Economic insight provided by Alberta Central Chief Economist Charles St-Arnaud.

Bottom line

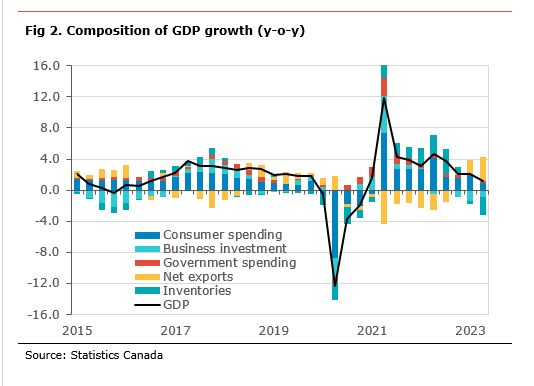

Growth in the second quarter was much weaker than expected after a strong start to 2023. The details show a significant slowdown in consumer spending and continued contraction in residential investment, as higher interest rates are impacting those sectors. Business investment significantly contributed to growth, largely thanks to strong investment on aircraft, which is unlikely to be sustained. Net exports were also a source of drag. Early estimates point to growth remaining flat in the third quarter.

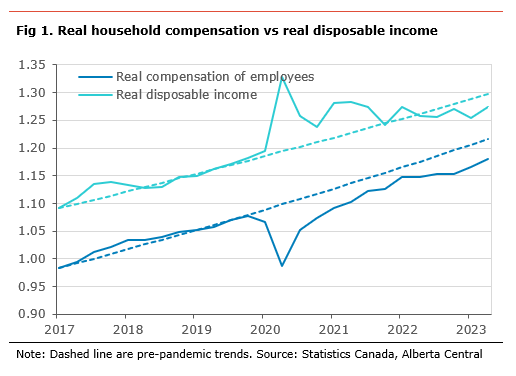

Disposable income rose in the second quarter due to higher compensation of employees. As a result, once adjusted for inflation, real disposable income increased, meaning an improvement in households’ purchasing power. However, real disposable income remains below its pre-pandemic trend. The saving rate increased on the quarter, suggesting that households are becoming more cautious with their spending. With inflation remaining high and interest rates increasing significantly, households continue to face pressures on their purchasing power and finances.

We expect economic activity to remain weak in the second half of 2023 as the sharp increase in interest rates continues to take its toll on economic activity, especially residential investment and consumer spending.

Today’s GDP number does not change our view that the Bank of Canada will keep its policy rate unchanged at next week’s meeting. However, with growth expected to be flat in the next quarter, the likelihood of another rate increase has diminished and depends solely on the inflation dynamic. With this in mind, we believe the BoC will keep its policy rate unchanged for the rest of the year.

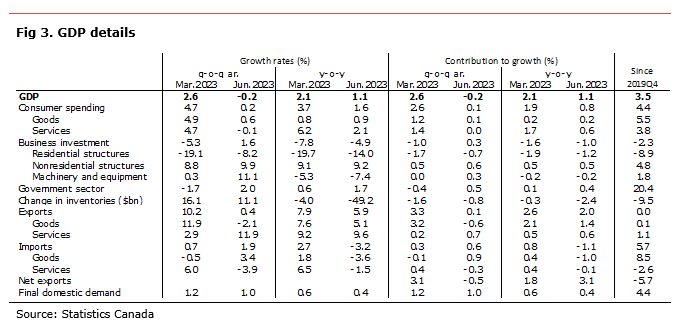

Canadian economic activity declined by 0.2% q-o-q annual rate (ar) in the second quarter of 2023 (+1.1% y-o-y), much weaker than expected by the consensus and the Bank of Canada. This followed a strong increase in the first quarter of 2023 (+2.6% q-o-q ar.). Two years after the start of the pandemic, economic activity stands 3.5% above its pre-pandemic level.

In terms of details, strong non-residential investment (contributing 0.9 percentage points (pp) to growth) and government spending (contributing 0.5pp to growth), in addition to a marginal increase in consumer spending (contributing 0.1pp to growth) were the main source of growth. These increases were offset by slower inventory accumulation (reducing growth by 0.8pp to growth), a decline in residential investment (reducing growth by 0.7pp to growth) and lower net exports (reducing growth by 0.5pp to growth). Final domestic demand slowed slightly in 2Q, contributing 1.0pp to growth.

Household spending increased by a marginal 0.2% q-o-q ar, contributing 0.1pp to growth, the weakest since 2021Q2. This followed a strong increase of 4.7% q-o-q ar. in the first quarter of 2023. The weakening in consumer spending was the result of weaker spending on both goods (+0.6% q-o-q ar) and services (-0.1% q-o-q ar.). The increase in spending on goods was mainly in non-durable and semi-durable goods, While spending on durable goods declined.

In terms of sector, spending on transport, especially trucks and SUVs and spending on travel services, housing, and food were the main sources of increase in spending. These increases were offset by lower spending abroad, on food, beverage and accommodation services, and on furniture and household equipment.

Residential investment dropped by 8.2% q-o-q ar., subtracting 0.7pp to growth. This is the fifth consecutive quarter of contraction. The reduction in activity in the sector was due to a contraction in new construction and renovation activity, while ownership transfer costs rebounded in line with the increase in resale activity.

Business investment rose on the quarter, adding 0.9pp to growth. The details show a strong increase in machinery and equipment investment (+11.1% q-o-q ar., adding 0.3 0.3pp to growth), mainly due to a higher investment on aircrafts and other transportation equipment. Excluding this components, machinery and equipment investment declined on the quarter. Investment in non-residential structures increased 9.9% q-o-q ar., contributing 0.6pp to growth as a result of an increase in engineering structures.

The external sector was a drag on growth, subtracting 0.5pp to growth. Exports of goods and services rose a modest 0.4% q-o-q ar. in Q3, contributing 0.1pp to growth. Exports of services, especially commercial services), was the main source of growth in the sector (contributing 0.8pp to growth), while exports of good declined (reducing growth by 0.6pp).

Imports increased 1.9% q-o-q ar., reducing growth by 0.6pp. The increase in the second quarter was led by imports of intermediate metal products, especially unwrought gold, silver and platinum group metals and their alloys, motor vehicles and parts, and aircrafts.

Canada’s terms-of-trade deteriorated for a fourth consecutive quarter in Q2 (-2.0% q-o-q) mainly as a result of a decline in commodity prices and other export goods. Nevertheless, the terms-of-trade remains above its pre-pandemic level.

On the income side, household disposable income rose by 2.6% q-o-q. The higher disposable income was mainly due to an increase in compensation of employees (+2.2% q-o-q) and non-farm self-employment income (+3.1% q-o-q). Real disposable income is estimated to have increased by 1.6% q-o-q in Q2.

With the increase in disposable income, while consumer spending was essentially flat, the household saving rate climbed to 5.1% from 3.7%.

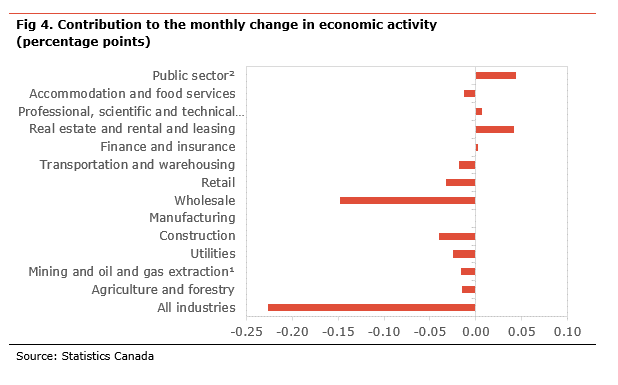

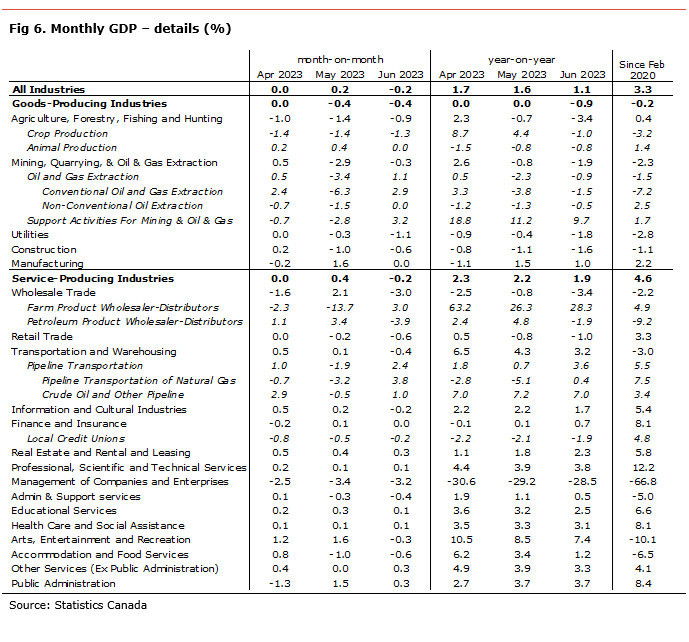

The monthly GDP for June declined by 0.2% m-o-m (+1.1% y-o-y). The preliminary estimate suggests that activity was likely unchanged in July.

The goods-producing sector decreased 0.4% m-o-m (-0.9% y-o-y). The contraction was mainly due to a drop in agriculture, natural resource extraction utilities and construction activity, while manufacturing activity was flat during the month.

The service sector edged lower by 0.2% on the month (+1.9% y-o-y). A significant drop in wholesale trade was the main drag on the sector, but there were also declines in retail trade, transportation and warehousing, accommodation and food services, and arts, entertainment and recreation. These were partly offset by increases in real estate, public administration, and other services.

For Alberta, there is no specific data in the report. However, we can make an assessment based on activity in some key industries specific to Alberta. The increase in the activity level on the month in oil and gas extraction and support activities and pipeline activity, reversing the drop in May due to the wildfires, suggests activity in the province was likely outperformed the rest of the country.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.