Economic insight provided by Alberta Central Chief Economist Charles St-Arnaud.

Bottom line

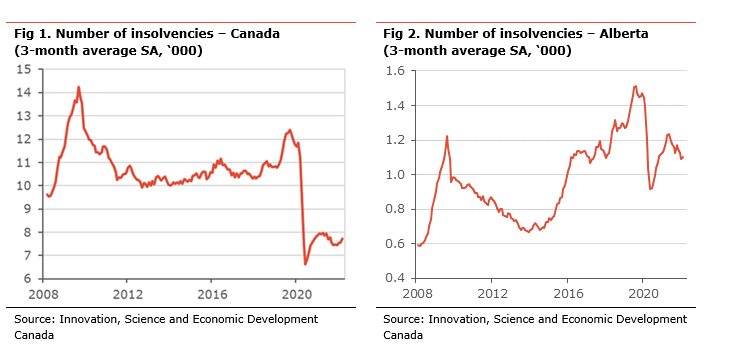

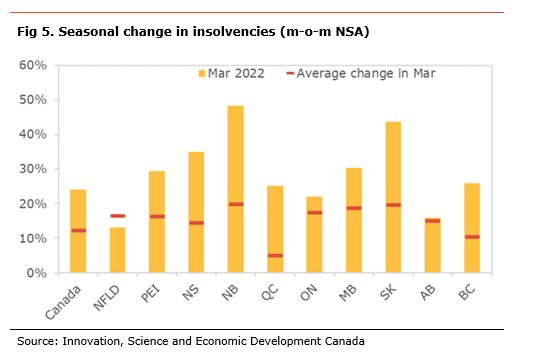

Insolvencies remained low in March, as low interest rates and the continued economic recovery with sustained employment gains are holding them back. However, they could be bottoming out. The rise in insolvencies so far this year has been stronger than suggested by seasonal patterns. In addition, a record level of household debt, a normalization in disposable income as income support programs are phased out, declining purchasing power due to rising inflation, and the sharp rise in interest rates will put pressure on households’ finances (see The Great Consumer Squeeze for details).

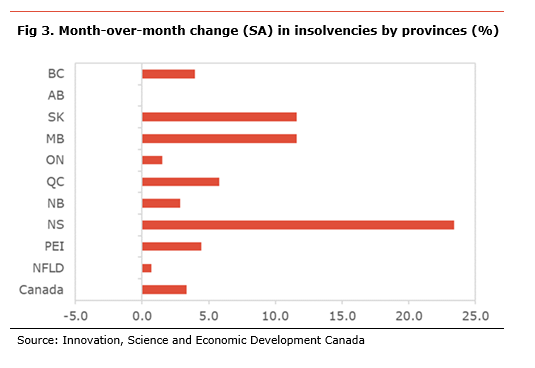

In Alberta, a strong recovery in the oil sector, with the value of oil production reaching an all-time high since mid-2021 (record production value of $14bn in March 2022), and the associated tailwind on income and confidence are likely to help to hold back insolvencies. However, Albertan households have one of the highest debt to income ratio making them vulnerable to rising interest rates.

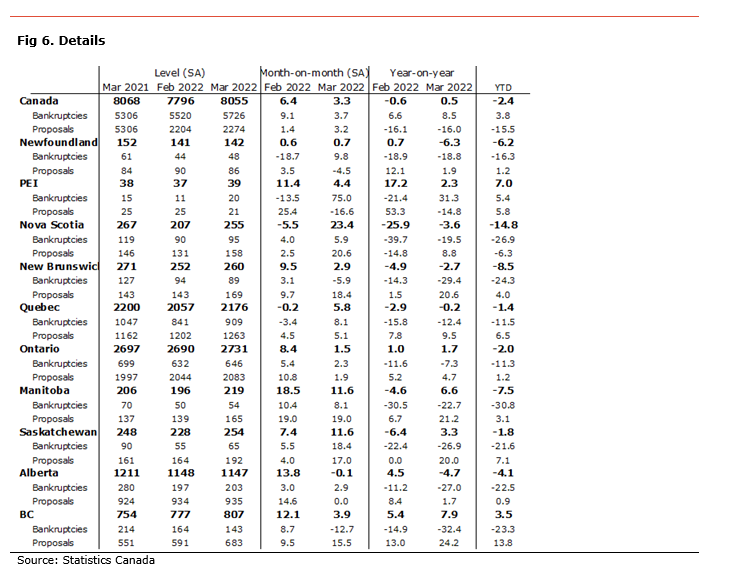

Insolvencies increased in March and remained well below their pre-COVID levels. Insolvencies, which include both bankruptcies and proposals (a renegotiation of terms), rose by 0.5% compared to the same month last year. This resulted from an 8.5% y-o-y increase in proposals, while bankruptcies were down 16.0% y-o-y.

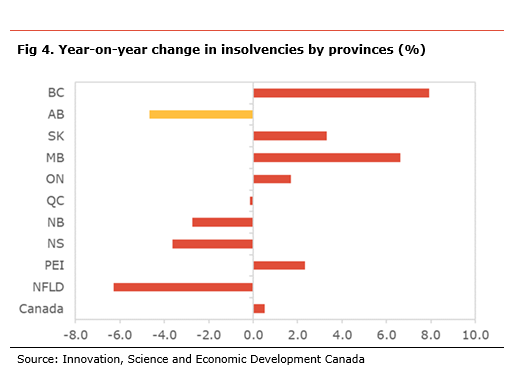

On a monthly basis, insolvencies rose 3.3% m-o-m seasonally-adjusted (sa) in January. The higher insolvencies were led by an increase in both bankruptcies (+3.2% m-o-m sa) and proposals (+3.7% m-o-m sa). Almost all provinces saw a rise in insolvencies on the month, led Nova Scotia (23.4% m-o-m), Manitoba (+11.6% m-o-m), Saskatchewan (+11.6% m-o-m) and Quebec (+5.8% m-o-m). Insolvencies were almost flat in Alberta (-0.1% m-o-m).

In Alberta, insolvencies eased by 0.1% m-o-m sa and by 4.9% compared to the same month last year. Over the past 12 months, there have been 14.0k insolvencies, still well below their pre-pandemic levels of 17.2k. The decrease in insolvencies in March, on a seasonally-adjusted basis, came from a reduction in both proposals (-0.5% m-o-m sa) and bankruptcies (-6.7% m-o-m sa.).

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.

Alberta Central member credit unions can download a copy of this report in the Members Area here.