Economic commentary provided by Alberta Central Chief Economist Charles St-Arnaud.

Bottom line

Today’s release of the GDP for July confirms that growth has slowed rapidly in the third quarter of 2022, with growth at its weakest since 2021Q2 when restrictions to slow the spread of COVID were in effect. The report shows that rate-sensitive sectors are feeling the impact of rising interest rates.

We expect growth in Canada to remain anemic in the second half of 2022 as the impact of fast-rising interest rates starts to impact the broad economy. As such, the “Great consumer squeeze,” an erosion of purchasing power and rising debt-service cost, will slow household spending meaningfully. The decline in retail trade in July indicates it is happening. Therefore, despite slowing growth momentum, we believe the BoC will continue to increase interest rates, hiking by 50bp in October.

For Alberta, the details available in the report suggest that economic activity bounced back in July due to a rise in oil and gas extraction and agriculture. High energy prices are expected to be a tailwind to the Alberta economy this year. This will mean that the slowdown in economic activity in Alberta in the second half of the year is likely to be less pronounced than in the rest of Canada.

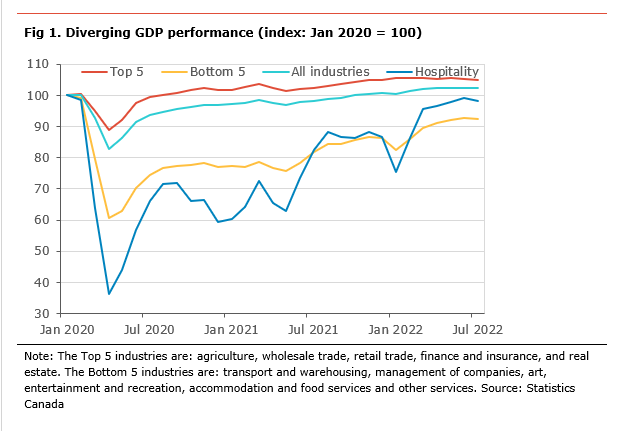

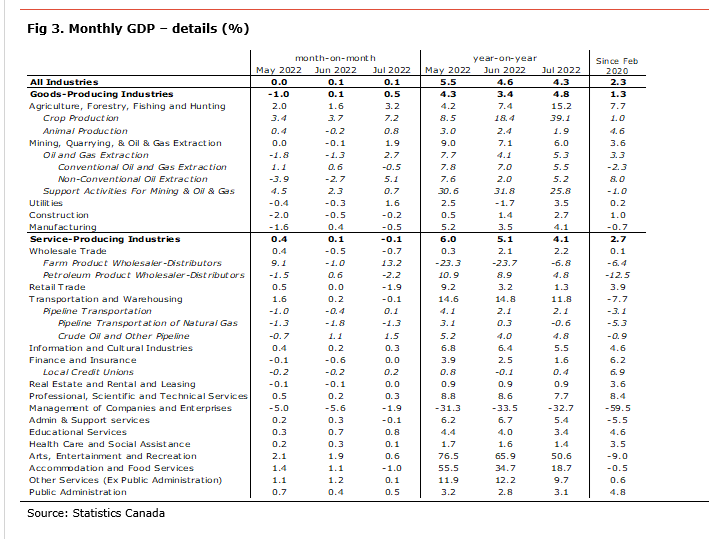

The monthly GDP inched higher by 0.1% m-o-m in July (+4.1% y-o-y). The details show that 11 out of 20 industrial sectors posted gains on the month. Despite the overall economy being 2.3 percentage points above its pre-pandemic level, 6 out of 20 industrial sectors still have economic activity below their pre-pandemic levels, namely manufacturing, transportation and warehousing, management of companies, administration and support services, arts, entertainment and recreation, and accommodation and food services.

Statistics Canada’s preliminary estimate for August points to no gains on the month. This suggests that growth in the third quarter of 2022 will very likely be below 1% q-o-q ar. The weakest since 2021Q1 when restrictions were put in place to slow the spread of COVID.

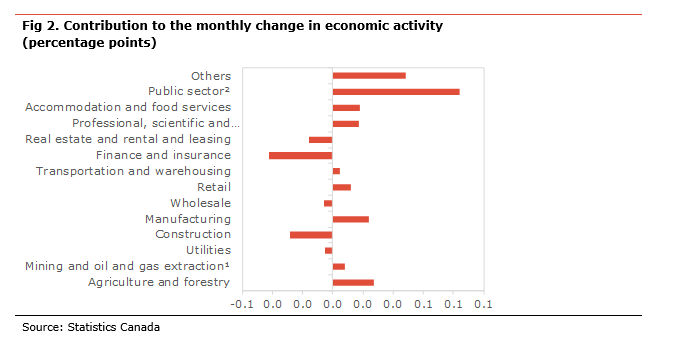

The goods-producing side of the economy expanded by 0.5% m-o-m, mainly due to a rise in natural resources extraction (+1.9% m-o-m), agriculture (+3.2% m-o-m) and utilities (+1.6% m-o-m). Those increases were partly offset by declines in manufacturing (-0.5% m-o-m) and construction (-0.2% m-o-m).

The services-producing side of the economy eased 0.2% on the month. The reduction in activity was led by retail trade (-1.9% m-o-m), wholesale trade (-0.7% m-o-m), accommodation and food services (-1.0% m-o-m), and management of companies (-1.9% m-o-m). Increases in public administration (+0.5% m-o-m), education (+0.6% m-o-m), arts, entertainment and recreation (+0.6% m-o-m), and professional, scientific and technical services (+0.3% m-o-m) offset part of the decline.

For Alberta, there is no specific data in the report. However, we can make an assessment based on activity in some key industries specific to Alberta. The level of activity in the oil and gas sector, especially oil sands, increased sharply on the month. There were also increases in oil pipeline activity. Strong growth in crop production and farm product wholesalers also positively affected the province. On the flip side, an increase in agriculture likely offset some of the declines. Overall, this means that the province’s economy grew more robustly than the rest of the country in July.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.