Economic insight provided by Alberta Central Chief Economist Charles St-Arnaud.

Bottom line

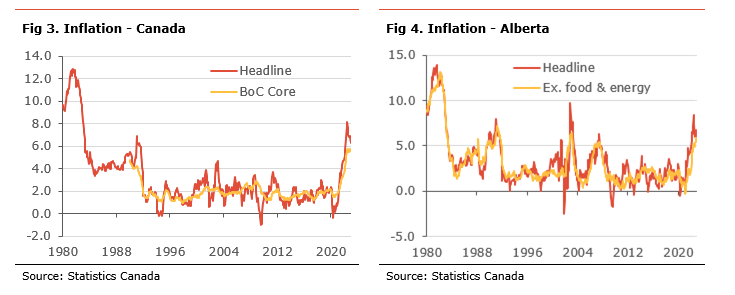

Inflation moderated in December but is still at the elevated level of 6.8%, in line with our expectations. Most moderation was the result to lower transportation costs due to the biggest decline in gasoline prices since April 2020. Nevertheless, there are some signs of modest moderation in underlying inflationary pressures, with most measures of core inflation easing slightly in December yet remaining elevated.

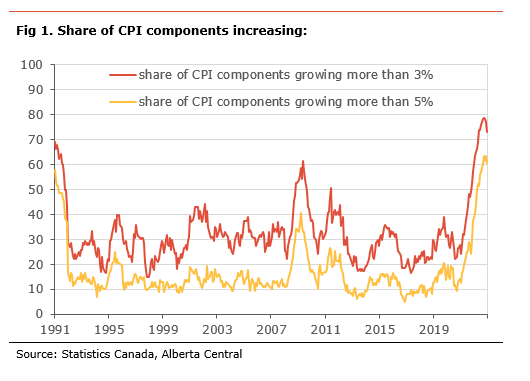

Inflationary pressures remain broad, with almost 7% of the components of CPI rising at more than 3% y-o-y, and more than 60% at more than 5% y-o-y (see Fig 1). The share of CPI components rising by more than 3% and by more than 5% declined slightly in December, suggesting a slight narrowing in inflationary pressures. This explains why measures of core inflation eased in December.

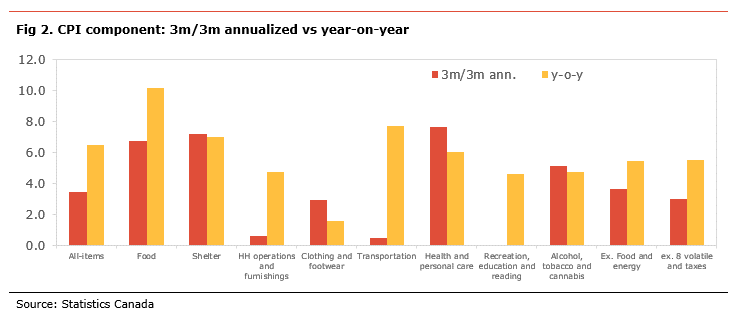

The recent trend in the CPI monthly changes suggests that inflationary pressures may be losing some momentum in recent months. The 3-month annualized change in most CPI components decelerated and remains below their year-on-year changes, except for shelter cost and clothing and footwear, suggesting that inflation should continue to moderate (see Fig. 2). However, the 3-month annualized changes remain elevated and well above 3%, the upper end of the BoC’s target for most categories, with CPI ex. food and energy at 3.7%. We note that inflation ex. food and energy have been relatively stable, around 5.3% since May 2022.

While inflation may be peaking and showing early signs of moderating, it remains well above the BoC’s target of 2%, inflation expectations are rising, and inflationary pressures remain broad and sticky. With this in mind, this CPI report is likely to be a small encouragement for the Bank of Canada, which will welcome the weakening in underlying inflationary pressures. In our view, while this slightly reduced the odds of further rate hikes, it will not be enough to prevent the BoC from increasing its policy rate by 25bp to 4.50% at next week’s meeting. However, signs that underlying inflationary pressures are easing open the door to a pause after this increase.

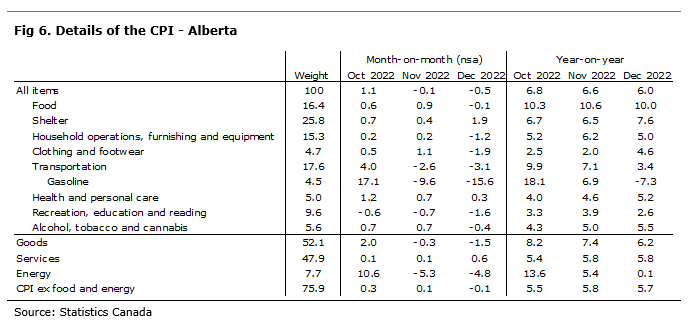

In Alberta, inflation declined to 6.0%. A deceleration in transportation costs, as gasoline prices dropped sharply on the month, was the main cause of the decline in inflation, while a continued rise in shelter costs was the main source of inflation. Inflation excluding food and energy (a measure of core inflation) eased to 5.7%, close to its highest since 2003. We note that core inflation in Alberta is significantly above the rest of the country.

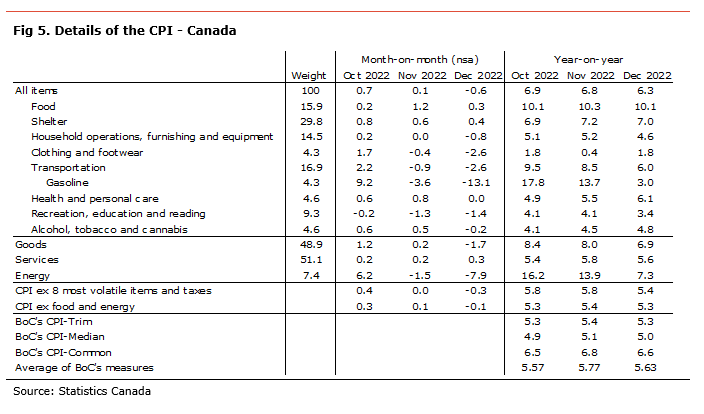

The Consumer Price Index (CPI) decreased by 0.6% m-o-m non-seasonally-adjusted in December and the inflation rate moderated to 6.3%, as we expected. Prices fell on the month in five of the eight major CPI components, led by transportation (-2.6% m-o-m), due to the biggest decline in gasoline prices since April 2020, clothing and footwear (-2.6% m-o-m), recreation, education and reading (-1.4% m-o-m), and household operations, furnishing and equipment (-0.8% m-o-m). The biggest increases were in shelter costs (+0.4% m-o-m) and food (+0.3% m-o-m). The rise in the shelter component was mainly the result of higher mortgage interest costs.

Five of the eight major CPI components decelerated in November on a year-on-year basis, led by transportation costs. Transportation costs decelerated to 6.0% y-o-y, contributing 1.0pp to inflation, with gasoline prices being the primary source of cost decreases in the category (+3.0% y-o-y contributing only 0.1pp, its smallest contribution since January 2021). Shelter costs decelerated to 7.0% y-o-y and are the biggest source of inflation, contributing 2.1 percentage points (pp) to headline inflation, mainly due to higher interest cost, rent and homeowners replacement costs. Food prices decelerated slightly to 10.1%, remaining close to its highest since 1981, contributing 1.6pp to inflation.

In December, goods prices inflation decelerated to 6.9% from 8.0%, mainly due to lower gasoline prices, and services inflation moderated to 5.6% from 5.8%. Energy prices decelerated to 7.3% y-o-y from 13.9% y-o-y. Excluding food and energy, prices decreased 0.1% on the month and rose by 5.3% compared to the same month last year, marking a slight deceleration. The Bank of Canada’s old measure of core inflation, CPI excluding the 8 most volatile components and indirect taxes, was eased to 5.4%.

Looking at the BoC’s core measures of inflation, all three indicators decelerated in December. CPI-Median eased to 5.0% from 5.1%, CPI-Trim to 5.3% from 5.4%, and CPI-Common to 6.6% from 6.8%.

In Alberta, inflation moderated to 6.0% in December from 6.6%. Lower transportation costs were the main reason for the decline in inflation and increased by 3.4% y-o-y and contributed 0.6pp to inflation. Lower gasoline prices, which declined 15.6% m-o-m in December, were the main driver for lower transportations cost. Shelter costs also accelerated on the month, rising 7.6% y-o-y from 6.5%, contributing 2.0pp to inflation. Higher costs for rented accommodation, owned accommodation and utilities, mainly electricity and natural gas, were all responsible for the increase in shelter costs. Food prices rose 10.0% compared to last year and remain an important source of inflation, contributing +1.6pp. Goods price inflation decelerated to 6.2% from 7.4%, mainly as a result of lower gasoline prices, while services prices rose to 5.8%. Inflation excluding food and energy eased marginally to 5.7%, remaining close to its highest level since 2003, while energy costs were almost unchanged (+0.1% y-o-y) compared to the same month last year, after 5.4% y-o-y the month before. This is the slowest y-o-y increase in energy prices since December 2020.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.

Alberta Central member credit unions can download a copy of this report in the Members Area here.