Economic insight provided by Alberta Central Chief Economist Charles St-Arnaud. This report includes regional details for Alberta.

Bottom line

As we expected, the central bank increased its policy rate by 50 basis-points to 1.00% and announced the start of quantitative tightening on April 25. There are three key messages in today’s decision. 1) the Canadian economy is strong and has fully recovered. As a result, it is entering into excess demand. 2) inflation is higher than expected due to further increases in commodity prices and supply chain disruptions. This leads to an increased risk of inflation expectations becoming unmoored. 3) Further rate hikes will be necessary to bring inflation to the target.

The BoC says the magnitude and the speed of the rate increases will depend on its assessment of the economy and inflation. Gov. Macklem mentioned on numerous occasions during the press conference that the BoC “remains ready to act forcefully if needed.” We believe that this means that the door remains open to further 50bp hikes. Moreover, Gov. Macklem also mentioned that interest rates will need to be brought to “a more normal setting,” i.e. to neutral, which the BoC estimates to be between 2% and 3%. He also added that rates may need to go beyond neutral and that a pause may be required at some point to reassess the impact of higher interest rates on the economy.

Overall, today’s decision suggests that the BoC is going on the offence to lower inflation and prevent a de-anchoring of inflation expectations. We believe that this means that another 50bp hike is likely at the June meeting. However, we do not necessarily think it will mean a higher level of interest rates by the end of the year, currently at 2.00%. As such, QT could substitute itself for some of the rate increases that could be required later this year and next.

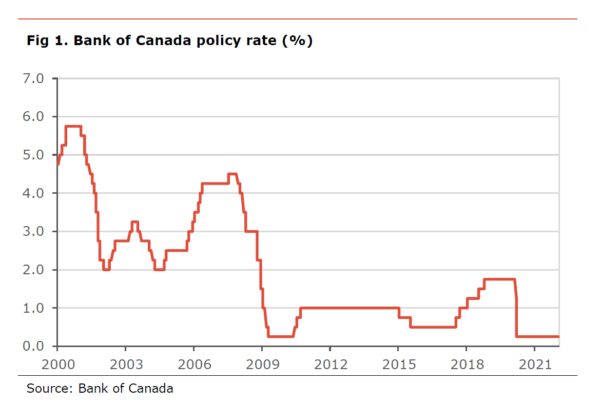

The BoC increased its policy rate by 50bp to 1.00% and announced that it will stop purchasing Government of Canada bonds (GoCs) on April 25. This was in line with our expectations. This is the first time the BoC has increased its policy rate by more than 25bp since May 2000. The statement makes it clear that further rate hikes should be expected, saying “the Governing Council judges that interest rates will need to rise further.” Gov. Macklem also added during the press conference that the BoC stands ready to act forcefully, if needed, to bring inflation back to target.

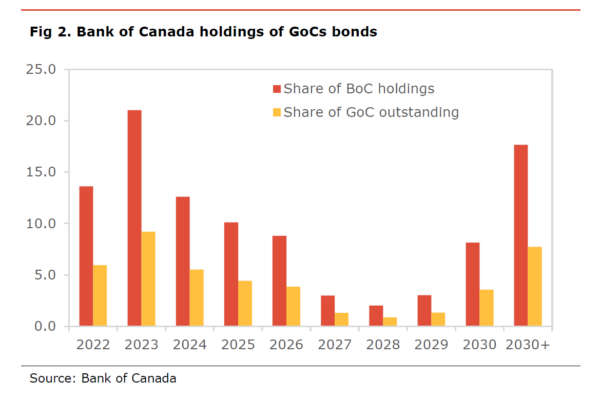

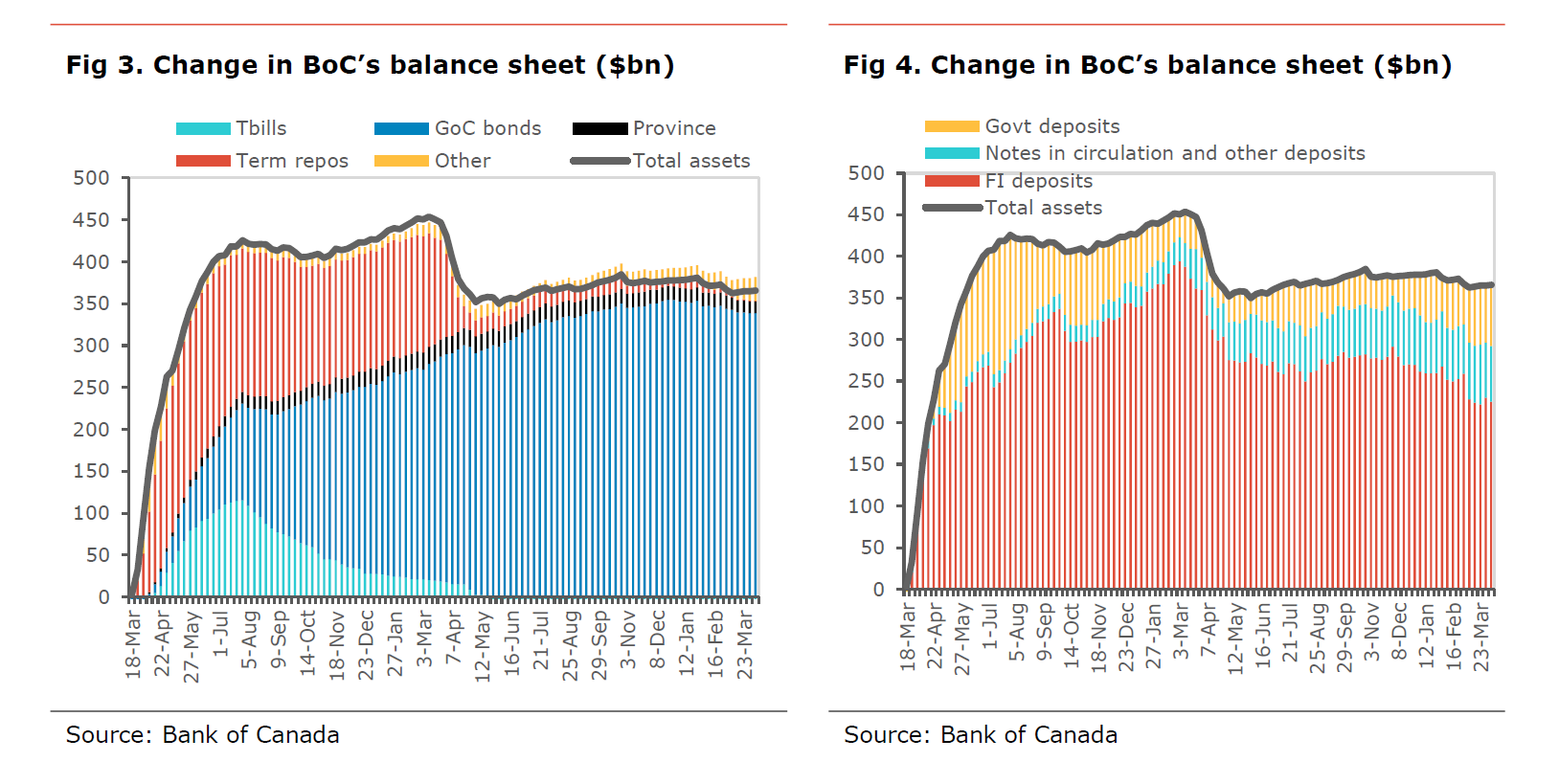

The BoC also announced the start of quantitative tightening (QT) by ending the reinvestment phase of its QE (quantitative easing) program. This means that the BoC will no longer be purchasing GoC bonds to replace maturing bonds. As a result, the BoC’s balance sheet will start to decrease over time. The BoC estimates that about 40% of its holding of GoC will mature over the next two years.

The ongoing invasion of Ukraine by Russia is causing significant disruptions to the global economy. It is causing a spike in commodity prices and supply chain disruptions that are further exacerbating inflation concerns. Moreover, the uncertainty from the war and the higher commodity prices are weighing on global economic activity, especially in Europe. In addition, the Chinese economy is facing challenges from new COVID outbreaks. The Bank projects global GDP to grow by 3.5% in 2022, 2.5% in 2023 and 3.25% in 2024.

The Boc notes that Canadian “growth is strong and the economy is moving into excess demand. Labour markets are tight, and wage growth is back to its pre-pandemic pace and rising.” The BoC acknowledges that many businesses are reporting difficulties meeting demand and greater ability to pass higher costs to customers. The central bank acknowledges that growth in the first quarter of 2022 is more robust than expected and that there is considerable momentum going into the second quarter.

The Bank now expects growth to reach 4.2% in 2022, slightly higher than in the January Monetary Policy Report. However, growth was revised to 3.2% in 2023 (3.5% in January) and 2.2% in 2024.

Inflation is expected to remain close to 6% in the first half of 2022, higher than the January projection. The Bank admits that “inflation is being driven by rising energy and food prices and supply disruptions, combined with strong global and domestic demand.” The BoC also acknowledges that price pressures have broadened, with two-thirds of CPI growing at more than 3% y-o-y, and that there are increasing risks that higher inflation expectations could become entrenched. The bank expects inflation “to ease to about 2½% in the second half of 2023 and return to the 2% target in 2024.”

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.

Alberta Central member credit unions can download a copy of this report in the Members Area here.