Economic insight provided by Alberta Central Chief Economist Charles St-Arnaud.

Bottom line

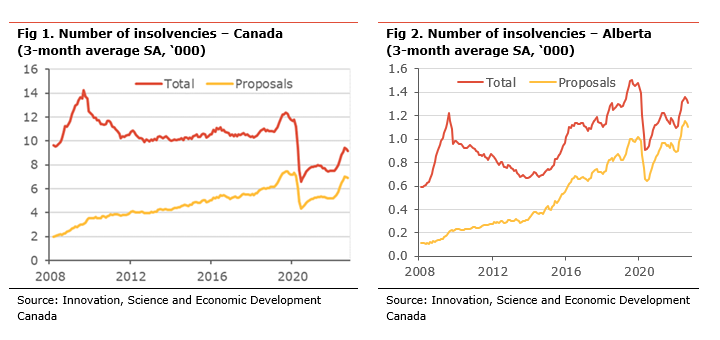

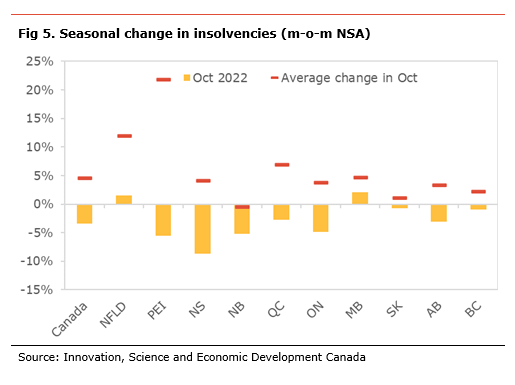

Insolvencies eased in October, the second consecutive monthly decline and are at their lowest level since April, on a seasonally-adjusted basis. This situation is perplexing, considering the sharp rise in interest rates and the continued erosion in households’ purchasing power over the period. However, it could be the result of the continued strength in the labour market and households using their savings to stay afloat.

Nevertheless, the reduction in October does not alter the trend. The insolvencies remain low, but proposals (a renegotiation of terms) have increased sharply over the past year. They are now above their pre-pandemic nationally and in BC, Alberta, Saskatchewan, and Manitoba. This situation suggests a rise in households struggling with their debt load as the Bank of Canada continues raising interest rates.

Record levels of household debt, declining purchasing power due to rising inflation, and the sharp rise in interest rates are putting pressures on households’ finances (see The Great Consumer Squeeze for details). Moreover, a slowing economy is likely to be associated with a rise in unemployment. All those factors point to an insolvencies increase in the coming months. The question is whether the strength of the labour market, with the lowest unemployment rate on record, and the vast amount of saving accumulated during the pandemic, estimated at $320bn, will continue to provide some relief.

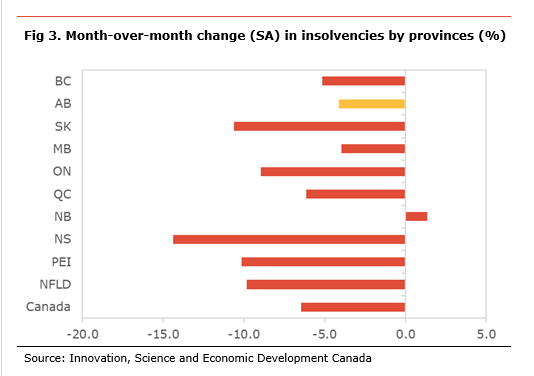

In Alberta, a strong recovery in the oil sector, with the value of oil production reaching an all-time high since mid-2021 (production value has averaged $12bn since the start of 2022), and the associated tailwind to the economy, and a robust labour market could help to hold back insolvencies. However, Albertan households have some of the highest debt-to-income ratios, making them vulnerable to rising interest rates. In addition, we note that the level of proposals (a renegotiation of terms) is well above its pre-pandemic one.

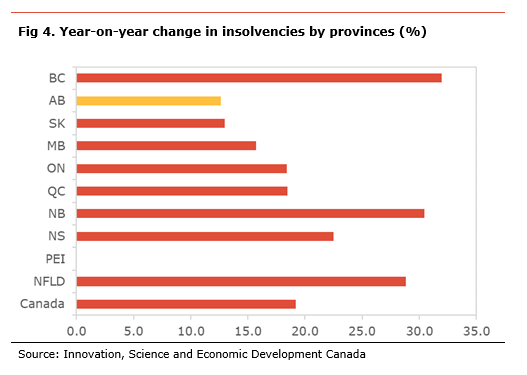

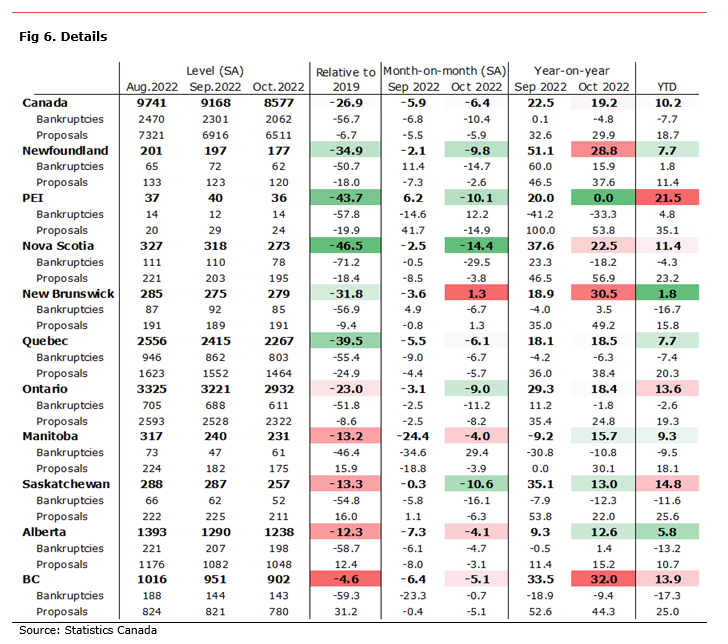

Insolvencies eased in October on a seasonally-adjusted basis, the second consecutive month of decline. Insolvencies, which include both bankruptcies and proposals (a renegotiation of terms), rose by 19.2% compared to the same month last year. This resulted from a 29.9% y-o-y increase in proposals, while bankruptcies were lower by 4.8% y-o-y. Compared to last year, insolvencies increased in every province, except in Manitoba where they were unchanged. The increase was the most significant in BC (+32.0% y-o-y), New Brunswick (+30.5% y-o-y), Newfoundland (+28.8% y-o-y), and Nova Scotia (+22.5% y-o-y). Alberta (+12.6% y-o-y), Saskatchewan (+13.0% y-o-y), Manitoba (+15.7% y-o-y) and Ontario (+%8.4% y-o-y) saw the smallest, yet still large, increases.

On a monthly basis, insolvencies declined by 6.4% m-o-m seasonally-adjusted (sa) in October. The lower insolvencies were led by a decrease in both proposals (-5.9% m-o-m sa) and in bankruptcies (-10.4% m-o-m sa). The reduction in insolvencies on the month was led by Nova Scotia (-14.4% m-o-m sa), Saskatchewan (-10.6% m-o-m sa), PEI (-10.1% m-o-m sa), and Newfoundland (-9.8% m-o-m sa). Insolvencies increased on the month only in New Brunswick (+1.3% m-o-m sa).

In Alberta, insolvencies declined by 4.1% m-o-m sa and increased by 12.6% compared to the same month last year. Over the past 12 months, there have been 14.9k insolvencies, still well below their pre-pandemic levels of 17.2k. On a seasonally-adjusted basis, the decrease in insolvencies in October came from a reduction in both proposals (-3.1% m-o-m sa) and bankruptcies (-4.7% m-o-m sa.). However, we note that the level of proposals is well above its pre-pandemic level.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.

Alberta Central member credit unions can download a copy of this report in the Members Area here.