Economic insights provided by Alberta Central Chief Economist Charles St-Arnaud.

Key takeaways:

- The Canadian economy has avoided falling into a recession in 2024, despite one of the sharpest increases in interest rates in Canadian history and the most restrictive monetary policy in over a decade.

- However, this doesn’t mean that the economy is performing well, with business and consumer sentiment remaining weak.

- The current situation could be referred to as a “Me-cession”. In other words, collectively, we are spending more and pushing economic activity higher but, individually, we are restricting purchases and behaving as if we are in a recession.

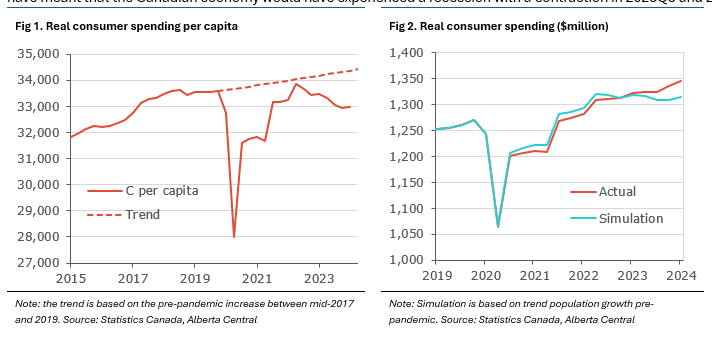

- The evidence can be seen in the divergence between continued increases in aggregate consumer spending and declining per capita consumer spending (in real terms).

- Population growth has been key for Canada to avoid experiencing a recession, leading to a sharp rise in the number of consumers in the economy and boosting the demand side, even though individual consumers are spending less.

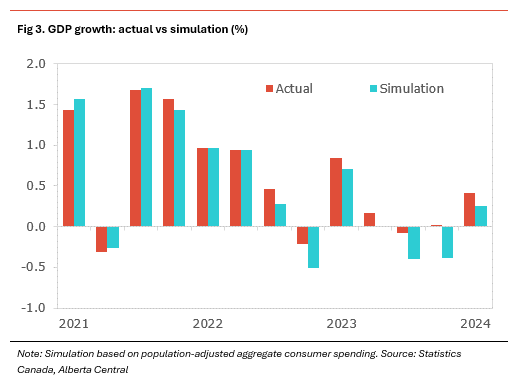

- We estimate that, if it were not for strong population growth, economic activity would have contracted in both 2023Q3 and 2023Q4, meaning that Canada would have been in a recession late last year.

- With the expected crackdown on non-permanent residents, population growth will slow dramatically over the next few years; consequently, the Canadian economy will lose a significant support to growth. The Bank of Canada expects population growth to be about 2 percentage points weaker.

- Nevertheless, the decline in real spending per capita, about 2.5%, is not as big as during previous recessions, despite the headwinds to household finance.

- The resilience of the labour market, characterized by a lack of layoffs, explains the better economic performance compared to previous recessions, as nominal household income has not declined.

- The lack of income shock has allowed households to weather headwinds from higher interest rates. As such, the situation has allowed lenders to be flexible in the face of rising borrowing costs by extending the amortization of loans or restructuring borrowing terms, thereby making the impact of higher interest rates on households less severe than expected. This is why we think the upcoming wave of mortgage renewals will not lead to a crisis.

- Nevertheless, consumer spending per capita is expected to remain subdued. However, some gains in disposable income and lower interest rates are likely to prevent a further decline in spending per capita, as long as the labour market remains resilient.

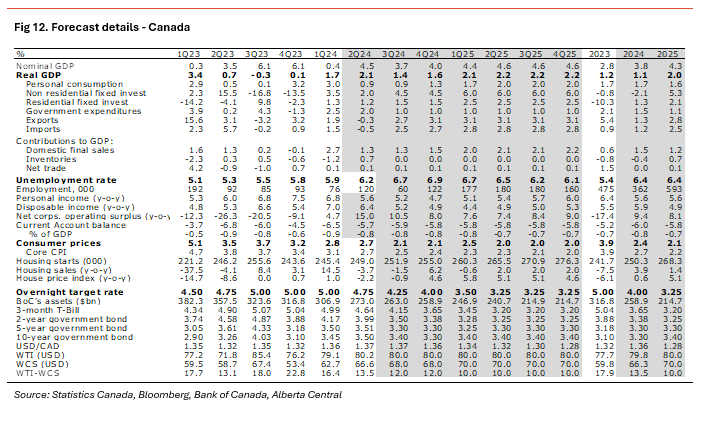

- Overall, the economy is expected to remain sluggish for the remainder of 2024 and most of 2025 despite the gradual decline in interest rates. With this in mind, growth is expected to remain between 1.5% and 2% for the rest of 2024 and to be around 2% for most of 2025.

- Inflation is expected to moderate slightly in the coming months and to remain consistent with the BoC’s inflation target.

- With inflation in line with its objectives, the BoC is turning its focus to the downside risks to the economy and the need to support growth. With this in mind, we expect the BoC to cut its policy rate in September and October, ending the year at 4.00%. Further cuts are also expected in early 2025, with the policy rate reaching 3.25% in the first half of the year.

- The “me-cession” is stronger in Alberta than in the rest of the country, as evidenced by the underperformance in retail sales per capita adjusted for inflation.

- Weaker individual spending is due to a bigger decline in purchasing power in the province than elsewhere in the country and to the higher level of household debt.

- However, stronger population growth in Alberta compared to the rest of the country and the tailwind from high oil prices means that economic growth in the province outperforms the rest of the country.

- Alberta is expected to continue to grow faster than the rest of the country in the coming year, despite continued headwinds to the household sector. Continued strong interprovincial migration will continue to support population growth, while the start of operation of the expanded TransMountain pipeline will allow for a continued increase in oil production and exports.

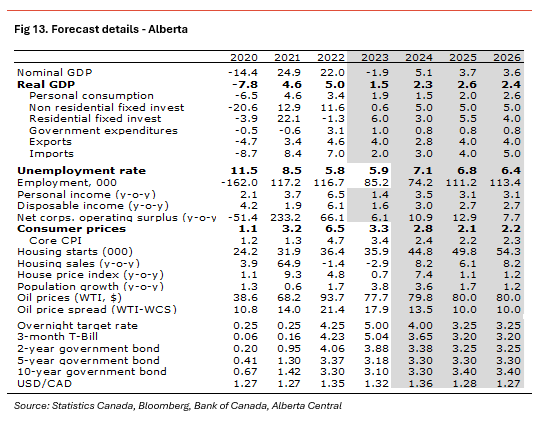

- All in all, we expect growth in Alberta to be 2.3% in 2024 and 2.6% in 2025, after reaching 1.5% in 2023, and to remain one of the best performing provinces.

The Canadian economy avoided falling into a recession in 2024, despite one of the sharpest increases in interest rates in Canadian history and the most restrictive monetary policy in over a decade. However, despite avoiding a recession, individual households and businesses do not feel positive about the state of the economy, with confidence measures below their pre-pandemic level.

The current situation can be referred to as a “Me-cession” rather than the standard recession: while the Canadian economy is still expanding, individuals are not increasing their spending, remain very cautious regarding their economic prospects and feel as though they’re in a recession.

This situation can be seen in the divergence between both the GDP in level versus GDP per capita and between aggregate household spending versus spending per capita. As such, while aggregate measures are still increasing, the per capita equivalent is declining. In other words, collectively, we are spending more and pushing economic activity higher, but, individually, we are restricting purchases and behaving as if we are in a recession.

Without strong population growth, Canada would have had a recession

Population growth has been key for Canada to avoid experiencing a recession, leading to a sharp rise in the number of consumers in the economy and providing a boost to the demand side. Hence, we look at how different the economy would have been – especially consumer spending – if it hadn’t experienced a surge in population.

Assuming population growth had continued its 2015-2019 trend during the pandemic and in the following recovery period, we estimate that the Canadian population would have reached 40 million in mid-2024 rather than the current 41 million; in other words, Canada’s population growth would be 2.5% lower.

Using this population simulation and real spending per capita over that period, we can estimate real aggregate consumer spending if we hadn’t had a population surge: in this scenario, real aggregate consumer spending would currently be about 2.2% lower than it is in the national account.

With this estimate of population-adjusted real aggregate consumer spending, we may also examine the impact of lower consumption per capita on economic growth: the level of real GDP would be 1.2% lower than it is currently. Moreover, looking at quarterly growth, the Canadian economy would have grown about 0.8 percentage point (pp) slower at an annual rate on average between 2022 and now. In addition, this slower growth would have meant that the Canadian economy would have experienced a recession with a contraction in 2023Q3 and 2023Q4 of -1.6% q-o-q ar. and -1.5% q-o-q ar., respectively.

It is clear from these estimates that strong population growth has provided a significant boost to the demand side of the economy. As such, while individual consumers are currently spending about 4% less per person adjusted for inflation than pre-pandemic, the overall increase in the number of consumers more than offsets this decline, with total real consumer spending being about 6% higher than pre-pandemic. This is the reason why growth remained robust, offsetting some of the negative impact from higher interest rates and lower purchasing power on the economy.

With this estimate of population-adjusted real aggregate consumer spending, we then look at the impact of lower consumption per capita on economic growth. We find that the level of real GDP would be 1.2% lower than it is currently. Moreover, looking at the quarterly growth profile, we find that the Canadian economy would have grown about 0.8pp slower at annual rate on average between 2022 and now. In addition, this slower growth would have meant that the Canadian economy would have experienced a recession in 2023, with a contraction in 2023Q3 and 2023Q4 of -1.6% q-o-q ar. and -1.5% q-o-q ar., respectively.

It is clear from these estimates that the strong population growth has provided a significant boost to the demand side of the economy. As such, while individual consumers are currently spending about 4% less per person adjusted for inflation than pre-pandemic, the overall increase in the number of consumers more than offsets this decline, with total real consumer spending being about 6% higher than pre-pandemic. This is an important reason why growth has remained robust since the BoC started increasing its policy rate, as it has offset some of the negative impact of higher interest rates and lower economic purchasing power.

Population growth to slow

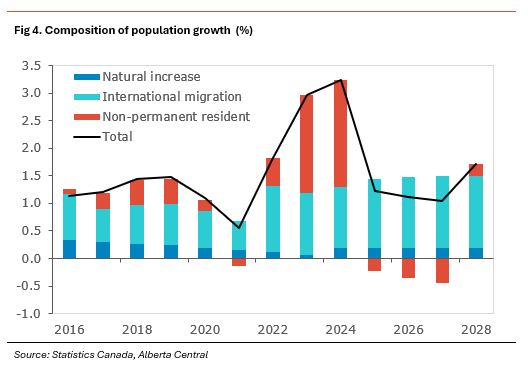

As seen in the previous estimate, the surge in population, with growth reaching 3.2% y-o-y in 2024, has had a profound impact on the economy, both in terms of its resilience and its associated challenges. Most of this population increase is due to a surge in non-permanent residents; this category of immigration contributed about a quarter of the rise in population or 0.8pp.

This sharp rise in population explains why, despite the “me-cession”, we haven’t seen a recession by boosting aggregate demand. However, the population surge also leads to challenges on the supply side of the economy, which tends to adjust slowly; it is responsible for a sharp rise in shelter costs and increased pressures on government services.

However, this situation is about to change. The federal government announced plans to reduce net inflows of non-permanent residents, aiming to lower their share of the total population from 6.2% to 5% within the next three years. As a result, population growth should slow significantly. According to the latest projections by Statistics Canada, the population is expected to increase by around 1.2% in 2025 and 1.1% in 2026, based on the high growth scenario. According to the Bank of Canada estimates, this means that population growth in 2025 will be 2pp lower than in 2024.

This slower demography will be a drag on economic growth, as aggregate demand will expand at a much slower pace as a result. However, it is important to note that this weaker population growth will also slow potential growth by about 0.5pp in 2025 and 2026, respectively, meaning that its impact on the amount of slack in the economy will be marginal. It also means that, as seen previously, if spending per capita declines further, the risk of a recession will increase.

Consumer spending: individual belt-tightening, but not as much as in previous recessions

As mentioned above, aggregate consumer spending remained robust in late 2023 and early 2024 and explains the resilience in the economy over the past year. However, spending per capita is not increasing and remains about 2.5% lower than its peak in 2022Q2, in real terms. Moreover, individual spending is about 4% below where it would have been had it grown at its pre-pandemic rate since 2020.

Households’ finances remain challenged by a loss in purchasing power from both higher inflation in 2022-2023 and interest rates. We estimate that real disposable income per person is still almost 5% below the level it should be if it had continued to increase at its pre-pandemic trend. While wages have been rising at a faster rate than inflation in recent quarters, lower purchasing power persists.

However, despite the many challenges to households’ finances in recent years, the decline in per capita spending is smaller than in previous recessions. As a comparison, during previous periods of decline, per capita spending decreased by 5.5% during the early 1980s recession, 5.5% during the early 1990s recession and by 2.5% during the recession that followed the global financial crisis of 2008.

The smaller decline in per capita spending in the current cycle compared to previous recessions, despite the decrease in purchasing power and the fastest monetary tightening in three decades, can be explained by on very crucial factor: the resilience of the labour market characterized by a continued increase in employment and minimal layoffs. This factor was nonexistent during the other episodes, with meaningful job losses in all three episodes.

This resilience of the labour market has been significant as it has meant that most households have not seen a drop in their income. This has allowed lenders to be flexible in the face of rising borrowing costs by extending the amortization of loans or restructuring the borrowing, thereby making the impact of higher interest rates on households less severe than expected.

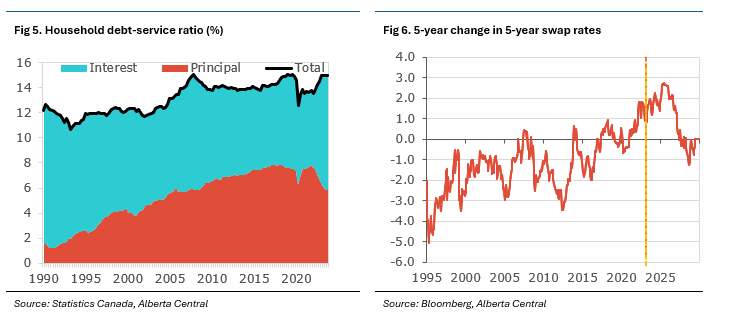

As a result, while the debt-service ratio has increased since the Bank of Canada started raising interest rates in March 2022, its rise remains subdued, considering the jump in interest rates, having increased by only 1pp to 14.9% of disposable income over the period. However, the composition of debt-service payments has changed dramatically. At the beginning of 2022, about 57% of the debt service went to obligated principal repayments. The latest data shows that this proportion has dropped to 38%. As a result, households currently spend about 9.3% of their disposable income to only cover the interest cost of their debt – 3pp higher than in early 2022.

The debt-service ratio has remained relatively stable despite the sharp rise in interest payments. This is because households have renewed their borrowing on longer amortization periods, thereby reducing the share of the obligated principal repayment in the total debt payment and offsetting the impact of higher interest rate payments. Additionally, this results in borrowers carrying debt for a longer period. We estimate that without lengthening the amortization period, the debt-service ratio would be about 2pp higher.

Similar observations can be made by looking at the insolvency data. While insolvencies have increased sharply in recent years, the increase has been mainly in proposals (i.e. a renegotiation of terms), while bankruptcies remain significantly lower by historical standards. Here again, the lack of decline in income allows borrowers to restructure their borrowing rather than having to declare bankruptcy.

Mortgage renewals are unlikely to turn into a crisis but a drag on the economy

The wave of mortgage renewals at higher interest rates in the coming years exemplifies how the resilience in the labour market, lack of decline in income and lenders’ flexibility will help mitigate what some have dubbed the “mortgage renewal cliff.”

With interest rates close to their highest in over a decade, many borrowers will need to renew their mortgages at much higher interest rates than when they initially took out the loans. In its latest Financial Stability Report, the BoC estimates that about half of mortgage holders have yet to see the impact of higher interest rates on their mortgage payments.

We estimate that 5-year fixed mortgage rates are currently about 175bp higher than they were 5 years ago. Using the benchmark house prices from July 2019 of $525k and assuming a 20% downpayment and amortization period of 25 years, the payments of a borrower who purchased a home 5 years ago were estimated at around $2053 per month. Renewing this mortgage at a mortgage rate that is currently 175bp higher than during the initial term, the mortgage payments would increase to $2382 per month, a 16% increase, if the original amortization schedule is kept constant (i.e. renewed on a 20-year year amortization). However, this borrower could opt to extend their amortization to 25 years, bringing the monthly payments to $2110, only 3% more per month.

With mortgage rates having hit a bottom of about 2.00% in late 2020 and early 2021, over the next 2 years, many borrowers renewing their mortgages will face an even bigger interest rate shock. As such, households renewing in late 2025 could face interest rates approximately 275bp higher than for their original term, assuming interest rates remain at the current level. This shock is also compounded by the fact that the size of some mortgages is likely higher since benchmark house prices rose by about 20% over the period to an average price of $630K.

Doing the same calculation as above, a borrower who bought a house in early 2021 at a price of $630K has a monthly mortgage payment of about $2134 per month. Renewing at a mortgage rate that is 300bp would push the monthly payment to about $2775 per month or 30% higher. However, even if this borrower extends their amortization period by 5 years, the monthly payment would rise to $2475 per month, a 15% increase. To keep payments relatively stable, the amortization period would need to be extended by 10 years to a total of 30 years, bringing the monthly payments to $2253 per month; this is still about 6% more per month.

The estimated increases in monthly payments over the next 2 years are still steep, even if the amortization period is lengthened, and will put extra financial stress on some households. However, as we have shown (see Will it be a hard landing or a soft landing? The labour market will decide), as long as households do not experience a drop in income, this situation is unlikely to lead to a dramatic rise in bankruptcies and bank loan losses, and the associated repercussions on the real economy. Lenders’ flexibility and willingness to prevent household bankruptcies explains why most of the increase in insolvencies is due to proposals (i.e. renegotiation of terms) rather than higher bankruptcies.

However, as we explained in the same report (see Will it be a hard landing or a soft landing? The labour market will decide), this dynamic could change rapidly if the labour market was to falter, leading to a sharp rise in layoffs. An income shock due to job losses would have a significant impact on the economic outlook, as borrowers would no longer be able to restructure their borrowing, forcing them to sell assets or default on their obligations. Such a scenario could have important negative spillovers to the rest of the economy as housing prices would fall and lenders would reduce credit availability to protect their balance sheets from further losses and defaults.

While the wave of mortgage renewals in the coming year is unlikely to lead to a major downturn, in our view, as higher debt payments will have a negative impact on many households’ finances, risks remain elevated.

The “Me-cession” may end, but don’t expect a rebound in spending

The refinancing of debt at higher interest rates will continue to put strains on consumer spending. In addition, most households believe that the economy is going through a recession, with individuals assessing the overall economic environment based on their individual situation or equate the “me-cession” to a wider recession. As such, consumer surveys show that, while having improved since the beginning of the year, consumer confidence remains weak and close to levels reached during the financial crisis. Moreover, most households believe that their financial situation will worsen, that now is a bad time to make big purchases, and are expecting an increase in job losses.

All this suggests that households are likely to remain cautious with their level of spending over the next year. Whether we will see an improvement in spending per capita will depend on: 1) a gain in real disposable income per capita, improving the purchasing power, and 2) continued resilience in the labour market, with no decline in employment. While lower interest rates will be positive on households, as the BoC continues to cut its policy rate, the reprieve will likely be only marginal and unlikely to lead to a significant rebound in spending.

With weaker population growth over the next two years, subdued increases in spending per capita likely mean that consumer spending is unlikely to be a significant driver of economic growth over that period. However, a marginal improvement in spending per capita means that a consumer-led recession is unlikely unless the labour market deteriorates.

Overall, the economy is expected to remain sluggish for the remainder of 2024 and most of 2025 despite the gradual decline in interest rates. With this in mind, growth is expected to remain between 1.5% and 2% for the rest of 2024 and to be around 2% for most of 2025.

Housing

The housing market is close to its lowest affordability in decades in many areas of the country, with prices having increased sharply as interest rates fell to all-time lows during the pandemic. The sharp increase in interest rates to fight inflation is compounding the effect of high prices on affordability. (see What does it mean to restore housing affordability? Significant sacrifices and adjustments for more details).

With interest rates remaining high, activity in the housing market has been subdued in most provinces, especially in areas with low affordability, while activity remains strong in provinces with higher affordability such as Alberta and Saskatchewan. Inventories have increased but remain well below their pre-pandemic levels in many cities. As a result, house prices have been relatively resilient in recent months, even in areas with low affordability.

There is an expectation that lower interest rates should provide some support to the housing market in the later months of 2024, as affordability will somewhat improve. However, the extend of the rebound in activity is likely to be limited, as interest rates are likely to remain elevated when compared to the past decade; this means that the impact on affordability will be limited (see What does it mean to restore housing affordability? Significant sacrifices and adjustments for an estimate of how much interest rates need to go to restore affordability).

While helpful for variable-rate mortgages, the expected decline in the policy rate may not feed through to fixed-rate mortgages. This is because, to a large extent, the BoC easing cycle is mostly priced in by financial markets and is unlikely to move the 5-year point of the yield curve significantly and push fixed mortgage rates lower. Moreover, the 5-year part of the yield curve is heavily influenced by US rates. Hence, the Federal Reserve may need to ease more than expected to lower the 5-year segment of the Canadian yield curve.

With most potential buyers expecting further rate cuts over the next year, many would-be buyers will likely opt to stay on the sidelines in the short term hoping for lower mortgage rates at a later date. As a result, the impact of lower rates on the housing market may be delayed to the end of 2024 or early 2025.

Affordability remains an important issue for the Canadian economy. Increasing the supply of new housing units in the coming years will be crucial. However, as we have shown in What does it mean to restore housing affordability? Significant sacrifices and adjustments, restoring affordability will require either significant adjustments in terms of prices or more than a decade of slow improvements.

Investment

Residential investment has been weak recently despite the urgent need for new supply. However, its composition is improving. As such, investment in new residential structures is higher than pre-pandemic investments, while spending on renovation and homeownership transfer costs are lower. Nevertheless, considering the number of new homes that will be required over the next decade to improve affordability and the strong increase in population, investment in new residential will need to be much higher over the next few years.

High financing costs, high levels of regulation and continued labour shortages in the construction sector are constraints to an increase in the supply of new homes. With the BoC cutting its policy rate over the next year, the hurdle caused by higher interest rates will ease. However, labour shortages are unlikely to decrease significantly over the next year. As a result, while investment in the sector should increase, the improvement will be modest.

The outlook for business investment also remains subdued. The latest business surveys continue to show that business sentiment is weak. Businesses are pointing to the weakness in domestic demand, elevated uncertainty, high borrowing costs and continued cost pressures for their bleak views. This is not an environment that is conducive to business investment and, as a result, investment intentions remain weak.

We may likely have reached a trough in business sentiment. With the economy not expected to moderate further and likely to improve marginally, thanks to lower interest rates, business sentiment should improve slightly over the next year, which could lead to a modest improvement in investment.

Labour market

As mentioned previously, the performance of the labour market remains key for the resilience of the Canadian economy. So far this year, job creation remained positive, with about 340k new jobs added over the past year. However, this is weaker than population growth. With the labour market unable to fully absorb all newcomers into the labour force, the unemployment rate has been slowly drifting higher; currently, the unemployment rate is 6.4%. However, there haven’t been significant layoffs so far, which means that the higher unemployment rate is not affecting household income.

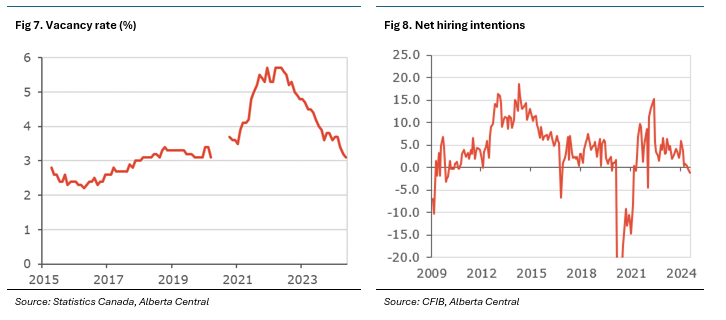

However, the pace of hiring is expected to be subdued as the economy remains weak. As such, the vacancy rate has normalized rapidly since the beginning of the year and is back to its pre-pandemic level. Moreover, the most recent survey by the Canadian Federation of Independent Businesses (CFIB) shows that net hiring intentions are marginally negative, suggesting that, on balance, a small majority of businesses expect to lower their employment levels over the next 3 to 4 months. Similarly, the latest Business Outlook Survey by the BoC shows hiring intentions are below long-term averages yet positive.

These indicators point to a weakening in the demand for labour while supply is expected to continue to increase. This means that we should expect the unemployment rate to continue to drift higher, likely reaching almost 7% by year-end. Nevertheless, there are no indications that we could be on the eve of a wave of significant layoffs.

All this supports our view that the Canadian economy is on the path to a soft landing. However, with the health of the labour market behind the economy’s resilience, any deterioration in the labour market should be monitored closely.

External sector

Global growth has been resilient so far this year despite the continued impact of higher global interest rates to fight inflation. The Chinese economy continues to face challenges caused by its property sector, while growth in Europe is improving marginally. In the US, the economy has remain robust in the face of sharply higher interest rates thanks to robust government and consumer spending. Consumer spending has remained solid, supported by high levels of accumulated savings during the pandemic and lower household indebtedness. Nevertheless, there are signs that the economy could be slowing going into the second half of 2024.

Canadian exports have been lackluster so far this year and have barely increased over the past year. The details show that, while exports of commodities have increased modestly, exports of manufacturing goods have eased slightly over the period.

The opening of the Transmountain pipeline is expected to increase exports in the second half of 2024. We estimated that the new pipeline capacity will increase oil exports by about 10% and could contribute about 0.25pp to growth over the next year. However, since this is a level shift in exports, the contribution to growth from TMX will fade away as its full capacity is reached.

There are some risks on the horizon when looking at the outlook for Canadian exports. More specifically, a victory of Donald Trump in the US Presidential election could see a return to more protectionist policies in the US and a push towards some de-globalization, which could be a headwind on Canadian exports.

Inflation

Inflation is expected to ease further from the current level of 2.7% in the coming quarters as the amount of slack in the Canadian economy continues to act as a drag on inflation. However, the expected decline is relatively modest. While headline inflation is expected to be around 2% – this is the midpoint of the inflation target – by the end of the year, the BoC’s preferred measures of core inflation, CPI-Trim and CPI-Median, will take longer to reach 2%. We expect the average of both core measures to reach 2% in early 2025.

While inflation is back within target, some components are expected to remain elevated. As such, the shelter component is likely to remain high for some time, despite a deceleration in rent increases and the impact of lower interest rates on mortgage interest rate payments. The concern is that elevated shelter inflation could hold back inflation expectations, slowing their return to levels more consistent with the inflation target. It is interesting to note that consumers’ perceived inflation is elevated and well above observed inflation.

Policy Rate

With inflation, both headline and measures of core, back within the inflation target, the door is open for the Bank of Canada to reduce its policy rate and make monetary policy rate less restrictive. At its most recent monetary policy decision, the BoC cut its policy rate by 25bp to 4.50%, the second cut this year, and made it clear that its concerns have shifted away from inflation to the downside risk to growth and the need to support economic activity.

This shift in focus by the BoC makes it clear that, as long as the inflation dynamic and the breadth of inflationary pressures remain consistent with the inflation target, it will very likely continue to cut interest rates.

With this in mind, we expect the BoC to cut its policy rate at both the September and October meetings. After these additional hikes, we think that the central bank may consider a pause to better evaluate the impact on the economy from having reduced the policy rate by 100bp, meaning that the policy rate is expected to end the year at 4.00%. We expect the BoC to resume easing monetary policy in early 2025, bringing the policy rate to 3.25% before mid-2025, and leaving it there for the rest of the year. This would bring the policy rate to the upper band of its neutral rate estimate.

At 3.25%, the policy rate would still be well above the levels seen during the decade following the global financial crisis or the decade preceding the pandemic. As a reminder, between 2009 and 2019, the highest level for the policy rate was 1.75% between October 2018 and February 2020. This means that households and businesses will need to adjust and adapt to higher interest rates.

Alberta: a deeper “me-cession”, but stronger growth overall

Alberta is also going through the “me-cession”. However, the difference is that the “me-cession” is more acute in the province than elsewhere in Canada. As such, the economy of the province is seeing a more extreme situation where spending per person has declined more than in the rest of country, while the stronger increase in population has meant that it is one of the fastest-growing provinces in Canada.

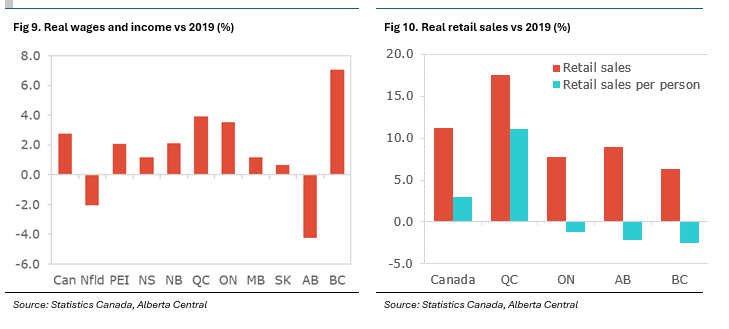

Looking at the details, we estimate that retail sales per person adjusted for inflation are about 2% lower than in 2019, while it is about 3% higher in the rest of the country. However, once the strong population growth over the period is accounted for, we estimate that retail sales adjusted for inflation are 9% above their 2019 level; it is 11% for the rest of Canada.

The two major factors explaining the underperformance in spending per person in Alberta:

- Real wages and income have underperformed significantly other provinces in recent years. As such, we calculate that real wages and income per person in Alberta are currently about 4% below their 2019 levels. As a comparison, the same measure for the rest of the country has increased by almost 3% over the same period (see Where’s the boom? And the rise and fall of the Alberta Advantage for an explanation of the underperformance). As a result, Albertan’s purchasing power is lower now than pre-pandemic, forcing households to adjust their spending accordingly.

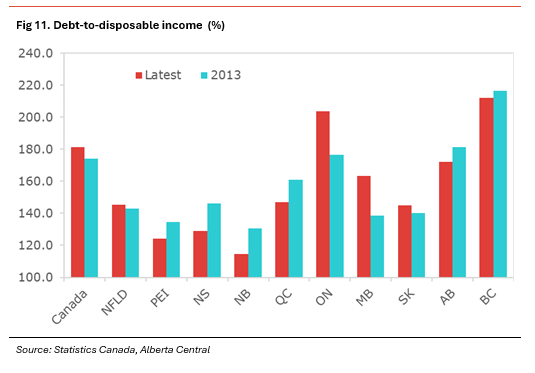

- Albertans are amongst the most indebted households in Canada, with a debt-to-income estimated at 179%; the most indebted households are in Ontario (with 210%) and BC (with 225%). Wit a higher proportion of non-mortgage debt in Alberta than in Ontario and BC means that a greater proportion of household debt in the province is at a fixed rate, the impact of higher interest rates on the debt-service ratio is high.

Population

As mentioned above, the outperformance of the Alberta economy relative to other provinces rests primarily on stronger population growth. As such, Alberta’s population has increased by about 4.3% over the past year, compared to 3.3% for the country as a whole. Like the rest of the country, the province benefits from the sharp rise in non-permanent residents. In addition, Alberta is also attracting residents from other provinces, especially BC and Ontario, who are moving to the province in search of better affordability. Population growth in Alberta should slow over the coming years as the flow of non-permanent residents slows significantly. However, population growth in the province should remain higher than in most provinces, as the factors supporting interprovincial migration are expected to stay in place.

Housing

Alberta’s housing market has also been very robust over the past year, creating about 70k jobs over the past year. While this performance is exceptional by historical standards, it has not been enough to absorb all newcomers into Alberta’s labour force. As a result, the unemployment rate has been trending higher, reaching 7.2% in May, higher than in the rest of the country.

Labour market

With the economy expected to remain robust, the labour market is expected to be stronger than in the rest of the country. However, there are signs that, as in the rest of Canada, labour demand is weakening and that the pace of job creation will slow. As a result, further increases in the unemployment rate should be expected.

Albertan housing is also significantly outperforming the rest of the country, with the transaction level more than 50% above its pre-pandemic one. Moreover, while prices have stagnated in most regions, house prices are rising fast in the province, especially in its metropolitan areas. Strong population growth and higher affordability explain this outperformance. With these factors unlikely to change soon, Alberta’s housing market is expected to remain robust and outperform the rest of the country over the next two years. The strong demographics and the robust housing market is expected to support residential investment in the coming years, as the supply of new homes needs to increase to prevent a further drop in affordability.

Oil sector

Additional support for the Alberta economy comes from the oil sector, where revenues remain elevated, as prices remain high and production continues to reach new records. While a smaller proportion of oil revenues are returned to the province (see xxx and Where’s the boom? And the rise and fall of the Alberta Advantage), they remain an important tailwind to the economy and a significant source of revenues for the government. On the production side, the completion and start of operations of the expanded TransMountain pipeline raises oil export capacity significantly. This will allow oil production to increase by at least 10%, if the pipeline is used to full capacity. Moreover, with more oil able to flow to new markets, oil producers will be able to take advantage of possible arbitrage, which is expected to lead to a narrowing of the spread between WTI and WCS oil prices. This would allow producers to maximize their revenues potential.

Business investment remains robust, despite investment in the oil and gas industry remaining relatively subdued despite higher oil prices. While the lack of investment boom in a backdrop of high revenue and profitability could be seen as a problem for the Alberta economy, it should actually be seen as a positive. The lack of boom means that the oil sector is not crowding out other sectors, allowing for new industries to flourish and diversifying the Albertan economy.

All in all, we expect growth in Alberta to be 2.3% in 2024 and 2.6% in 2025, after reaching 1.5% in 2023.

Looking for more ? Subscribe now to receive Economic updates right to your inbox here!

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.