Economic insight provided by Alberta Central Chief Economist Charles St-Arnaud.

Bottom line

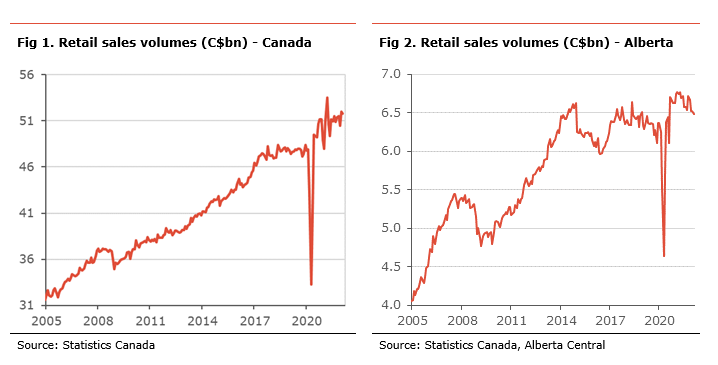

Retail sales eased in February after a strong bounce back the prior month. However, the preliminary estimate for February shows the correction is likely to be temporary. There are increasing signs that rising inflation is increasingly impacting retail sales, with a widening in value and volume performance. Supply chain woes could continue to somewhat hold back retail sales in the coming months. In addition, a return to more normal spending behaviour could also lead to an underperformance in retail sales, as spending shifts from goods to services (restaurants, bars, personal care, etc).

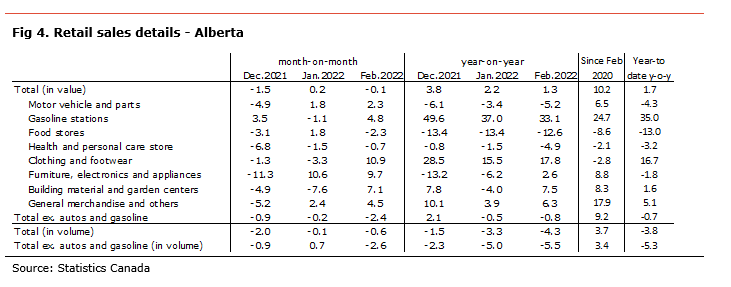

In Alberta, retail sales performance shows further signs of underperformance relative to the rest of the country. We note that core retail sales, which exclude motor vehicles dealers and gasoline stations, have declined for four consecutive months, suggesting some weakness in underlying retail sales. In its too soon to say whether this is due to consumer restraining their purchases or redirecting their spending toward sectors not included in retail sales, such as travel service, restaurants, entertainment, etc. We also note a divergence in retail sales between the metropolitan areas and the rest of the province, with sales stronger in Calgary and Edmonton. This could be explained by stronger employment gains in the metropolitan areas relative to the rest of the province.

The outlook for retail sales and consumer spending more broadly remains uncertain and tilted to the down side. On one side, consumers’ finances are being squeezed by an erosion in purchasing power due to high inflation, rising interest rates and a normalization in disposable income (see The Great Consumer Squeeze for more details on how those factors affect housholds). On the other side, households have accumulated a significant amount in saving during the pandemic. Whether they spend it or keep it as precautionary saving or to repay their debt will matter for the outlook.

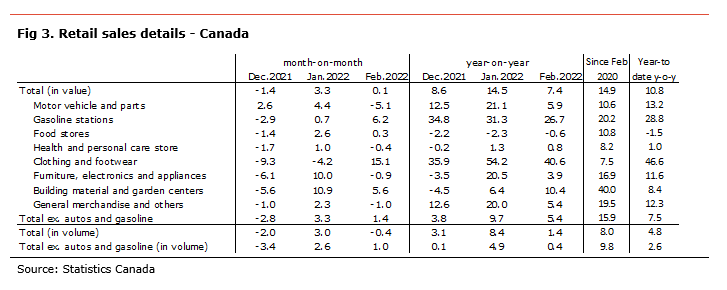

Retail sales rose by 0.1% m-o-m in February, following an increase of 3.3% m-o-m in January. Compared to the same month last year, retail sales rose +7.4% y-o-y. The level of retail sales is 14.9% above its pre-pandemic level. Statistics Canada also reports that retail sales increased by 1.4% in February based on a preliminary estimate.

Monthly sales increased in 6 out of 11 subsectors. On the month, the rise in retail sales resulted mainly from higher sales at clothing and footwear stores (+15.1% m-o-m), gasoline stations (+6.2% m-o-m), and building material and garden centers (+5.6% m-o-m). The sectors with lower sales were motor vehicle and parts (-5.1% m-o-m), general merchandise stores (-1.2% m-o-m), and miscellaneous stores (-1.5% m-o-m). Core retail sales, which exludes motor vehicles and parts and gasoline stations, increased by 1.4% m-o-m.

In volume terms, retail sales decreased by 0.4% on the month (-1.4% y-o-y), while core retail sales ar up by 1.0% on the month (0.4% y-o-y).

In Alberta, retail sales decreased by 0.1% m-o-m in February (+1.3% y-o-y). The level of sales in the province was 10.2% higher than before the pandemic. Retail sales by sectors were mixed. There wre increases in clothing and footwear (+10.9% m-o-m), motor vehicle and parts (+2.3% m-o-m), gasoline stations (+4.8% m-o-m), while there were declines in food stores (-2.3% m-o-m) and health and personal stores (-0.7% m-o-m).

Core retail sales decreased by 2.4% m-o-m (-0.8% y-o-y) in February. This is the fourth consecutive decline in core retail sales. Although there are no official volume details at the provincial level, we estimate that retail sales volumes in the province eased by 0.6% m-o-m (-4.3% y-o-y).

Statistics Canada has recently started to release retail sales numbers for Calgary and Edmonton. The data shows some divergence between regions. As such, retail sales in Calgary increased by 7.5% y-o-y, by 4.6% y-o-y in Edmonton, while sales declined in the rest of the province (-6.0% y-o-y). The lack of details and the relative volatility in the data make it hard to determine the exact cause of divergences in retail sales between regions. However, the recent employment reports suggest that the recovery in the labour market has been stronger in Calgary and Edmonton over the past year than in the rest of the province and could explain part of the outperformance of the metropolitan areas.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.

Alberta Central member credit unions can download a copy of this report in the Members Area here.