Economic commentary provided by Alberta Central Chief Economist Charles St-Arnaud.

Bottom line

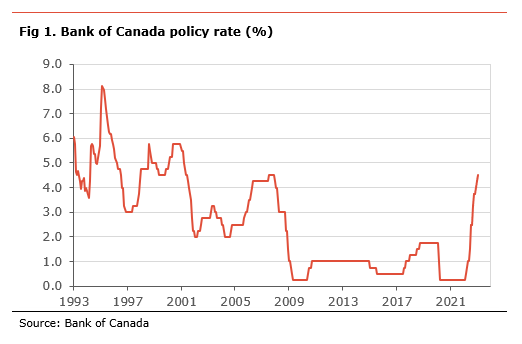

The Bank of Canada increased its policy rate by 25bp, in line with our expectations, to 4.50%, its highest level since November 2007. The central bank also announced that it would continue quantitative tightening (QT). So far this year, the BoC has increased its policy rate by 400bp, the fastest pace since the mid-1990s.

The key message in today’s decision is that the central bank expects interest rates to remain on hold for some time. However, it clearly states that it remains ready to hike again, if inflation does not ease as expected, continuing to show a strong commitment to restoring price stability. This suggests the BoC could hike later this year if underlying inflationary pressures prove stickier. However, we note that, at this point, the likelihood of further rate hikes is low.

Today’s decision supports our view that the BoC is likely done with its tightening. As such, we believe that interest rates will stay on hold unit at least the end of 2023, as we believe that inflation has likely peaked.

The BoC increased its policy rate by 25bp to 450%, in line with our expectations. It also continued its quantitative tightening policy. The statement shows that interest rates are likely to remain on hold for some time, with the BoC saying that the “Governing Council expects to hold the policy rate at its current level while it assesses the impact of the cumulative interest rate increases”. However, the BoC also notes that it remains “prepared to increase the policy rate further if needed to return inflation to the 2% target”, suggesting that it will not refrain from acting if inflation does not ease as much as expected.

The BoC took note core inflation has likely peaked but notes that the level of both headline and core inflation remains too high. The BoC notes, “Inflation has declined from 8.1% in June to 6.3% in December, reflecting lower gasoline prices and, more recently, moderating prices for durable goods.” Moreover, the central bank notes that, despite remaining close to 5%, “3-month measures of core inflation have come down, suggesting that core inflation has peaked”, as a positive development for the BoC.

The release of the January Monetary Policy Report shows that the BoC’s forecast is little changed from the October edition. The BoC estimates the economy grew by 3.6% in 2022, slightly above the 3.3% that was projected in October. “Growth is expected to stall through the middle of 2023, picking up later in the year. The Bank expects GDP growth of about 1% in 2023 and about 2% in 2024, little changed from the October outlook.”

The BoC expects inflation to decline slightly faster than in the October MPR, reaching 3% around mid-year, mainly due to a bigger drag from gasoline prices and a quicker easing of some of the supply chain disruptions.

The BoC continues to view that “the economy remain in excess demand.” The central bank points to a tight labour market with “the unemployment rate is near historic lows and businesses are reporting ongoing difficulty finding workers”. The BoC points that the rate increases are slowing economic activity, especially household spending. The central bank expects growth to stall in the first half of 2023, before picking up later in the year. “This overall slowdown in activity will allow supply to catch up with demand.”

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.