Economic insight provided by Alberta Central Chief Economist Charles St-Arnaud.

Main takeaways

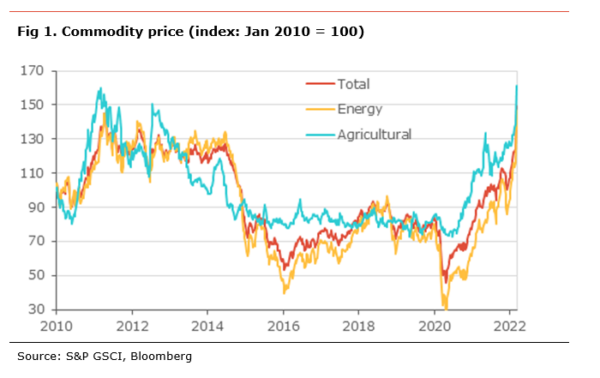

- The invasion of Ukraine by Russia has led to a surge in commodity prices, with implications for the global economy.

- Oil prices have soared by about 25% since the invasion, natural gas prices have tripled at one point, and agricultural prices have increased 20% since the invasion (almost 50% over the past year).

- This sharp rise in the cost of many essential inputs will be an important drag on global growth. However, the world is less oil intensive than during previous oil shocks.

- Inflation globally should pick up as gasoline prices and food costs are pushed higher. In Canada, we wouldn’t be surprised to see inflation reaching 6% in the coming months.

- A rise in inflation will further erode households’ purchasing power. As a result, households in Canada will face headwinds over the next year: from a normalization in disposable income, declining purchasing power, and rising debt-service costs as interest rates increase.

- However, households managed to accumulate a vast amount of savings during the pandemic. Whether they are willing to spend it will matter for for consumer spending and the economic outlook.

- The higher inflation may also warrant more aggressive rate hikes from the Bank of Canada, especially if it leads to a further rise in inflation expectations. The risk is that it could stall economic activity.

- Some have expressed the desire for the government to intervene to address the rising cost of food and energy. However, there is not much the government can do against global price pressures. Moreover, any tax cuts, tax credits or direct payments to consumers will come at the expense of a bigger fiscal deficit. Alberta’s decision to cut the gasoline tax is different because the increased bitumen royalty revenues from high oil prices will likely fully offset the foregone tax revenues.

- It is unclear how much the Canadian energy sector can do in the short term to ease the supply pressures in the energy sector stemming from the war. However, we expect to see some investment to optimize and increase output at current operations.

- In the long term, the current situation is likely to lead to a desire for greater energy security, both in terms of supplier and type of energy. Moreover, at current prices, there is an incentive for consumers to invest in reducing their reliance on fossil fuels and for more research and development to reduce the cost of alternative forms of energy. This could lead to global demand for oil to peak earlier and decline faster in the future. Natural gas demand is likely to be less affected as it is seen as a viable backup to renewable energy production.

- Energy security will somewhat increase demand for Canadian energy, especially natural gas, and we expect some LNG terminal projects to be likely revived. We should also expect some investment to improve production at existing oil projects. However, with its long life span and high initial fixed costs, the hurdles for new oil sands projects remain, especially considering the risk of a faster transition away from fossil fuel due to the high prices.

- The agricultural sector is likely to benefit, as Canada produces many agricultural products whose production may be negatively affected by the war in Ukraine and profit from higher prices.

The invasion of Ukraine by Russia in late February will have a significant impact on the global economy. Despite being thousands of kilometers away from the explosions, Canada and Alberta will feel their tremors, at least economically. The situation continues to evolve rapidly and remains fluid. However, we thought it would be helpful to provide initial thoughts on the economic impact rather than wait for a more thorough and complete analysis.

Surging commodity prices

So far, the significant economic impact of the war in Ukraine has been the surge in commodity prices. Part of these increases is due to the economic sanctions imposed by many countries on Russia. Another part is due to expectations of significant disruptions in the supply of key commodities.

Agricultural products

Since the beginning of the conflict, the price for agricultural products has increased by almost 20%, according to the S&P GSCI Agricultural price index. The reason for the sharp increase in agricultural prices is that Russia and Ukraine are significant producers of key agricultural products. Agricultural prices had already increased by almost 60% in the year before the start of the conflict and have more than doubled since mid-2020 due to constraint on supply due to weak harvest around the globe.

According to the Atlas of Economic Complexity, Russia and Ukraine represent about 25% of global wheat exports. But while most analysts have focused on wheat, the conflict will significantly impact the supply of other grains. For example, Ukraine accounts for 14% of global corn exports, and Russia and Ukraine account for 20% of global barley exports. Ukraine also represents 15% of global exports of canola/rapeseed.

An important factor is the agricultural cycle timing. We are at the start of the sowing period in Easter Europe (not counting the winter wheat, which have already been sowed). Armed conflict makes sowing difficult and more likely impossible. Even if sowing will be achieved in areas with less combat, there is still risk of the crops being destroyed or unharvested due to lack of labour, machinery, or future combat actions. Higher grain prices also increase the cost of livestock feed and, as a result, will push the price of meat around the globe.

Energy products

Energy prices have soared by 35% since the start of the conflict, with Brent oil prices rising by almost 25% since the invasion and the cost of natural gas in Europe skyrocketing, more than tripling. This is the worst energy shock since the Gulf War in the early 1990s. These recent increases also followed a sharp increase in energy price over the prior year.

According to Rystad, an independent energy consultancy group, Russia produces about 11 million barrels per day, half of which is exported, representing about 11% of world exports. If most countries that have imposed sanctions on Russia decide to ban Russian oil, global supply could decline by about 4 million barrels per day. They believe that such an outcome could push oil prices above $200 a barrel (Rystad energy).

While the current oil shock is big, the global economic reliance on oil, as measured by oil consumption per $ of GDP, has declined over the past four decades, and it is about half what it was in the 1970s. This means that the impact on growth, while negative, is likely to be less pronounced than in previous sharp increases in prices (for example, the 1970s oil shock and Gulf War). Nevertheless, it will likely lead to slower global growth.

On the natural gas side, about 40% of the supply to Europe is from Russia. If this supply disappeared, it would be difficult to replace, but not impossible. According to Rystad, Europe could partly compensate for the decline in Russian supply by increasing LNG imports and local production. However, it could still be missing about 10% of its supply, requiring a shift to other energy sources (likely coal) and a forced reduction in demand.

Another major issue affecting the European gas market is that inventories are also low by historical standards, suggesting that inventory drawdowns are not a solution and increase the risk of shortages next winter if inventories cannot be rebuilt.

However, so far, the impact of the Russian invasion of Ukraine on natural gas prices in North America has been more subdued, with the Henry Hub and the AECO prices for natural gas relatively stable in recent weeks. The lack of increase is due to the limited capacity for North American producers to convert their production into LNG to be shipped towards Europe.

Further rise in inflation

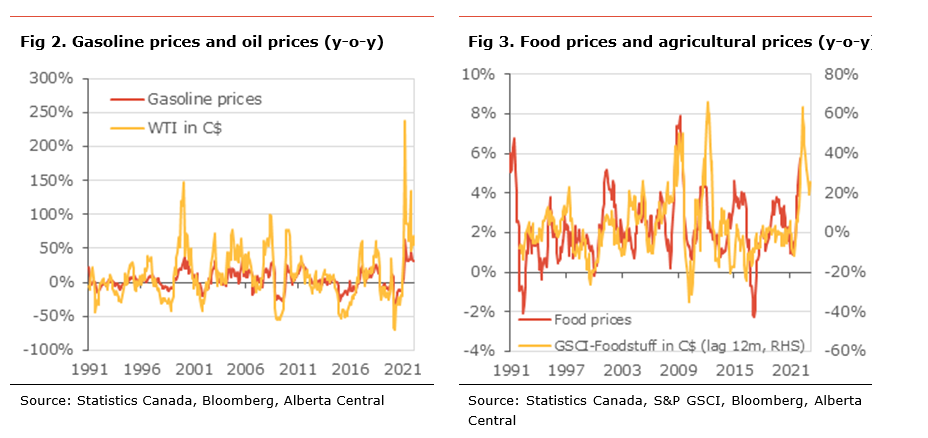

The sharp increase in commodity prices will impact Canadian inflation and exacerbate the already concerningly high level of inflation, currently at 5.1%.

The most immediate impact is already being felt on gasoline prices, which have increased sharply in recent days and have even passed the level of $2 a liter in some regions of the country. A further increase in oil prices will push gasoline prices higher.

We estimate that every 10% increase in the price of oil will push gasoline prices higher by 3.5%. This means that the current rise in oil prices will push gasoline prices by almost 15%. This would translate into an increase in the CPI of about 0.5 percentage points.

The increase in agricultural prices will also push food prices higher. The impact will likely be the price of bakery and cereal and meat. However, our estimates suggest that the pass-through from higher agricultural products prices to Consumer Price Index (CPI) is relatively slow and takes about a year to be fully embedded in the CPI.

In addition, the increase in energy prices will lead to an increase in transportation and operating costs for businesses. Those higher costs will eventually be passed to consumers and will push other components of the CPI to grow at a faster pace.

We will be conducting further analysis on the impact on inflation in the coming weeks as we revise our forecast. Nevertheless, considering the inflationary pressure from higher gasoline and food prices, we are likely to see inflation rise to close to 6% in the coming months.

Strong headwinds on consumers

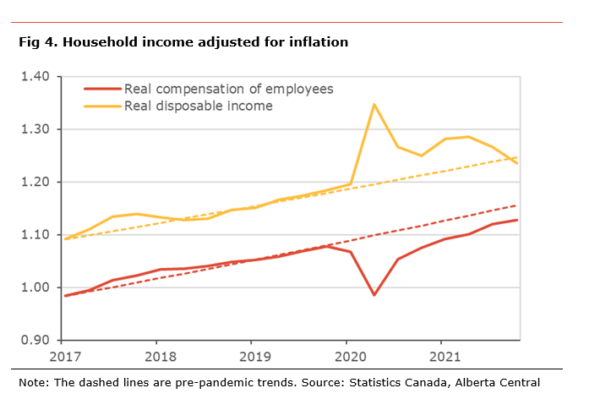

Even before the start of the conflict, Canadian consumers where set to face some strong headwinds over the next year.

- The high level of inflation, while wage growth remains contained, suggests that the household’s purchasing power was already being eroded by the general increase in prices. The accelerations in inflation due to the conflict will only worsen the situation.

- In response to increasing inflationary pressures, the Bank of Canada started raising interest rates at its March meeting and further increases are expected at the next few meetings. With Canadian households being heavily indebted, each increase in interest rates will increase the debt-service ratio.

- After having increased above trend during the pandemic thanks to the various government programs, we are witnessing a normalization in household disposable income. As such, the most recent data shows that disposable income declined by 1.3% q-o-q (2.5% in real term).

All these factors are pointing to headwinds for consumer spending. Households will need to dedicate a greater share of their income towards necessary expenses (food, shelter, transportation, debt-services) at the expense of discretionary spending (eating out, travel, etc.).

We estimate that Canadian households have accumulated about $320bn in savings during the pandemic. Some of this amount has been used to repay some debt, mainly credit card debt, and to invest. Nevertheless, we estimate Canadian households have accumulated about $185bn in demand deposits. Whether households use the savings accumulated during the pandemic to maintain their level of spending or increase it or keep it as precautionary spending will matter greatly for the outlook.

The housing market is also likely to be affected. As we have shown recently (see here), declining affordability due to increasing interest rates is likely to slow the resale market. Moreover, a reduction in purchasing power may force some households to reconsider their housing needs, i.e. purchase smaller and or less expensive houses.

Impact on monetary and fiscal policy

A stagflationary environment, where we see rising inflation while there are some strong headwinds on growth, will be a major headache for the Bank of Canada.

In such a situation, the Bank of Canada should normally look through the first-round impact of higher commodity prices on inflation through higher gasoline prices and food prices and focus almost exclusively on domestically generated inflation. After all, rising interest will not lower commodity prices.

However, it needs to prevent and react to any increases in inflation expectations that would lead to higher wage growth and more broad-based price increase as businesses pass extra costs to consumers. In other words, the central bank needs to prevent the higher inflation rate from becoming embedded and permanent.

With inflation already running well above target at slightly above 5% and additional inflationary pressure building up and leading to further increases in the inflation rate, inflation expectations are likely to rise further. This will require an additional reduction in the amount of policy accommodation. So, the risk is the BoC may need to raise interest rates more aggressively than expected.

But, as we have explained in the past (see here), a fight against supply-induced inflation leads to a difficult balance between fighting inflation and not jeopardizing the recovery or pushing the economy into a recession. In other words, the Bank of Canada needs to slow domestic demand to reduce domestic inflationary pressures enough to offset the inflationary pressures generated by higher global commodity prices and higher inflation expectations. The risk is that it could stall economic activity.

Some have argued that the government needs to address the rising living costs generated by higher energy and food prices. Already, the government of Alberta announced it would forgo its provincial tax revenue on gasoline. While the idea of supporting household purchasing power is appealing, it has some important drawbacks:

- Reducing taxes to lower prices would increase the fiscal deficit and government debt in most provinces and at the federal level, as it would cut fiscal revenues. Someone has to pay the higher price, either the consumers or the government. Alberta is in a different situation, as the revenues lost from a cut in the gasoline tax and likely more than offset by the increase in bitumen royalties resulting from surging oil prices.

- Cutting taxes to compensate for price increases would only have a one-off impact on inflation, changing the level of prices, not the pace of the rise. Moreover, it would support domestic demand leading to increased inflationary pressures, all else equal. As a result, the BoC would have to increase interest rates more than otherwise would be the case to offset these new inflationary pressures.

Canada’s commodity market

Interestingly, Canada has a strong presence in many commodities markets that will see disruptions due to the war in Ukraine. However, it is not clear how much Canada can do to ease the pressures on price due to the supply risks.

Short-term oil and gas

We believe we could see some investment in the oil market in the short term to optimize and maximize existing production. However, we are unlikely to witness significant investment in new production in the short-term, as oil sand extraction projects are planned on long-term expectations and require sizeable initial fixed costs.

Shale oil in the US has a much greater capacity to pick up production because of the short life of the wells and the smaller upfront capital required. Moreover, US oil production is still about 10% below where it was at the onset of the pandemic, suggesting the possibility of increasing production. However, oil shale producers have remained hesitant at committing capital, as they remain cautious and prefer to continue to repay debt and improve returns to shareholders.

Similarly, on natural gas, Canadian production is unlikely to be an alternative to Russian gas in the short-term. The country does not have liquefaction capability on the East Coast. As a result, the only way for natural gas to reach Europe is via the US, where liquefaction capacity exists along the Gulf of Mexico.

Long-term

In the longer term, this is where the current situation could have the most impact. The constraint on supply due to the war in Ukraine is likely to have two important implications:

- An increased desire for energy security. The increased desire for energy security will mean that countries worldwide are likely to look for ways to reduce their dependence on a unique supplier and type of energy use, allowing them to switch more easily from one to the other. This is where Canada could benefit. As the pandemic showed, Canada’s oil production is resilient despite negative shocks, contrary to US shale oil, which proved to be fickle. This could lead to some investment in improving some of the accessibility to Canadian oil. However, it could also mean that some countries would prefer to invest in their national capacity to generate their own energy by investing more massively in renewables and nuclear.

- A faster transition away from fossil fuels. Higher prices for oil and gas is likely to incentivize many energy consumers to invest in alternative energy. For example, high gasoline prices make the purchase of an electric vehicle more attractive. High natural gas prices could increase investment in heat pumps and geothermal as a source of heating. In addition, it will incentivize an increase in funding for research in improving and reducing the cost of renewable alternatives. (This is what happened when oil reached $100 a barrel in 2008. We saw increased investment in research on solar energy, leading to an accelerated decline in cost). The result of a faster transition away from fossil fuel could mean that global demand for oil and gas peak earlier than previously expected and decline more rapidly afterwards.

The result of these factors for the Canadian sector is that we may only see a slight increase in investment in the sector. Oil sands projects have a long-time lifespan that are counted in decades. Hence, rather than committing capital for such a long period, oil producers are likely to make smaller investments to existing production sites to increase production rather than invest in costly new projects. The decision of TransCanada not to revive the Keystone XL project is likely the result of the expectation that long-term production expectations have not changed dramatically to justify the project.

We could see some projects such as LNG gasification projects being revived. Natural gas is likely to be part of the energy security story as an alternative to renewables. With this in mind, many countries would want to improve their accessibility to the LNG market.

Agricultural sector

Canada produces many agricultural products whose production may be negatively affected by the war in Ukraine. However, whether Canada will be able to offset the expected decline in the production of wheat, canola/rapeseed, and barley depends largely on the weather.

Following last year’s drought, we closely follow soil moisture levels across the Prairies. As of the end of February, most regions are in severe drought territory. However, it remains early and the situation could change depending on the melting snowpack and rainfall between now and June.

Nevertheless, we believe that Canadian farmers are likely to increase the planting areas for commodities that have seen price surges in recent weeks. Moreover, a quick calculation suggests that even if harvest 2022 was on par with the drought-affected harvest of 2021, Canadian farmers could see better revenue in 2022 than in 2020.

Conclusion

The impact of the war in Ukraine will be negative for the Canadian and global economies. A sharp increase in energy and food prices, and their spillover to other prices, will lead to higher inflation and further erosion of households’ purchasing power. Moreover, with an increased risk of further rise in inflation expectations, there is a risk that the BoC may need to be more aggressive in its fight against inflation and raise rates more than currently anticipated.

The desire for energy security and more reliable suppliers could benefit the Canadian energy sector. However, we could see an acceleration in the shift away from fossil fuel at current prices, leading to global demand for oil peaking sooner and declining faster in the longer term. As a result, the increase in investment in the oil sector could be modest. However, some of the LNG export hub projects could be revived, as natural gas could be used as an alternative to renewable when improving energy security.

The strong rise in agricultural prices is likely to lead to solid revenues in the sector, even in the case of a poor harvest.