Economic insight provided by Alberta Central Chief Economist Charles St-Arnaud.

Bottom line

Growth in the first quarter came in weaker than expected, as net exports were a drag on economic activity. However, the monthly GDP profile suggests robust momentum going into the second quarter. The details show strength in domestic demand, with consumer spending and housing being the main drivers of growth, while the weakness in net exports is likely to be short-lived.

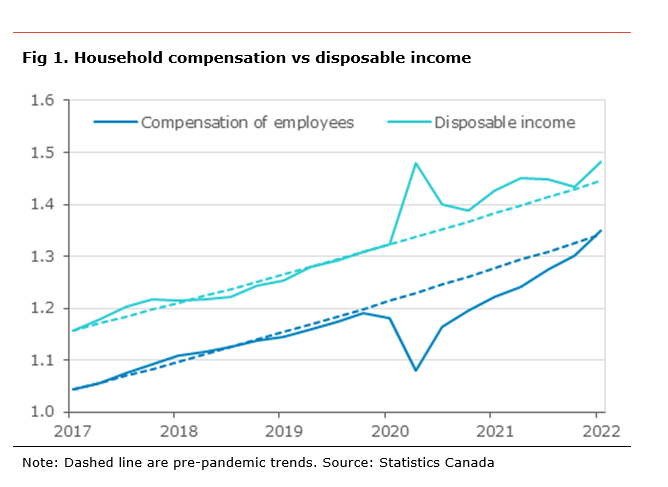

Both employee compensation and disposable income improve in the first quarter. Even adjusted for inflation, both measures managed some small gains, suggesting a slight improvement in purchasing power. Moreover, the saving rate increased slightly with income growing faster than spending. This will likely put households on a somewhat better footing to face continued pressure on their purchasing power and the impact of sharply higher interest.

We expect economic activity to remain robust in the second quarter, given the strong momentum in the monthly GDP. As such, there is nothing in the latest GDP number to change our view that the BoC will hike by 50bp at the June (tomorrow) and July meetings.

However, with growth primarily driven by consumer spending and housing, there are some risks that growth could slow meaningfully in the second half of the year, as sharply higher interest rates take a toll on those sectors. How strong consumer spending will be will depend on households’ willingness to spend the money saved during the pandemic, especially as inflation erodes households’ purchasing power and higher interest rates lead to higher debt-service payments.

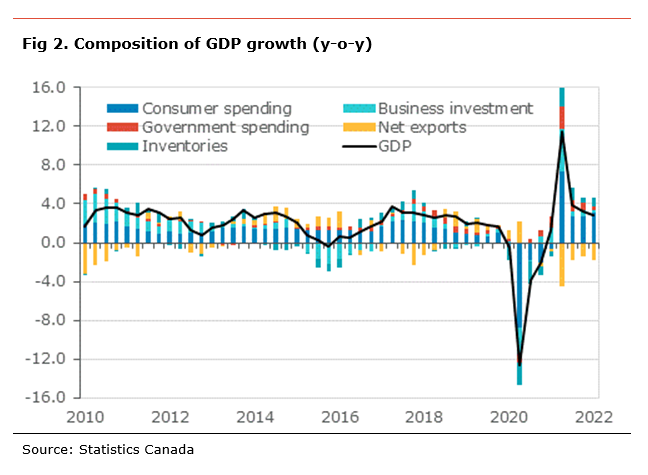

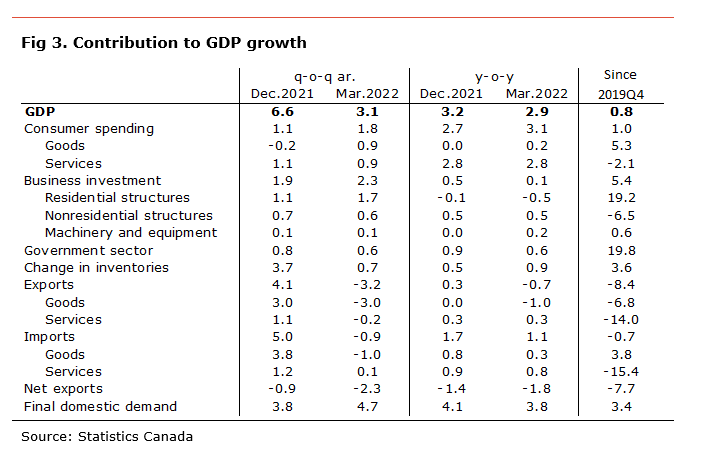

The Canadian economy decelerated in the first quarter of 2022, growing by a weaker than expected 3.1% q-o-q annual rate (ar) (+2.9% y-o-y). This followed a sharp increase of 6.6% q-o-q ar. in the fourth quarter of 2021. Two years after the start of the pandemic, economic activity stands 0.8% above its pre-pandemic level.

In terms of details, a large proportion of the rise in economic activity can be attributed to a robust increase in domestic demand (contributing 4.7 percentage points (pp) to growth), while net exports were a drag on growth (subtracting 2.3pp from growth). Inventory accumulation accounted for 0.7pp of the growth on the quarter. The strength in final domestic demand was mainly in business investment and consumer spending.

Household spending increased by 3.4% q-o-q ar, contributing 1.8pp to growth, despite the restrictions imposed at the beginning of the year to slow the spread of Omicron. This followed a modest 1.8% q-o-q ar. rise in the fourth quarter of 2021. Spending on goods rose by 3.8% q-o-q ar., led by a sharp increase in spending on motor vehicles. Nevertheless, spending on motor vehicles remains well below their pre-pandemic level due to the ongoing supply chain issues. Spending on services increased 3.0% q-o-q ar., but are still be about 2% below their pre-Covid level.

Business investment rose by 11.0% q-o-q ar. on the quarter, contributing 2.3pp to growth, with strong contribution from residential investment and non-residential structures.

Residential investment rose by 18.1% q-o-q ar., contributing 1.7pp to growth. The increase in activity was mainly the result of a surge in renovation activity and an increase in ownership transfer costs, resulting from continued strong housing resale activity. New construction only increase marginally.

Business investment in non-residential structures increased 12.0% q-o-q ar., contributing 0.6pp to growth, as a result of an increase in engineering structures as spending at the Kitimat LNG project and other oil and gas projects increased in the first quarter.

Investment machinery and equipment edged higher by 3.8% q-o-q ar., contributing 0.1pp to growth. Investment in machinery and equipment remains well below its pre-pandemic level.

International trade declined in the first quarter and the external sector was a big drag to the economy, subtracting 2.3pp to growth. Exports decreased 9.4% q-o-q ar. in Q1. led by lower exports for energy, other commodities and services. Imports edged lower by 2.8% q-o-q ar. The decline in imports was primarily driven by energy and services.

Canada’s terms-of-trade improved in Q1 (+4.2% q-o-q) mainly as a result of a continued increase in crude prices and other commodities, especially lumber and electricity. As a result, the terms-of-trade reached its highest level on record, boosting income growth on the quarter. This impact of the terms-of-trade on income will positively affect Alberta and other oil-producing provinces.

On the income side, household disposable income decreased by 3.3% q-o-q., after two consecutive declines. The higher disposable income was due to a 3.8% q-o-q rise in employees’ compensation, one of the strongest increases since 1981. The increase in compensation of employees was mainly due to a rise in average pay, as employers offer higher salaries to attract and retain workers. On the other hand, government transfers edged lower slightly (-0.4% q-o-q), as pandemic-related programs were phased out.

With consumer spending growing slower than disposable income, the household saving rate increased to 8.1% from 6.9%, still well above its pre-pandemic level.

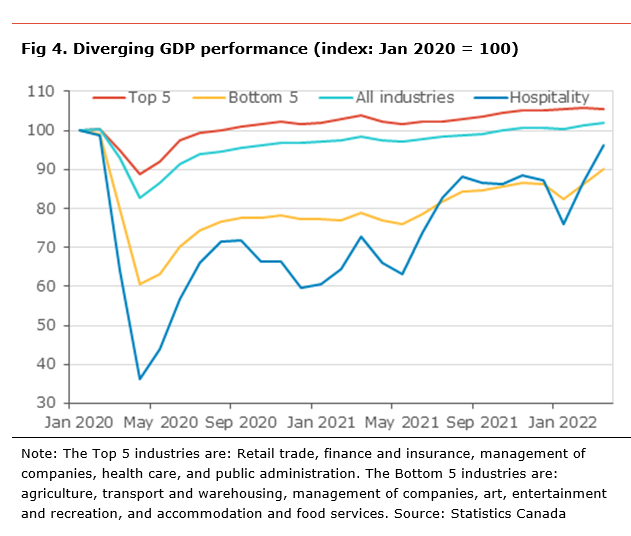

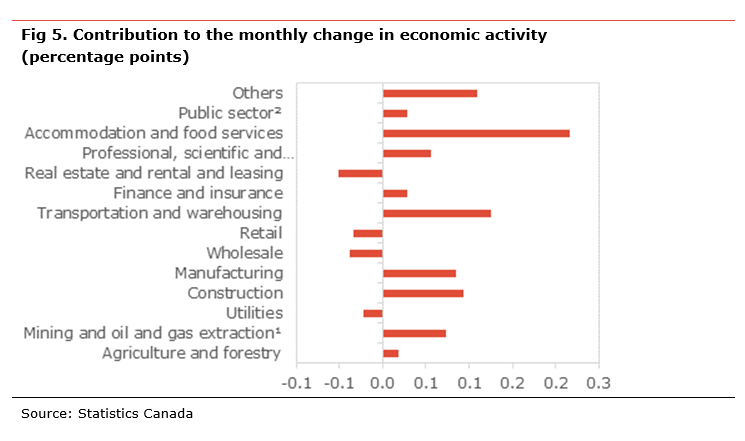

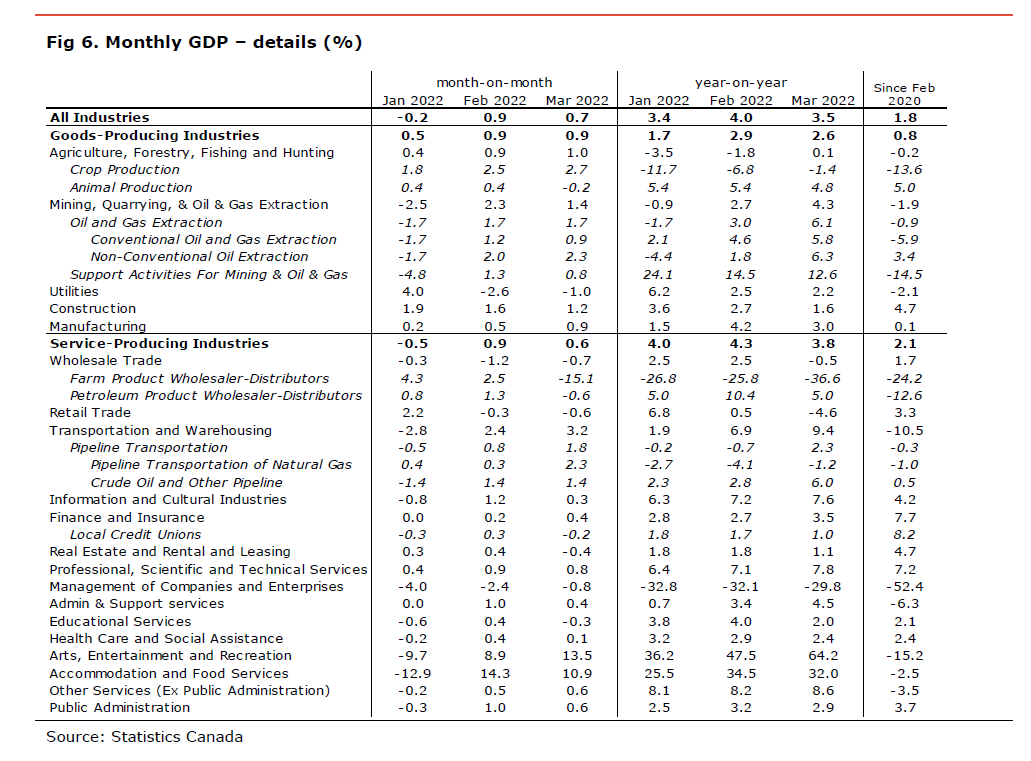

The monthly GDP for March rose by 0.7% m-o-m (+3.5% y-o-y), as activity in client-facing industries continues to normalize. The detail shows that 14 of 20 industrial sectors posted gains in March.

The level of economic activity is 1.8% above its pre-pandemic level. Only 11 out of 20 industrial sectors have economic activity above pre-pandemic levels, while others, like the arts, entertainment and recreation, and transportation and warehousing still about 15% and 10% below their pre-pandemic level, respectively. Nevertheless, the preliminary estimate for April suggests that activity likely rose by 0.2% m-o-m.

The goods-producing sector rose 0.9% m-o-m (+2.6% y-o-y), mainly due to mining, oil and gas, construction, agriculture, and manufacturing activity. A decline in utilities partly offset those increases. The service sector increased by 0.6% m-o-m (+3.8% y-o-y). Most of the higher activity was due to a normalization in industries affected by Covid-related restrictions, led by accommodation and food services (+10.9% m-o-m), arts, entertainment and recreation (+13.5% m-o-m), and transportation and warehousing (+3.2 m-o-m).

For Alberta, there is no specific data in the report. However, we can make an assessment based on activity in some key industries specific to Alberta. The activity level increased on the month in oil and gas extraction, support activity for the mining, oil and gas sector, pipeline transportation, crop production, and client-facing industries. This suggests robust growth in March.

The continued improvement in the terms-of-trade in Q1, as oil prices continued increase, suggests continued support to income growth for both individuals and businesses in Alberta. This is in line with our observation that the value of the oil produced in Alberta reached a record level of about $14bn in March.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.

Alberta Central member credit unions can download a copy of this report in the Members Area here.