Economic insight provided by Alberta Central Chief Economist Charles St-Arnaud.

Bottom line

National house prices declined for the first time since the start of the pandemic in April. However, despite a sharp moderation in April as interest rates started to increase, the level of activity in the housing market remains well above pre-pandemic. As a result, we are seeing an improvement in inventory, which is leading to some easing in price pressures. As such, some of the best performing and most expensive markets, especially in Ontario, saw their first monthly price declines since April 2020.

In Alberta, housing market activity eased but remained close to a record. Price gains in the province’s metropolitan area accelerated this year but remained weaker than in the rest of the country on a year-on-year basis. The continued improvement in the oil sector, with the value of oil production reaching records in recent months, will be a tailwind on household income and the recovery, providing some support to the housing market in the coming months. In addition, signs of increased migration and buyers from other provinces will also support activity and prices.

Low interest rates have been one of the main drivers of the housing market, supporting affordability. The moderation in activity since the Bank of Canada started to raise rates in March points to further weakness this year, especially with the policy rate likely to increase by 150bp before the end of year. (see). However, continued lack of supply in many regions and increased immigration are expected to continue to provide some support.

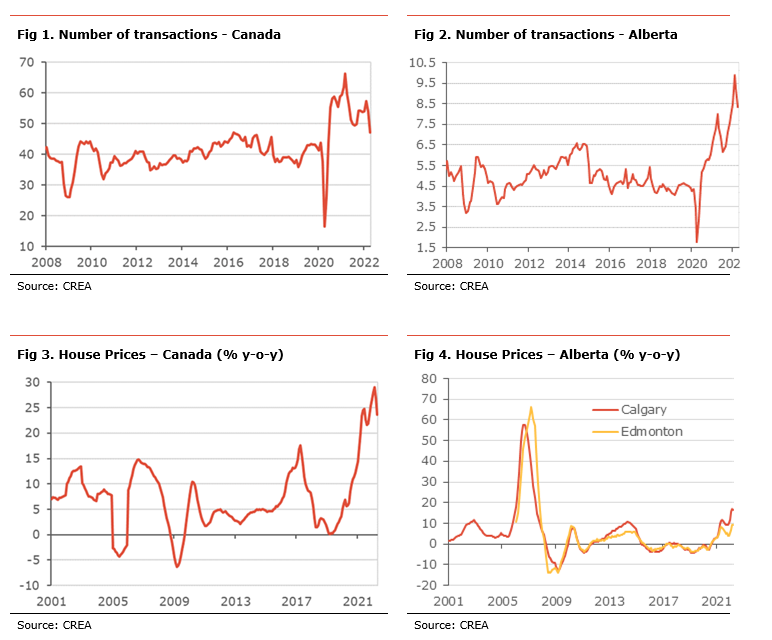

Activity in the Canadian housing market decreased by 12.6% m-o-m seasonally-adjusted in April. Nevertheless, the number of transactions remained elevated, about 15% higher than on average in 2019. It is important to note that all the year-on-year comparisons are distorted by the sharp boom in activity a year ago and, as a result, we will focus on the changes compared to 2019. Activity declined the most on the month in Ontario, BC and Alberta, while it increased in Newfoundland and Nova Scotia. In Alberta, the number of transactions decreased 10.0% m-o-m in April and is about 89% higher than in 2019.

The level of activity in every provincial market remains well above the level seen pre-pandemic, as pent-up demand, changing housing preferences and low interest rates continue to support sales activity. Compared to the average level of 2019, the number of transactions is above its pre-pandemic level by 15% in Canada, led by Alberta (+89%), Newfoundland (+86%), Saskatchewan (+40%), and New Brunswick (+53%), while it is lower in Ontario (-5%) and Quebec (-2%).

New listings decreased by 2.2% m-o-m seasonally-adjusted in April. Most provinces saw a decline in new listings, led by Newfoundland (-11% m-o-m), Alberta (-5.8%), BC (-3.4% m-o-m), and Manitoba (-2.8% m-o-m). New listings rose in PEI (+6.5% m-o-m), Nova Scotia (+0.9% m-o-m) and New Brunswick (+0.9% m-o-m).

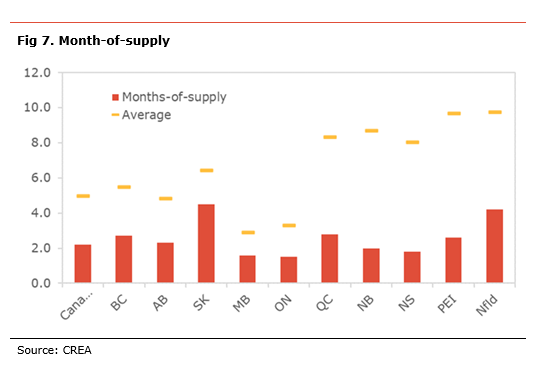

With sales activity weaker than listings in most regions, the month-of-supply measure[1] eased to 2.2 nationally, still well below its pre-pandemic level. Based on this measure, all provinces are seller’s markets in Canada, led by New Brunswick, Quebec, Nova Scotia and Ontario. With a month-of-supply at 2.3, Alberta’s housing market remains much tighter than before the pandemic.

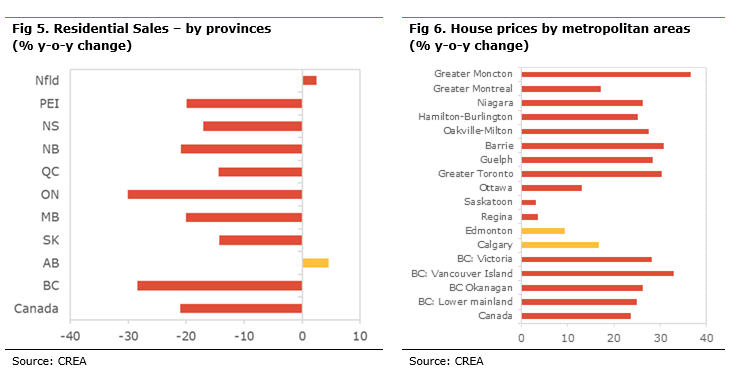

With sales performances moderating and an increase in the month-of-inventory, upside pressures on house prices eased further in April, leading to a 0.6% m-o-m decline in the MLS House Price Index, the first decrease since April 2020. Compared to last year, house prices rose nationally by 23.7%, still close to a record pace. The biggest monthly changes were in Vancouver Island (+2.4% m-o-m), Moncton (+2.3 m-o-m), Victoria (+1.9% m-o-m), and Montreal (+1.8% m-o-m). Prices declined the most on the month in Oakville-Milton (-5.6% m-o-m), Niagara (-1.9% m-o-m), Toronto (-1.8% m-o-m), and Barrie (-1.5% m-o-m).

On a y-o-y basis, the most significant increases were in Moncton (+37% y-o-y), Vancouver Island (+33% m-o-m), Barrie (+31%), and Toronto (+31%).

In Alberta, benchmark prices rose by 0.9% m-o-m and by 16.7% y-o-y in Calgary, and by 1.4% m-o-m +9.4% y-o-y) in Edmonton. Edmonton continued to have some of the weakest price increases in the country. However, prices in Calgary have picked up sharply since the start of 2022.

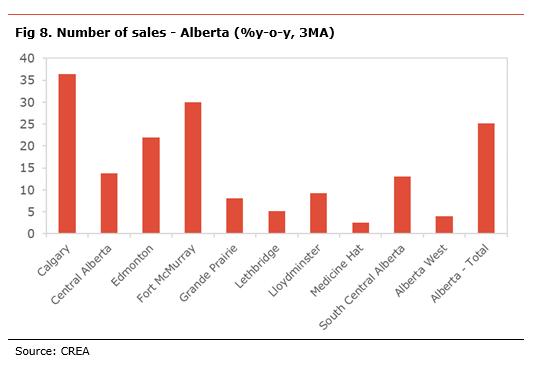

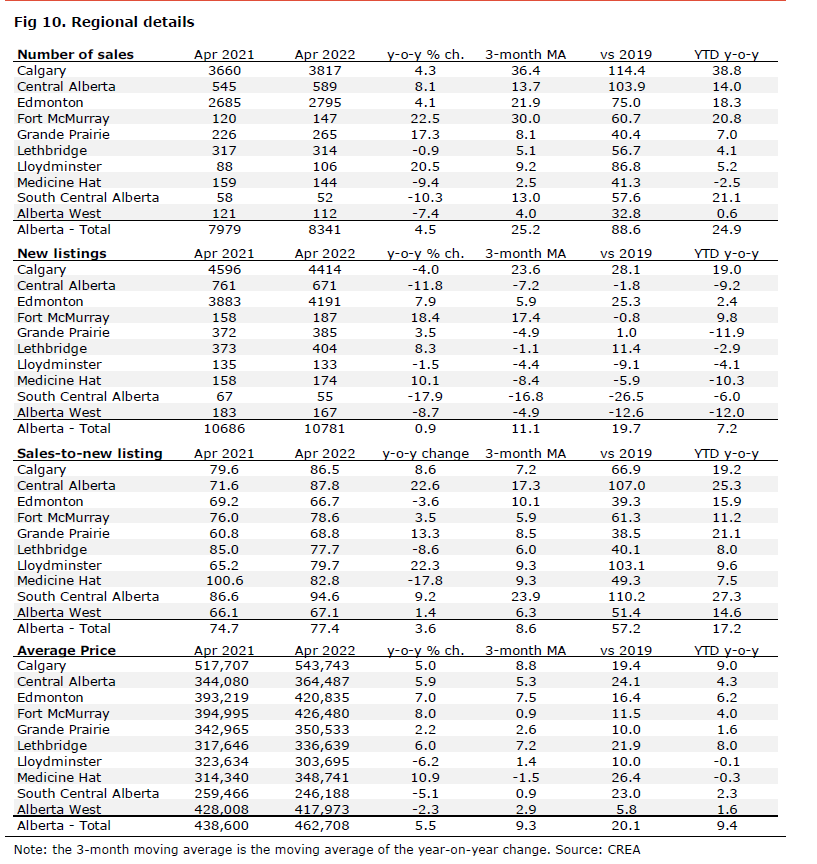

In Alberta, despite a moderation in activity in April, the housing market remains robust, with the level of transactions still well above their pre-pandemic level and above to the record seen in Spring 2021. The number of transactions is higher than last year’s same month in many regions. (see table below for details). Compared to the average level of transactions in 2019, activity in the province increased by 89%, led by Calgary (114%), Central Alberta (+104%), Lloydminster (+87%), Edmonton (+75%), Fort McMurray (+61%), South Central Alberta (+58%) and Lethbridge (+57%). Activity is the weakest in Alberta West (+33%), Grande Prairie (40%), and Medicine Hat (+41%) but still well above its pre-pandemic level.

New listings rose on the month at the provincial level. Compared to the average level of new listings in 2019, new supply in the province increased by 20%, led by Calgary (+28%), Edmonton (+25%) and Lethbridge (+11%). New supply is the weakest in South Central Alberta (-27%), Alberta West (-13%), Lloydminster (-9%), and Medicine Hat (-6%).

With sales stronger than new listings, many regions have seen a tightening of their housing markets. The primary seller’s markets are South central Alberta, Central Alberta, Calgary and Lloydminster, while the main buyer’s markets are Edmonton, Grande Prairie and Alberta West.

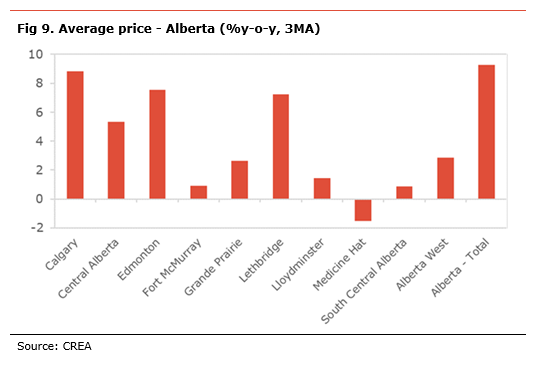

With the further tightening of the housing markets, average house prices have risen in almost all regions on a 3-month moving average of the year-on-year, with the most significant increase in Calgary (+8.8%), Edmonton (+7.5%), and Lethbridge (+7.2%). On the flip side, Medicine Hat (-1.5%) saw a decline in average house prices over the same period.

[1] The month of supply measures how many months is would take at current sales volume and without an increase in listings to bring inventories to 0.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.

Alberta Central member credit unions can download a copy of this report in the Members Area here.