In Alberta, the agriculture sector plays a significant role in the regional economy. It represents 2.2% of the province’s Gross Domestic Product and 13.4% of total exports for 2020. And while the socioeconomic profile of Canadian farmers is changing – the share of women farmers has increased to 28.7% from 25.3% in the past two decades – there are still challenges to the full participation of women in the industry.

In a new policy commentary called Credit Unions and Women in Agriculture, Alberta Central provides insights into the current landscape of Canadian agriculture and women farmers, existing supports and government efforts, current credit union offerings and opportunities for credit unions.

Here are some highlights from the commentary.

Who are women farmers

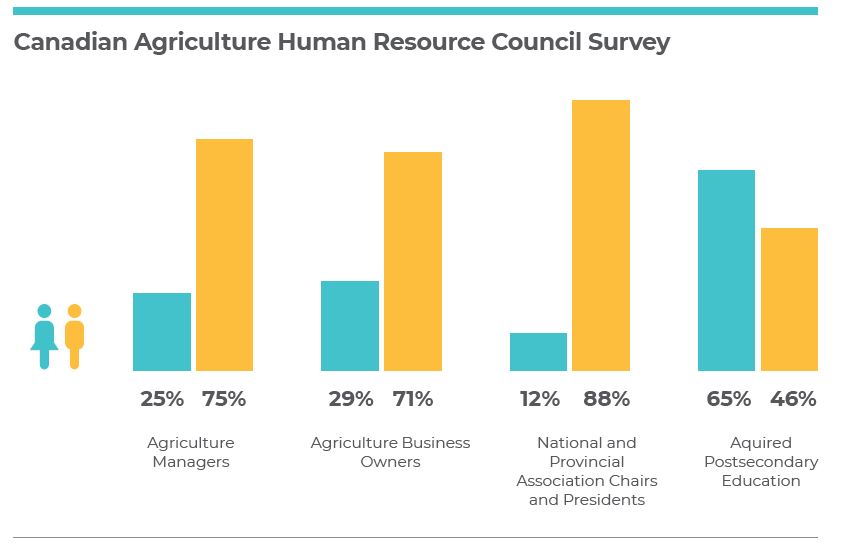

According to the Census of Agriculture, the largest share of female farm operators is between 35 to 54 years of age. While fewer women are agriculture managers, business owners or in leadership positions in the industry than men, a higher share of women have acquired post secondary education. Women farmers are young and educated.

Government efforts

In 2020, the Government of Canada’s Minister of Agriculture and Agri-Food Marie-Claude Bibeau shared her dedication to promote the participation of women in the industry and the urgency to fight the obstacles for women, including financial barriers. The federal government offers an Advance Payments Program; a loan of up to $400,000 that is federally guaranteed for agricultural producers. The loans are repaid as producers sell their products, with a maximum of 18 months to repay the loans (with some exceptions). The federal government pays the interest charges on the initial $100,000 of the advance.

Credit union offerings

Credit unions in Alberta have several offerings targeted towards the agricultural sector in the province, including:

- customized agricultural mortgages with flexible payment options and structures

- customized loans for operations, land and equipment

- agriculture-specific accounts and credit cards

- farm succession webinars

- personalized financial advice for farm owners

- visits from ag specialists

- blogs highlighting farmers

Opportunities

Accessing capital is a significant challenge for women in agriculture. The rising cost of land is a significant barrier to entry and credit unions can help with financing and loans, grants, capital and financial literacy. In addition to capital, Farm Credit Canada has identified the need for access to business and competency skill development as well as access to tools, resources and people to learn from in regards to their Women Entrepreneur Program. Credit unions can assist women in agriculture with strategic planning, skill development and training as well as tools, resources and networks to support and encourage participation. As credit unions have a presence in rural communities across the province – and in some cases are the sole financial service provider in a community – credit unions can expand their offerings for current and prospective farm owners.