Economic insight provided by Alberta Central Chief Economist Charles St-Arnaud.

Bottom line

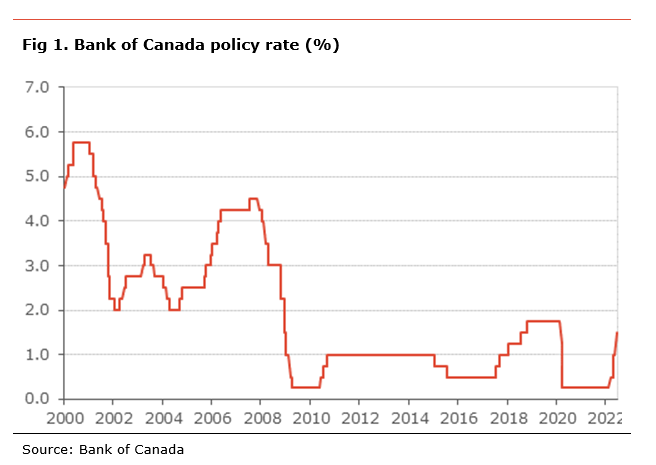

As expected, the Bank of Canada increased its policy rate by 50bp to 1.00% and announced it would continue quantitative tightening. The key message in today’s decision is that the central bank stands ready to be more aggressive in its fight against inflation. This likely mean bringing the policy rate to neutral faster, estimated between 2% and 3%. This means that the likelihood of a 75bp hike at the July meeting cannot be dismissed or more consecutive 50bp hikes than currently expected, if inflation continues to rise.

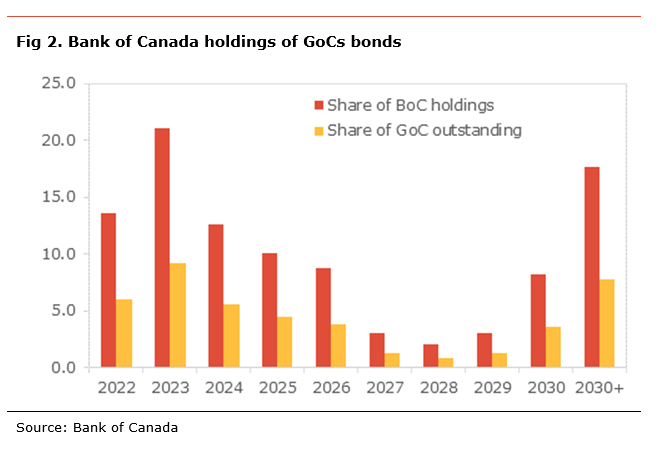

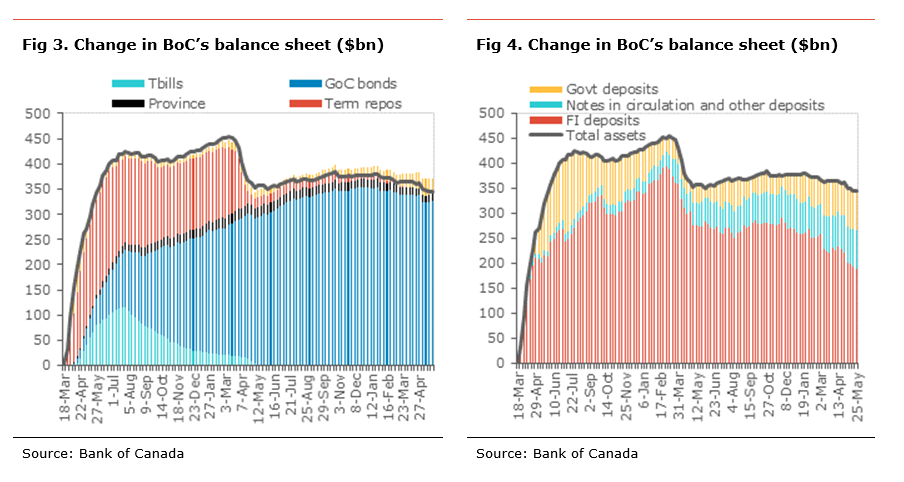

Overall, today’s decision shows the BoC will remain aggressive to lower inflation and prevent a de-anchoring of inflation expectations. We believe that this means that another 50bp hike is a certainty at the July and September meetings. Of course, whether some of those increases are front-loaded will depend on incoming inflation numbers. However, we do not necessarily think it will mean a higher level of interest rates by the end of the year, currently expected at 2.50%. As such, QT could substitute itself for some of the rate increases that could be required later this year or next.

It is important to stress that the BoC has little control over global inflationary pressures coming from higher commodity prices or global supply chain disruptions. As such, increasing interest rates will not lower food prices or make the computer chip shortage disappear. The only way for the BoC to lower inflation is by slowing the domestic economy, leading to excess capacity and a reduction in domestic inflationary pressures. This is a balancing act that could lead to a period of economic underperformance, notably in the labour market and consumer spending.

The BoC increased its policy rate by 50bp to 1.50% and announced it will continue its policy of quantitative tightening, in line with our expectations. This was in line with our expectations. The statement makes it clear that further rate hikes should be expected, saying, “With the economy in excess demand, and inflation persisting well above target and expected to move higher in the near term, the Governing Council continues to judge that interest rates will need to rise further.” The communiqué also warns that the central bank stands ready to act more aggressively if needed to return inflation back to the 2% target.

The BoC continues to view inflation is primarily driven by energy and food prices, but that inflation continues to broaden. As such, the BoC notes that “almost 70% of CPI categories now show inflation above 3%.” Moreover, the central bank’s concern is that high inflation could become entrenched. The BoC also notes that “the increase in global inflation is occurring as the global economy slows,” which could complicate its task of controlling inflation.

The Boc notes that “Canadian economic activity is strong and the economy is clearly operating in excess demand.” The BoC acknowledges that growth in the first quarter was in line with its projection and expects growth to remain robust in the second quarter, led by consumer spending and exports. The central bank also notes that “Job vacancies are elevated, companies are reporting widespread labour shortages, and wage growth has been picking up and broadening across sectors”.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.

Alberta Central member credit unions can download a copy of this report in the Members Area here.