Economic insight provided by Alberta Central Chief Economist Charles St-Arnaud.

Bottom line

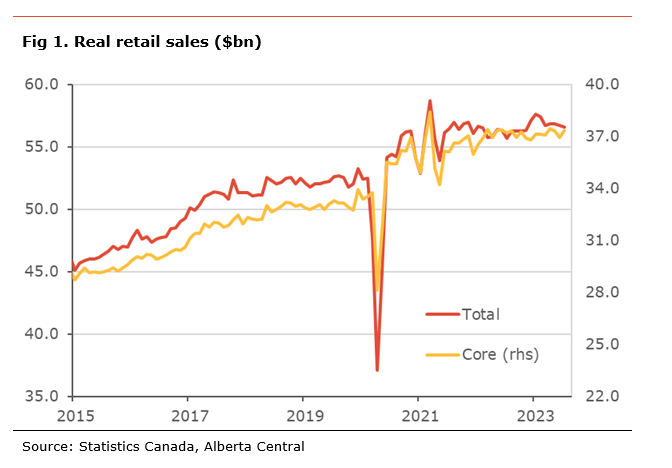

Retail sales rose modestly in July and the preliminary estimate suggests that sales remained unchanged. After some strength in late 2022 and earlier this year, there are clear signs that consumer spending is stalling and suggest that consumer spending will have little to no contribution to growth in the second half of the year. The moderation in consumption is even more evident when adjusting for inflation and population growth, with an estimated decline of 0.3% y-o-y for headline retail sales and by 0.7% y-o-y for core retail sales.

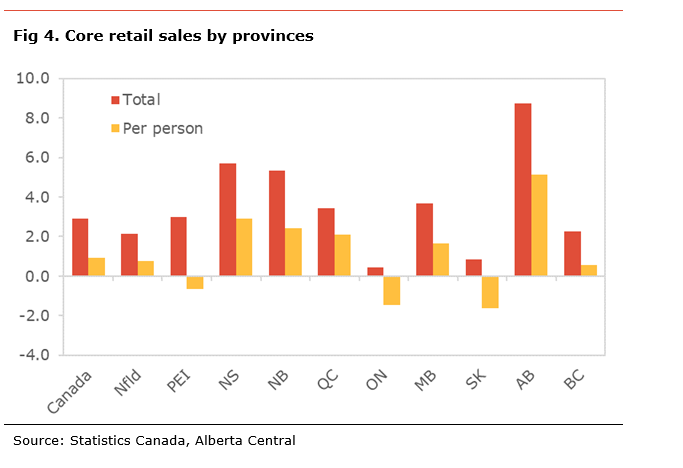

There are some regional divergences. At one end, consumer spending in Alberta, PEI, Nova Scotia and New Brunswick remains strong, even once adjusted for population growth, while it is weak in Ontario, BC; two regions highly sensitive to interest rate increases as they have the highest level of household indebtedness and highly unaffordable housing market.

The outlook for retail sales and consumer spending more broadly remains tilted to the downside. Consumers’ finances continue to be squeezed by an erosion in purchasing power due to high inflation and rising interest rates (see The Great Consumer Squeeze for more details on how those factors affect households). The resilience in the labour market, with continued robust job growth, is likely a significant support to household spending. A weakening of the labour market, especially job losses, could lead to significant underperformance in consumer spending.

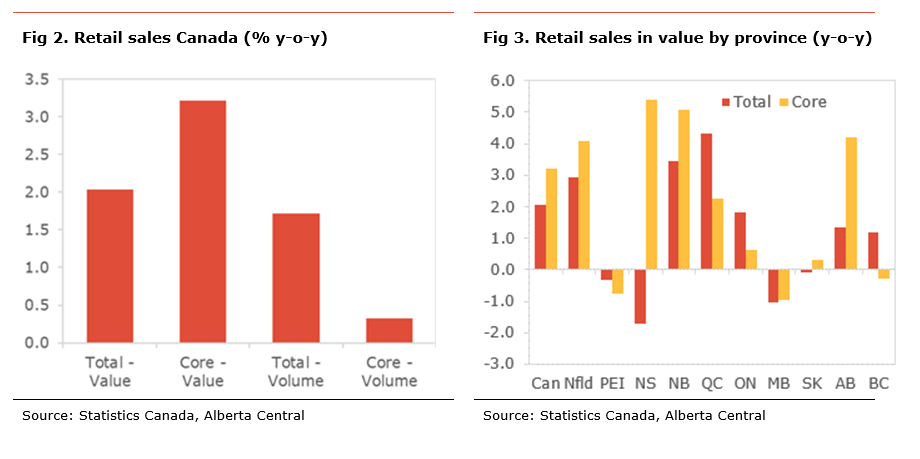

Retail sales rose 0.3% m-o-m in July. Compared to the same month last year, retail sales increased 2.0% y-o-y. Statistics Canada also reports that retail sales are estimated to have decreased 0.2% m-o-m in August based on a preliminary estimate.

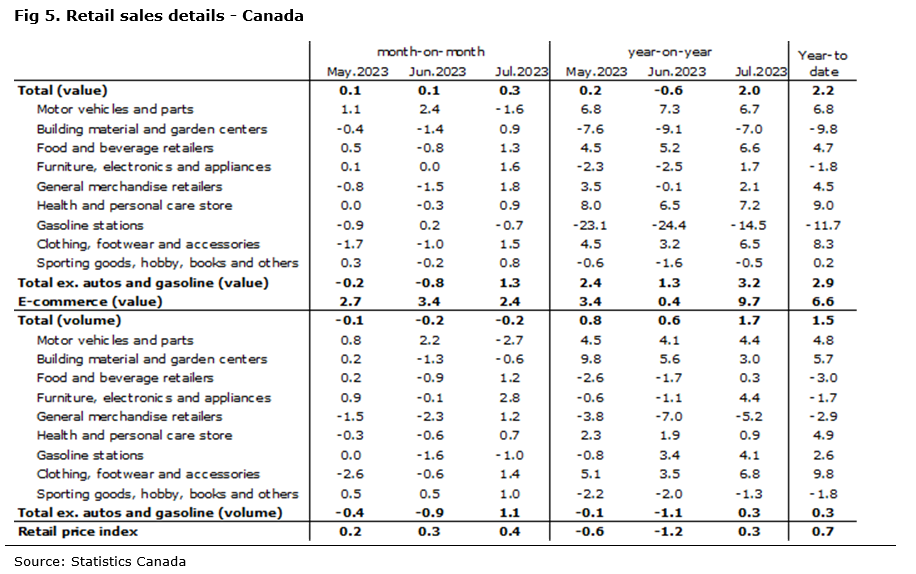

Monthly sales increased in 7 out of 9 subsectors. The biggest rises on the month were at general merchandise retailers (+1.8% m-o-m), Furniture, electronics and appliances stores (+1.6% m-o-m), clothing, footwear and accessories stores (+1.5% m-o-m), and food and beverage retailers (+1.3% m-o-m). These increases were partly offset by lower spending on motor vehicles and parts (-1.6% m-o-m), and at gasoline stations (-0.7% m-o-m).

Core retail sales, which excludes motor vehicles and parts and gasoline stations, jumped 1.3% m-o-m (+3.2% y-o-y). The focus on core retail sales is important in the current context, as lower gasoline prices are leading to a sharp decline in sales at gasoline stations (-14.5% y-o-y)

In volume terms (i.e. adjusted for inflation), retail sales decreased by 0.2% in August (+0.6% y-o-y), a third consecutive decline. Core retail sales are estimated to have increased by 1.1% on the month (+0.3% y-o-y).

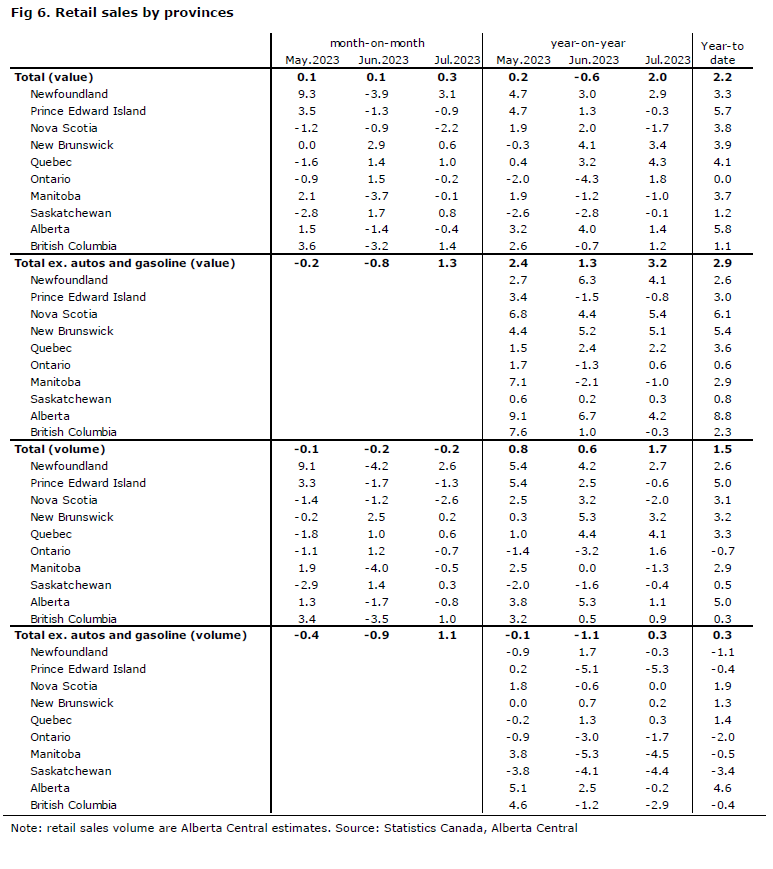

By provinces, there are some important divergences. Focusing on the y-o-y changes, the value of retail sales increased the most in Quebec (+4.3% y-o-y), New Brunswick (+3.4% y-o-y), Newfoundland (+2.98% y-o-y), and Ontario (+1.8% y-o-y). On the flip side, retail sales are lower in Nova Scotia (-1.7% y-o-y), Manitoba (-1.0% y-o-y), PEI (-0.3% y-o-y), and Saskatchewan (-0.1% y-o-y).

Looking at the value of core retail sales, we estimate they increased the most in Nova Scotia (+5.4% y-o-y), New Brunswick (+5.1% m-o-m), Alberta (+4.2% m-o-m), and Newfoundland (+4.1% y-o-y). Core spending decreased in Manitoba (-1.0% y-o-y), PEI (-0.8% y-o-y), and BC (-0.3% y-o-y).

In Alberta, retail sales decreased 0.4% m-o-m in July (+1.4% y-o-y). The drop in headline retail sales was mainly due to lower sales at motor vehicles and parts dealers, and at gasoline stations. As a result, we estimate that core retail sales rose by 3.1% m-o-m (+4.2% y-o-y) in July. Although there are no official volume details at the provincial level, we estimate that retail sales volumes in the province decreased by 1.7% m-o-m (+1.1% y-o-y).

Statistics Canada also releases retail sales numbers for Calgary and Edmonton. The data continue to show some divergences between regions. As such, retail sales in Calgary rose by 1.7% y-o-y in July, while it increased a more modest 0.5% y-o-y in Edmonton and declined by 2.0% y-o-y in the rest of the province. The core measure also shows the same trend, with Calgary up 6.0% y-o-y compared to 4.1% and 2.6% for Edmonton and the rest of the province, respectively. Stronger population growth in Calgary over the past year than in Edmonton and the rest of the province could explain part of the outperformance.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.