Economic insight provided by Alberta Central Chief Economist Charles St-Arnaud.

Bottom line

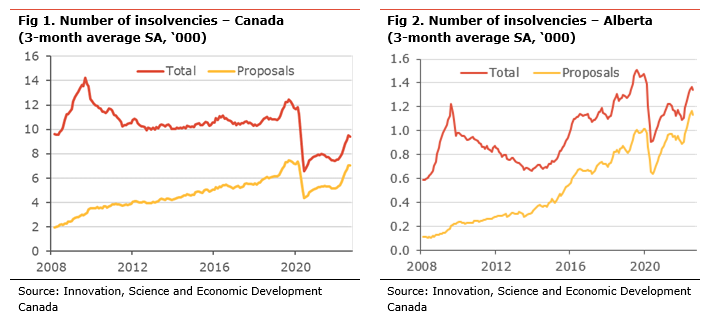

Insolvencies eased in September. However, the decline comes after an unusually strong increase in August. Nevertheless, the reduction in September does not alter the trend. The insolvencies remain low, but proposals (a renegotiation of terms) have increased sharply in recent months. They are now above their pre-pandemic nationally and in Saskatchewan, Alberta, Manitoba, BC, and Ontario. This situation suggests a rise in households struggling with their debt load as the Bank of Canada continues raising interest rates.

Record levels of household debt, declining purchasing power due to rising inflation, and the sharp rise in interest rates are putting pressure on households’ finances (see The Great Consumer Squeeze for details). Moreover, a slowing economy is likely to be associated with a rise in unemployment. All those factors are pointing to a continued increase in insolvencies in the coming months. The question is whether the strength of the labour market, with the lowest unemployment rate on record, and the vast amount of saving accumulated during the pandemic, estimated at $320bn, will provide some relief.

In Alberta, a strong recovery in the oil sector, with the value of oil production reaching an all-time high since mid-2021 (production value has averaged $12bn since the start of 2022), and the associated tailwind on income and confidence, and a robust labour market could help to hold back insolvencies. However, Albertan households have some of the highest debt-to-income ratios, making them vulnerable to rising interest rates. In addition, we note that the level of proposals (a renegotiation of terms) is well above its pre-pandemic one.

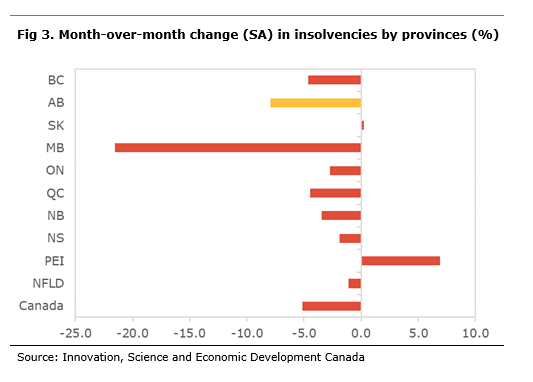

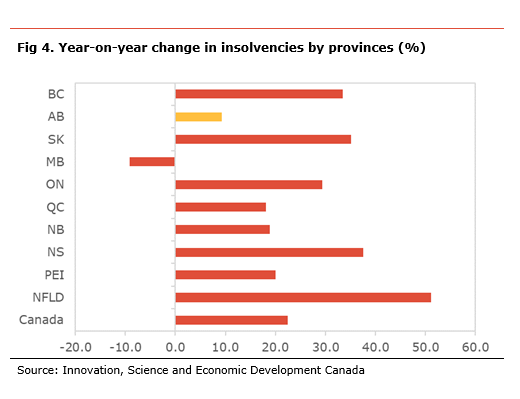

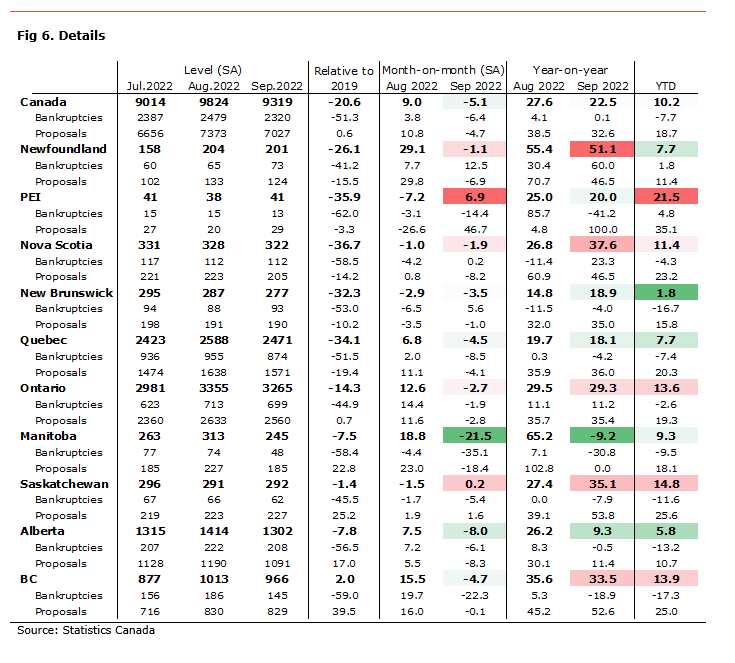

Insolvencies eased in September, on a seasonally-adjusted basis and their number remained below their pre-COVID levels. Insolvencies, which include both bankruptcies and proposals (a renegotiation of terms), rose by 22.5% compared to the same month last year. This resulted from a 32.6% y-o-y increase in proposals, while bankruptcies were mostly unchanged +0.1% y-o-y. Compared to last year, insolvencies increased in every province, except in Manitoba were they are lower by 9.2% y-o-y. The increase was the most significant in Newfoundland (+51.1% y-o-y), Nova Scotia (+37.6% y-o-y), Saskatchewan (+35.1% y-o-y), and BC (+33.5% y-o-y). Alberta (+9.3% y-o-y), Quebec (+18.1% y-o-y), New Brunswick (+18.9% y-o-y), and PEI (+20.0% y-o-y) saw the smallest, yet still large, increases.

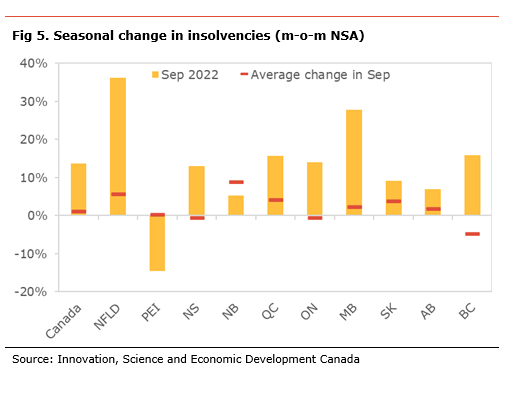

On a monthly basis, insolvencies declined by 5.1% m-o-m seasonally-adjusted (sa) in September. The lower insolvencies were led by an decrease in both proposals (+4.7% m-o-m sa) and in bankruptcies (-6.4% m-o-m sa). The reduction in insolvencies on the month was led by Manitoba (-21.5% y-o-y), Alberta (-8.0% m-o-m), BC (-4.7% m-o-m), and Quebec (-4.5% m-o-m). Insolvencies increased on the month in PEI (+6.9% m-o-m sa) and Saskatchewan (+0.2% m-o-m sa).

In Alberta, insolvencies declined by 8.0% m-o-m sa and increased by 9.3% compared to the same month last year. Over the past 12 months, there have been 14.7k insolvencies, still well below their pre-pandemic levels of 17.2k. On a seasonally-adjusted basis, the decrease in insolvencies in September came from a reduction in both proposals (-8.3% m-o-m sa) and bankruptcies (-6.1% m-o-m sa.). However, we note that the level of proposals is well above its pre-pandemic level and rising.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.