Economic insight provided by Alberta Central Chief Economist Charles St-Arnaud.

Bottom line

The Bank of Canada’s Business Outlook Survey shows that business confidence remains elevated. However, it also shows that most firms face significant constraints to their sales, mainly resulting from labour shortages and supply-chain issues. In an effort to ease those bottlenecks, hiring and investment intentions are elevated.

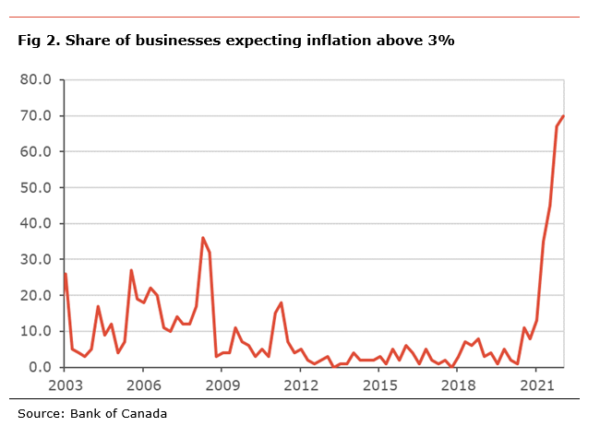

Moreover, the survey indicates rising inflation expectations, with a record number of firms expecting inflation to be above 3% over the next two years (fig. 2). In addition, a high proportion of firms expect to increase wages over the next year to attract and retain workers and provide some cost-of-living adjustments. Many firms also expect to increase their prices over the next year, passing the increased cost of inputs to customers.

Overall, the report shows that supply chain issues and labour shortages remain a major constraint on economic activity. In addition, the combination of solid demand, higher commodity and inputs prices, and supply bottlenecks are expected to continue to put upward pressures on economic activity. This report is another indication that inflation expectations are elevated and increasing.

The report solidifies our view that the BoC will need to address inflation aggressively (see). We now believe that the BoC will accelerate the path for its policy rate increases and hike by 50bp at next week’s meeting, bringing the official rate to 1.00%.

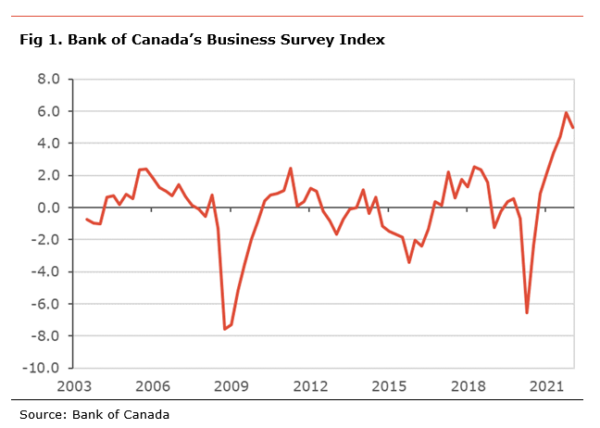

Business sentiment eased slightly from its highest level on record. The Bank of Canada’s Business Outlook Survey for 2022Q1, an important input in the BoC’s rate decision process, shows a small deterioration in business sentiment, decreasing to 4.98, from 5.9. The survey was conducted during the second half of March, therefore, after the invasion of Ukraine by Russia.

The details show that future sales indicators, including order book, advanced bookings, sales inquiries, etc., declined to 39 from close to its highest level on record. However, on balance, firms expect future sales volume to be lower. This indicates that demand remains strong but that businesses expect supply-side issues to continue to constrain the level of sales. Moreover, it could also indicate that sales are expected to normalize after being boosted by the reopening of the economy.

Hiring intentions remain elevated, with 63% of firms on balance saying they expect their level of employment to be higher over the next 12 months. As such, 40% of firms report that labour shortages are holding back their sales, with 62% of businesses reporting an intensification of the labour constraint.

Capital expenditures are expected to increase over the next 12 months, with 42% of firms saying they intend to increase investment over the next year, slightly lower than at the end of 2021. The strong investment intentions are broad-based across sectors and regions and directly result from continued supply constraints.

The share of firms reporting some or significant difficulty to meet an unexpected increase in demand rose to 81%, its highest on record. As such, businesses reported that supply chain issues have worsened. Moreover, most firms cited that they expect supply chain issues to persist until at least 2023.

With inflation remaining high and supply-issues persisting, inflation expectations have increased, with 70% of firms expecting inflation to be above 3% over the next year, the highest on record. Businesses note that the main drivers of inflation are supply-chain disruptions, rising commodity prices and input costs, and increased labour costs.

In addition, 68% of the firms expect labour costs to increase over the next 12 months. Those wage increases are seen as necessary to attract and retain workers and to allow for cost-of-living adjustments. On average, businesses expect to have to increase wages by 5.2% y-o-y. As a result, a greater share of firms ( expect to pass increasing input costs to their customers over the next 12 months.

Most businesses expect inflation to gradually return towards the BoC’s inflation target of 2% in the coming years. Only 20% of firms expect inflation to still be above 2% three years from now.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.

Alberta Central member credit unions can download a copy of this report in the Members Area here.