Economic insight provided by Alberta Central Chief Economist Charles St-Arnaud.

Bottom line

Today’s release of the monthly GDP suggests that the Canadian economy is losing momentum after a strong start to 2023. As such, the monthly GDP is pointing to growth in the first quarter of 2023 at around 2.2% q-o-q ar. However, with the preliminary estimate suggesting a small contraction in March and the negative impact of the federal worker strike on economic activity in April, it is very likely that growth may be flat in the second quarter.

The details in February show that sectors linked to consumer discretionary spending, namely retail trade, accommodation and food services, arts, entertainment and recreation, were all weak. This is likely the result of the loss in purchasing power due to high inflation and rising debt-service cost. Household spending remains key to the outlook and is likely supported so far by the strong labour market.

The reduction in the momentum of the Canadian economy will be welcomed by the Bank of Canada, as it suggests that it was right to remain on hold at the April meeting to better assess the impact of the increases in interest rates on the economy. We continue to believe that the BoC will leave its policy rate unchanged for the rest of the year.

For Alberta, the details available in the report suggest that economic activity outperformed slightly the rest of the country in February due to strong activity in the oil and gas sector. High energy prices have been a tailwind to the Alberta economy this year, but not as much as in the past (see Where’s the boom? How the impact of oil on Alberta may have permanently weakened).

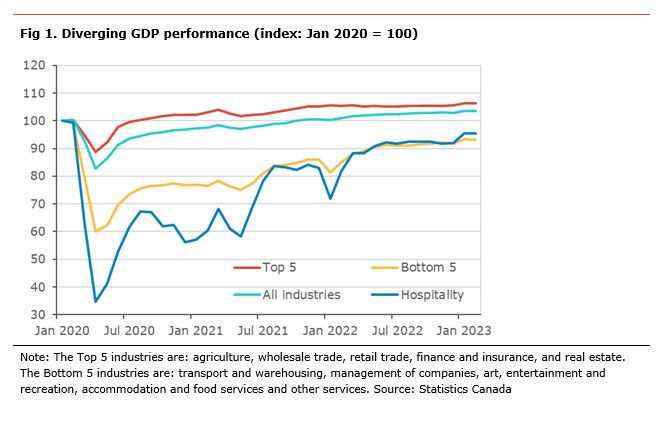

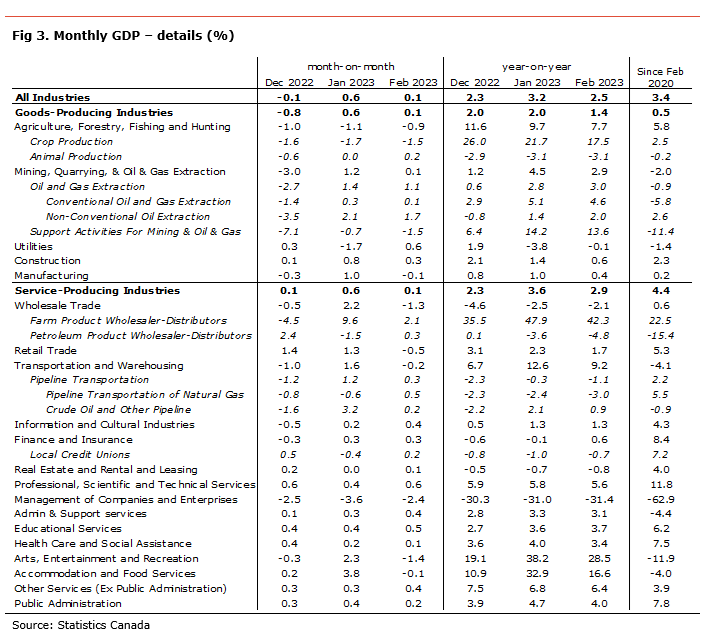

The monthly GDP rose by 0.1% m-o-m in February (+2.5% y-o-y). The details show that 11 out of 20 industrial sectors posted gains on the month. Despite the overall economy being 3.4 percentage points above its pre-pandemic level, 7 out of 20 industrial sectors still have economic activity below their pre-pandemic levels, namely natural resource extraction, utilities, transportation and warehousing, management of companies, administration and support services, arts, entertainment and recreation, and accommodation and food services.

Statistics Canada’s preliminary estimate suggests GDP for March declined by 0.1% m-o-m. This suggests that growth in the first quarter of 2023 could be strong at around 2.5% q-o-q ar. However, with the current federal public worker strike likely to cause on contraction in the economy, growth is likely to be close to 0 in the second quarter.

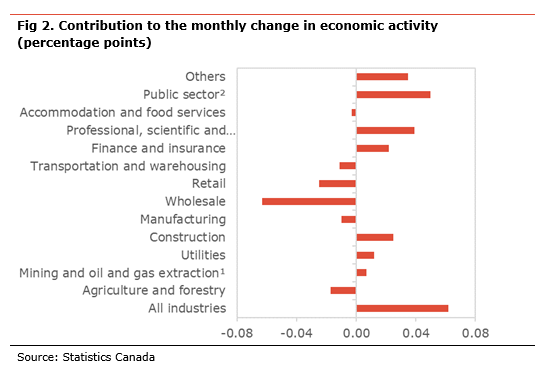

The goods-producing side of the economy increased by 0.1% m-o-m in February. Economic activity was higher in construction (+0.3% m-o-m), utilities (+0.6% m-o-m) and natural resource extractions (+0.1% m-o-m). These increases were partly offset by declines in agriculture (-0.9% m-o-m) and manufacturing (-0.1% m-o-m).

The services-producing side of the economy rose 0.1% in February. The increase in activity was led by professional, scientific and technical (+0.6% m-o-m), education (+0.5% m-o-m), other services (+0.4% m-o-m), and finance and insurance (+0.3% m-o-m). Declines in wholesale trade (-1.3% m-o-m), retail trade (-0.5% m-o-m), and transportation and warehousing (-0.2% m-o-m) were the main drag to growth in the sector.

For Alberta, there is no specific data in the report. However, we can make an assessment based on activity in some key industries specific to Alberta. The level of activity in the oil and gas sector, especially non-conventional oil and gas extraction, rose sharply on the month, while support activity for mining, oil and gas declined for a fifth consecutive month. A decline in crop production may also have acted as a drag on growth. An increase in pipeline activity, especially gas pipeline, has provided further support. Overall, this means that the province’s economy likely marginally outperformed the rest of the country in February.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.