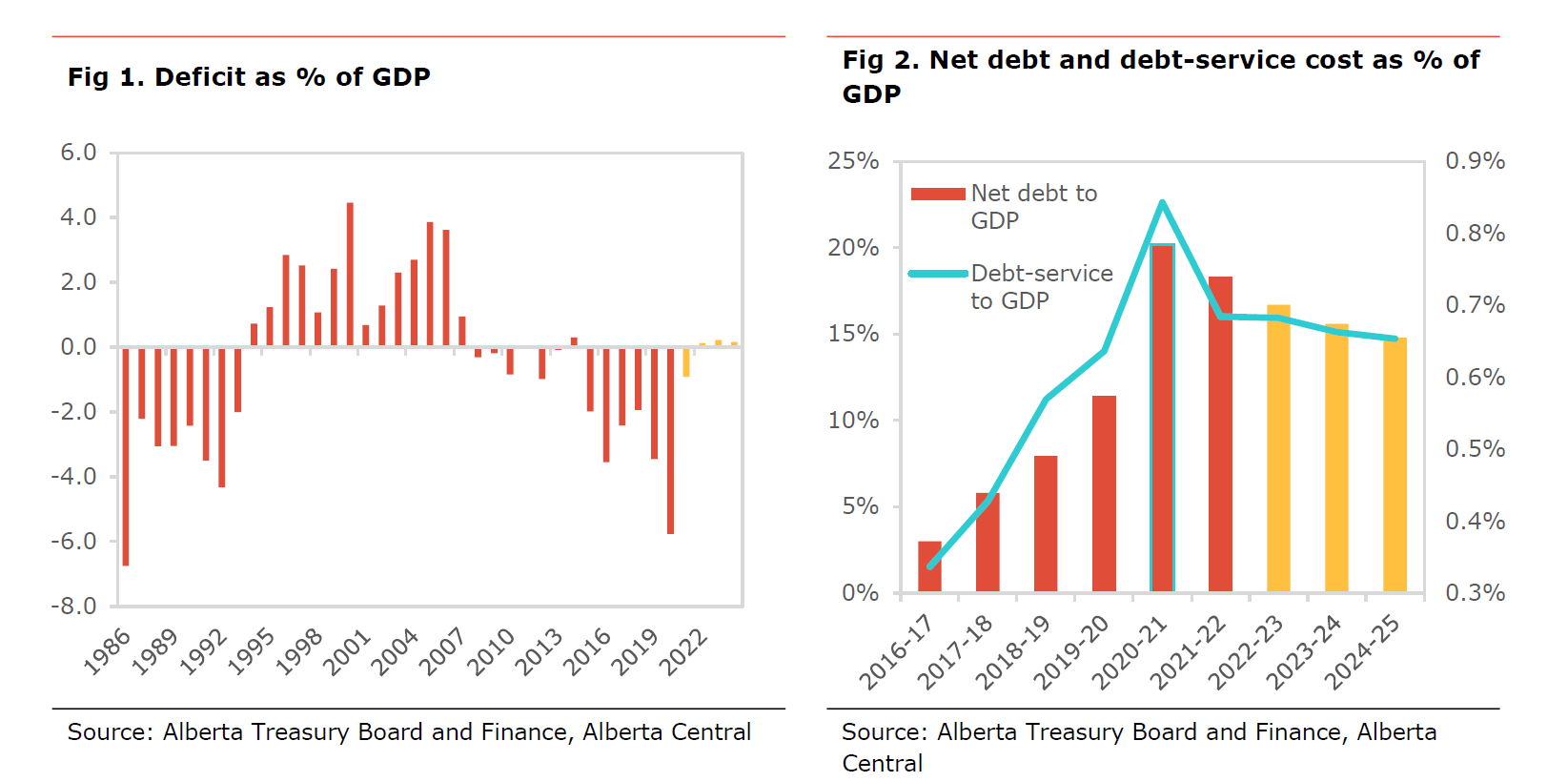

- A small surplus of $0.5bn is expected for FY2022-23, the first surplus since 2014, followed by surpluses of $0.9bn and $0.7bn in FY2023-24 and FY2024-25, respectively.

- The surplus for FY2022-23 marks a sharp improvement from the $3.3bn deficit expected in the November fiscal update.

- Revenues are expected to be $7.0bn higher than in the fiscal update. More than half of the higher revenues come from a jump in resources-linked revenues (+$4.0bn) and an increase in federal transfers of about $1.7bn.

- As a result of the small fiscal surplus, the province’s debt level is expected to ease gradually in the coming years, reaching 15% of GDP in FY2024-25 from 18% of GDP currently.

- Consequently, it is believed that the cost of servicing the debt will decline to slightly above 4% of the government’s revenues by FY2024-25, about 1% of GDP.

- Overall, it is a prudent budget based on the principle of “underpromise with the hope to over-deliver,” given the conservative revenue projections. It is likely that the surplus for FY2022-23 may be smaller than currently projected.

- The Alberta at Work program is a welcome initiative that should help bring more workers into employment and improve workers’ skills.

- However, the Budget lacks details on how the government plans to solve the issue of the mismatch between volatile revenues that depends on energy prices and expenses that depend on population growth.

Alberta’s Finance Minister, Travis Toews, delivered the fourth Budget of the current government, showing a projected surplus of $0.5bn for FY2022-23. This would be the first surplus since 2014 and comes after a significantly smaller than expected deficit of $3.2bn in FY2021-22.

The sharp improvement in the fiscal situation is mainly the result of revenues expected at $62.6bn, $7.0bn higher than in the November fiscal update. More than half of the stronger revenues ($7.0bn) come from resources revenues, with bitumen royalties $3.4bn higher than expected. In addition, an increase in transfers from the federal government, likely to fund the affordable daycare of about $1.7bn, is responsible for nearly a quarter of the higher revenues. A more robust economic recovery explains the rest of the improvement in revenues.

As revenues increase slightly faster than spending in the coming year, the deficit is projected to expand to $0.9bn in FY2023-24 and $0.7bn in FY2024-25.

As a result of the small surpluses and continued growth, the government’s net debt is expected to ease gradually to slightly below 15% of GDP by FY2024-25 from somewhat more than 20% of GDP in FY2020-21. As a direct consequence of the stabilization in the debt level, the cost of servicing the debt is expected to remain roughly constant at $2.7bn and reach about 0.4% of revenues in FY2024-25.

The Budget is based on conservative economic projections, especially when it comes to oil prices, with WTI oil prices expected to average $70 in FY2022-23, $69 in FY2023-24 and $66.5 in FY2024-25. The forecast for FY2022-23 is well below the level at which WTI has been trading so far this year. Moreover, as we showed recently, the value of Alberta oil production is reaching about $10bn per month, well above the levels seen in 2014.

The forecast is also below the consensus for most of the projection period. Bloomberg’s latest survey points to analysts expecting WTI to be $76 in 2022, $71 in 2023, $73 in 2024 and $72 in 2025.

As a result, we would not be surprised if the current fiscal year’s revenues are revised to the upside in the upcoming fiscal updates.

One important omission in the Budget is the lack of a precise plan on how to tackle the mismatch between volatile revenues that depend on energy prices, and expenses, which depend on the size of the population. The current boom in resource revenues would make this reform much easier than during the next downturn in oil. However, as shown in recent years, the risk is that a decline in oil prices could rapidly lead to a return to fiscal deficits.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.