Economic insight provided by Alberta Central Chief Economist Charles St-Arnaud.

Bottom line

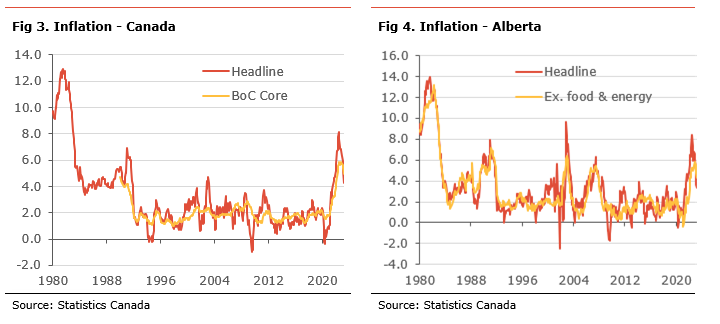

Inflation increased slightly to 4.4% in April the first increase since June 2022. The increase is mainly the result of a reduced drag from gasoline prices and continue strong contribution from shelter costs, especially mortgage interest payments and rent. Nevertheless, there are continued signs of modest moderation in underlying inflationary pressures, with most measures of core inflation easing in April yet remaining elevated, above 4%.

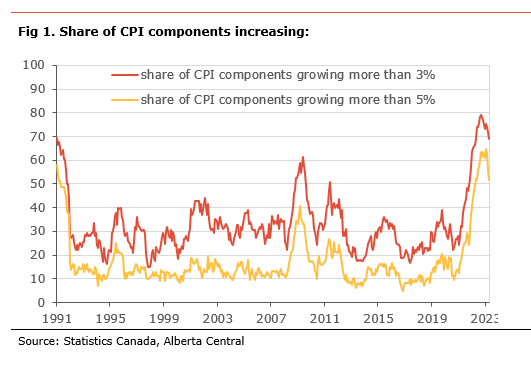

Inflationary pressures remain broad but are narrowing slightly, with a little more than half of the components of CPI rising at more than 5%, compared to 55% in March. Similarly, the share of components rising by more than 3% decreased slightly below 70% (see Fig 1.) A reduction in the percentage of components rising by more than 3% and 5% will be welcomed by the Bank of Canada as a sign that the moderation in inflation remains broad-based.

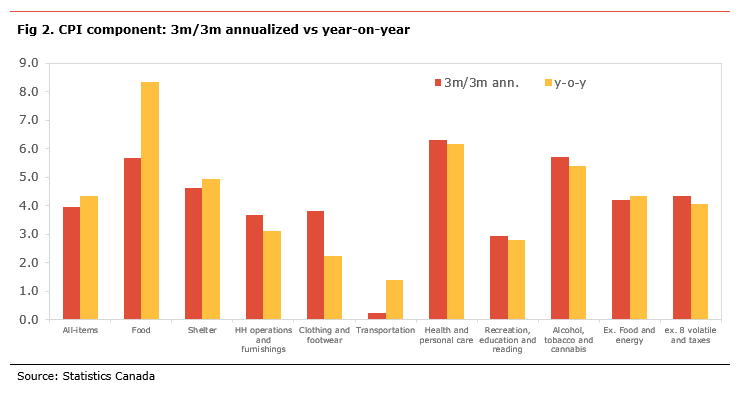

However, the recent trend in CPI’s monthly changes suggests that inflationary pressures have accelerated slightly in recent months. Moreover, we can observe that many of the 3-month annualized change in many CPI components are either on par with the year-on-year changes or slightly above, suggesting that the moderation in inflation maybe be stalling (see Fig. 2). The 3-month annualized changes in headline CPI is now at 3.9%, above the BoC’s target band. Similarly, the measure for CPI excluding food and energy is at 4.2%, also above the BoC’s target range, while it is 24.3% for the BoC’s old measure of core (CPI ex the 8 most volatile components and indirect taxes).

Inflation has clearly peaked but there are signs that the pace of the moderation may be slowing. Moreover, it remains well above the BoC’s target of 2%, inflation expectations are elevated, and inflationary pressures remain broad and likely sticky. The BoC may find the recent inflation dynamic, as measured by the 3-month annualized changes, slightly concerning, but continues to support the case for the BoC to leave its policy rate unchanged at 4.5% for the rest of the year.

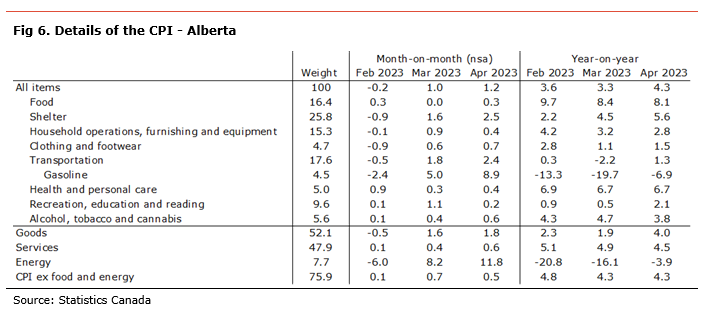

In Alberta, inflation jumped to 4.3%. The acceleration was mainly the result of a sharp rise in electricity costs (+20% y-o-y) pushed shelter costs higher. As such, electricity costs are contributing 0.5 percentage points to inflation. An increase in transportation costs, due to less drag from gasoline prices, was another source of upside pressure on inflation. Food prices decelerated but remain one of the main sources of inflation. Inflation excluding food and energy (a measure of core inflation) was unchanged at 4.3%, its lowest since February 2021.

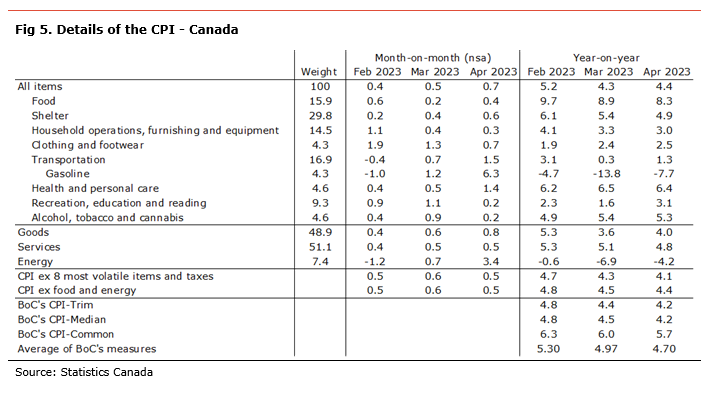

The Consumer Price Index (CPI) increased by 0.7% m-o-m non-seasonally-adjusted in April and the inflation rate increased slightly to 4.4%, higher than expectations. Prices rose on the month in all of the eight major CPI components, led by transportation costs (+1.5% m-o-m), pushed higher by a continued rise in gasoline prices (+6.3% m-o-m), health care and personal care costs (+1.4% m-o-m), and clothing and footwear (+0.7% m-o-m). Shelter costs rose 0.6% m-o-m, led by a continued rise in mortgage interest costs (+2.0% m-o-m), as more homeowners renewed their mortgages at higher interest rates, and rents (+0.5% m-o-m). Food prices showed another robust increase of +0.4% m-o-m).

Five of the eight major CPI components decelerated in April on a year-on-year basis. Shelter costs decelerated to 4.9% and remain the main source of inflation, contributing 1.5 percentage points (pp), with about 0.8pp attributable to higher mortgage interest costs and 0.4pp due to higher rent. Food prices inflation moderated to 8.3% y-o-y, contributing 1.3pp to inflation. Prices at the grocery stores, especially for meat, dairy and egg, and bakery products, were the main source of food inflation. Transportation costs accelerated to 1.3% y-o-y, contributing 0.2pp to inflation, with gasoline prices remaining a drag on inflation by declining 7.8% y-o-y. Household operation costs grew at a slower pace of 3.0% y-o-y, contributing 0.4pp to inflation, with the deceleration attributable to a slower increase in household furnishing and equipment cost.

In April, goods prices inflation accelerated to 4.0% from 3.6%, while services inflation moderated to 4.8% from 5.1%. Energy prices dropped 4.2% y-o-y compared to the same month last year. Excluding food and energy, prices increased 0.5% on the month and rose by 4.4% compared to the same month last year, its lowest level since February 2022. The Bank of Canada’s old measure of core inflation, CPI excluding the 8 most volatile components and indirect taxes, moderated to 4.1%.

Looking at the BoC’s core measures of inflation, all three indicators decelerated in April. CPI-Median eased to 4.2% from 4.5%, CPI-Trim to 4.2% from 4.4%, and CPI-Common to 5.7% from 6.0%.

In Alberta, inflation moderated to 4.3% in March from 3.3%. Shelter costs accelerated in April, increasing by 5.6% y-o-y, compared to 4.5% y-o-y the prior month, contributing 1.5pp to inflation. This rebound in shelter costs was due to an increase in electricity costs (+17.3% m-o-m and 19.7% y-o-y) in April, contributing 0.5pp to inflation. Transportation costs increased by 1.3% y-o-y, compared to a decrease of 2.2% y-o-y in March, with a continued rise in the cost of motor vehicles over the past year and higher gasoline prices in April being the main source of pressure. Food prices decelerated to 8.1% y-o-y and remained an important source of inflation in the province, contributing 1.3pp to inflation.

Goods price inflation accelerated to 4.0% from 1.9%, while services prices eased to 4.5% from 4.9%. Inflation excluding food and energy was unchanged at 4.3%, its lowest since February 2021, while energy costs declined a modest 3.9% y-o-y due to lower gasoline prices compared to last year.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.