Economic commentary provided by Alberta Central Chief Economist Charles St-Arnaud.

Bottom line

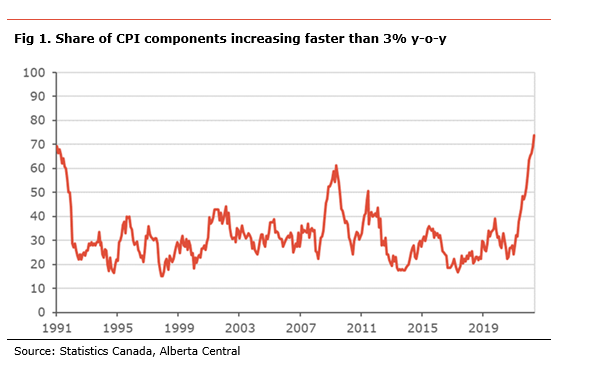

Inflation continued to accelerate in May, reaching a level not seen since 1983. The high level of inflation continues to be mainly due to a handful of components: gasoline prices, food prices, homeowners’ costs, utilities costs and motor vehicle prices. Altogether, these five items are responsible for about 5.8 percentage points of the 7.7% inflation rate. Nevertheless, inflationary pressures are broad, with about 75% of the components of CPI rising at more than 3% y-o-y (see Fig 1) and various core measures of CPI accelerating sharply and reaching record levels.

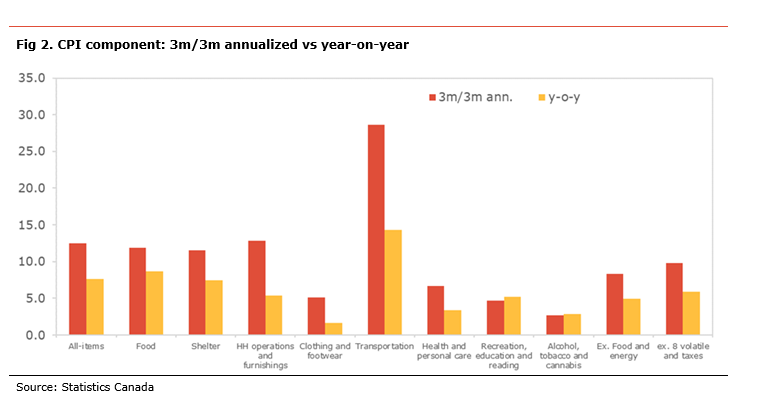

Additionally, the recent trend in the CPI monthly changes suggests that inflationary pressures remain elevated. As such, the 3-month annualized change in most of the CPI components remains well above 3% and above their year-on-year changes, suggesting an acceleration in price increases (see Fig. 2). Many of these pressures are partly due to supply constraints resulting from the pandemic, a surge in shipping costs and the broad-based increase in commodity prices, especially energy. However, rising inflation expectations are becoming a concern.

The sharp increase in commodity prices since the invasion of Ukraine by Russia will lead to further inflationary pressures and will push inflation higher in the coming months, especially food prices (see).

With inflation well above its target of 2% and more persistent than initially thought, inflation expectations rising and a broadening of inflationary pressures, we believe the Bank of Canada will continue to aggressively hike interest rates. Moreover, the sharp acceleration means that the BoC will continue to front-load the rate increase. In our view, the BoC will likely increase its policy rate by 75bp at the July meetings and by 50bp at the September and October meetings, ending the year at 3.25%.

In Alberta, inflation accelerated to 7.1%, due to a rise in gasoline prices. As it is the case nationally, most of the inflation is due to higher energy costs (gasoline, electricity and natural gas), homeownership cost, motor vehicles and food prices. We note that both headline and core inflation for the province remains slightly lower than in the rest of the country and it has been the case since October 2020.

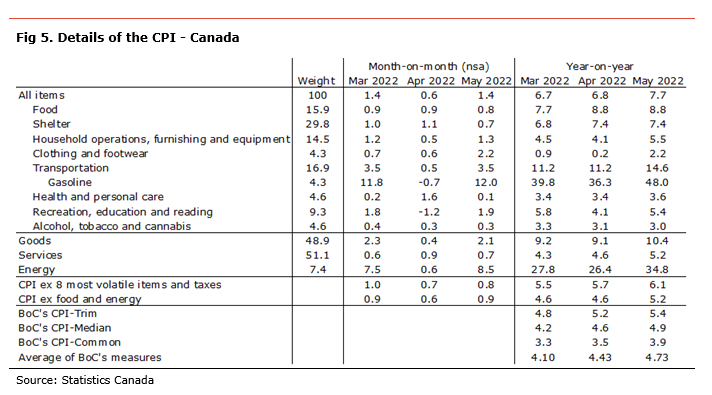

The Consumer Price Index (CPI) increased by 1.4% m-o-m non-seasonally-adjusted in May. The inflation rate accelerated to 7.7%, its highest level since January 1983. Prices rose on the month in all of the major CPI components. The biggest increases were in transportation (+3.5% m-o-m), clothing and footwear (+2.2% m-o-m), education, recreation and reading (+1.9% m-o-m), and household operations (+1.3% m-o-m). Most of the increase in transportation costs can be traced back to a 12.0% m-o-m increase in gasoline prices. The increase in transportation (+0.6pp), shelter (+0.2pp), household operations (+0.2pp) and recreation, education and reading (+0.2pp) were the main contributors to the monthly increase in CPI.

Seven of the eight major CPI components either accelerated or rose at the same pace in May on a year-on-year basis, led by transportation costs, food prices, and shelter costs. Transportation costs were accelerated to 14.6% y-o-y, contributing 2.5pp to inflation, with gasoline prices being the main source of cost increases in the category (+48.0% y-o-y contributing 2.1pp). Food prices inflation reached its highest since 1982 at 8.8% y-o-y and contributed 1.4pp to inflation. Shelter costs rose 7.4% y-o-y, the highest since 1983, as owned accommodation costs, mainly homeowners’ replacement costs, other owned accommodation costs and utilities costs continued to increase.

In May, goods prices inflation accelerated to 10.4% from 9.1% and services inflation accelerated to 5.2% from 4.6%. Energy prices also decelerated, increasing by 26.4% since April last year. Excluding food and energy, prices rose 0.9% on the month and increased by 5.2% compared to the same month the previous year, the fastest since 1991. The Bank of Canada’s old measure of core inflation, CPI excluding the 8 most volatile components and indirect taxes, edged higher to its highest level since records started in 1984 at 6.1%.

Looking at the BoC’s core measures of inflation, they all accelerated in May. CPI-Trim rose to 5.4 % from 5.2%, its highest on record, CPI-Median to 4.9% from 4.6%%, its highest on record, and CPI-Common to 3.9% from 3.5%. The average of the core measures increased to 4.7%, its highest on record.

In Alberta, inflation jumped to 7.1% in May. Transportation costs were the main reason for the acceleration in inflation in May, as gasoline prices rose 7.7% m-o-m, and contributed 1.4pp to inflation. Shelter costs are another important contributor to inflation (contributing +2.0pp), mainly due to rising utilities costs, especially electricity and natural gas prices, and owned accommodation costs. Food prices are also an important source of inflation, contributing +1.2pp. Goods price inflation rose to 9.7% and services price inflation increased to 4.4%. Inflation excluding food and energy accelerated to 4.9%, while energy costs jumped by 31.7% compared to the same month last year.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.