Economic insight provided by Alberta Central Chief Economist Charles St-Arnaud.

Bottom line

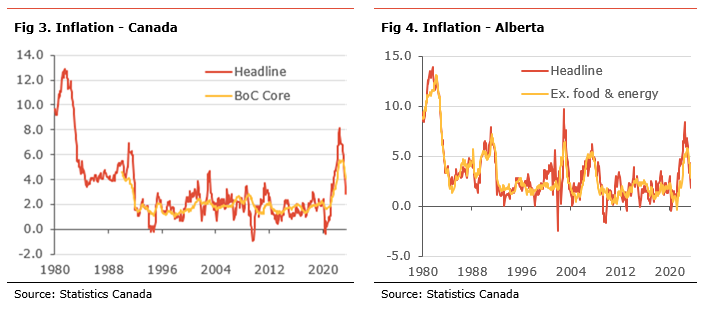

Inflation accelerated to 3.3% in July, more than expected. The higher inflation rate is largely the result of higher travel service costs, while shelter costs, especially mortgage interest payments, rent and electricity costs, and food prices remain significant sources of inflation. There are continued signs of modest moderation in underlying inflationary pressures, with most measures of core inflation easing in July and settling well below 4%.

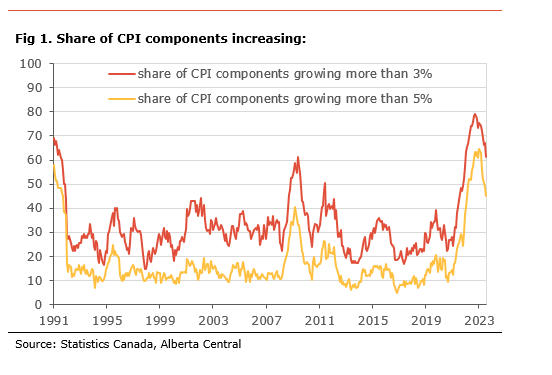

Inflationary pressures are also narrowing, with 45% of the components of CPI rising at more than 5%, compared to 49% in June. Similarly, the share of components increasing by more than 3% declined to 61% (see Fig 1.) Further progress in the reduction in the percentage of components rising by more than 3% and 5% will be welcomed by the Bank of Canada and suggests a narrowing of the distribution of y-o-y increases.

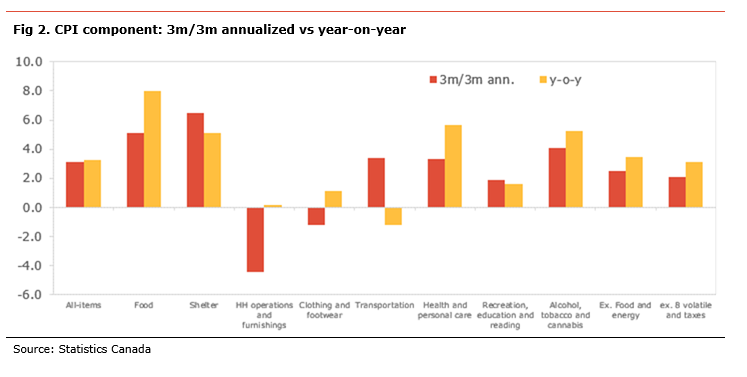

The recent trend in CPI’s monthly changes suggests that the momentum in inflationary pressures continues to ease, albeit slowly. Moreover, we can observe that many of the 3-month annualized changes in many CPI components are lower than the year-on-year changes, suggesting continues moderation in inflation, except for shelter costs that are accelerating due to mortgage interest costs and transportation costs due to small increases in gasoline prices in recent months (see Fig. 2). The 3-month annualized changes in headline CPI is now at 3.1%, only marginally above the BoC’s target band. However, the same measure for the BoC’s core measures increased 3.5% on average, suggesting continued strong price pressures. CPI excluding food and energy is at 2.5%, in line with the BoC’s target range, while it is 2.1% for the BoC’s old measure of core (CPI ex the 8 most volatile components and indirect taxes).

Inflation continues to moderate, but inflationary pressures remain somewhat broad and sticky. The BoC is likely to welcome the recent dynamic in its measures of core inflation, as measured by the 3-month annualized changes that are still above 3%.

However, higher interest rates are having a significant impact on inflation. We estimate that inflation excluding food, energy and mortgage interest payments is about 1.9% and its 3m/3m annualized change is around 1.4%. This means that excluding the impact of the rate hikes, underlying inflation is well in line with the BoC’s target.

With the surprise increase in July and the continued rise in gasoline prices, inflation is expected to rise slightly in the coming months and to average about 3.6% for the rest of 2023. Similarly, a base effect could also push core measures higher. While inflationary pressures remain high and the short-term dynamic suggests some stickiness in core inflation, we believe the BoC will be patient and will stay on the sideline for some time. The decision to raise rates again hinges on whether the domestic economy slows, reducing excess demand, and further moderation in inflationary pressures. In the coming months, a lack of progress on both fronts could trigger further hikes, but the probability is low, in our view.

In Alberta, inflation jumped to 2.9%. The sharp acceleration was mainly the result of a sharp rise in electricity costs (+28.1% m-o-m and 127.8%y-o-y), due to a rise in prices and the end of the provincial rebate and price cap. As a result, shelter costs accelerated, contributing 2.0pp percentage points to inflation. Food prices decelerated and remained one of the main sources of inflation. Inflation excluding food and energy (a measure of core inflation) inched higher to 3.0 and remains below the national measure.

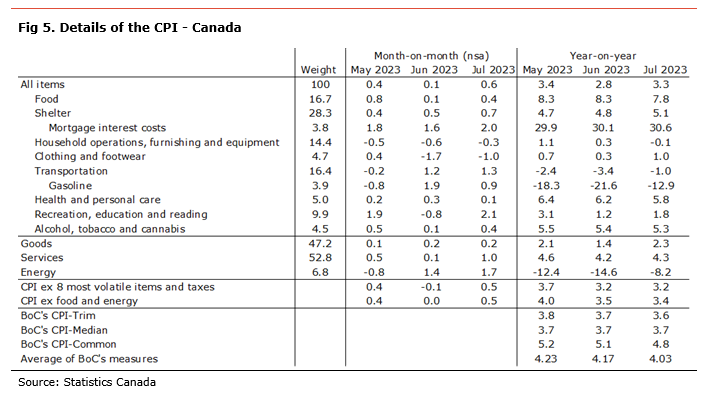

The Consumer Price Index (CPI) increased by 0.6% m-o-m non-seasonally-adjusted in July and the inflation rate accelerated to 3.3%. Prices rose on the month in six of the eight major CPI components, led by recreation, education and reading (+2.1% m-o-m), as travel costs jumped by 10.5% m-o-m. Transportation rose +1.3% m-o-m, due to a 11.6% m-o-m increase in gasoline prices and shelter prices were up +0.7% m-o-m, once again due to higher mortgage interest rate cost (+2.0% m-o-m). Food prices rose 0.4% m-o-m in July. Declines in clothing and footwear (1.0% m-o-m) due to seasonal sales and household furnishing and equipment (-0.3% m-o-m) were a small drag on the CPI in July.

Four of the eight major CPI components decelerated in July on a year-on-year basis. Shelter costs accelerated to 5.1% and is the main source of inflation, contributing 1.4 percentage points (pp), with about 1.16pp attributable to higher mortgage interest costs and 0.4pp due to higher rent. A sharp rise in electricity cost (3.3% m-o-m and +11.7% y-o-y) due to higher prices in Alberta was also an important source of pressure on shelter costs. Food prices remained one of the main sources of inflation, increasing by 7.8% y-o-y, the lowest since March 2022, contributing 1.3 percentage points (pp) to inflation. Transportation costs declined 1.0% y-o-y, reducing inflation by 0.5pp to inflation, with gasoline prices being the main drag on inflation by declining 12.9% y-o-y.

In July, goods prices inflation accelerated to 2.3% from 1.4, while services inflation rose to 4.3% from 4.2%. Energy prices dropped 8.2% y-o-y compared to the same month last year. Excluding food and energy, prices rose 0.5% on the month and by 3.4% compared to the same month last year, its lowest level since December 2021. The Bank of Canada’s old measure of core inflation, CPI excluding the 8 most volatile components and indirect taxes, was unchanged at 3.2%, its lowest since June 2021.

Looking at the BoC’s core measures of inflation, most indicators decelerated in July. While CPI-Median was unchanged at 3.7%, CPI-Trim eased to 3.6% from 3.7% and CPI-Common to 4.8% from 5.1%. As a result, the average of the three measures moderated to 4.03% from 4.17%, its lowest level since January 2022.

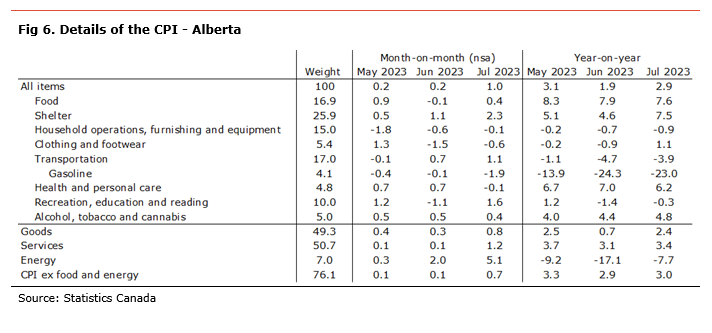

In Alberta, inflation jumped to 2.9% in July from 1.9%. The main source of inflation acceleration was shelter costs, which rose 2.3% m-o-m due to a 28.1% m-o-m jump in electricity cost (127.8% y-o-y). The sharp rise in electricity costs is due to higher prices and the phasing out of the provincial rebate and price cap. Shelter costs are contributing 2.0pp to inflation. Food prices decelerated to 7.6% y-o-y and remained one of the main sources of inflation in the province, contributing 1.3pp to inflation. Transportations cost declined 3.9% y-o-y, reducing inflation by 0.7pp, mainly as a result of lower gasoline prices (-23.0% y-o-y).

Goods price inflation jumped to 2.4% from 0.7%, while services prices rose to 3.4% from 3.1%. Inflation excluding food and energy edged higher to 3.0%, while energy costs declined 7.7% y-o-y due to lower gasoline and natural gas prices compared to last year, more than offsetting the surge in electricity.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.