Economic commentary provided by Alberta Central Chief Economist Charles St-Arnaud.

Bottom line

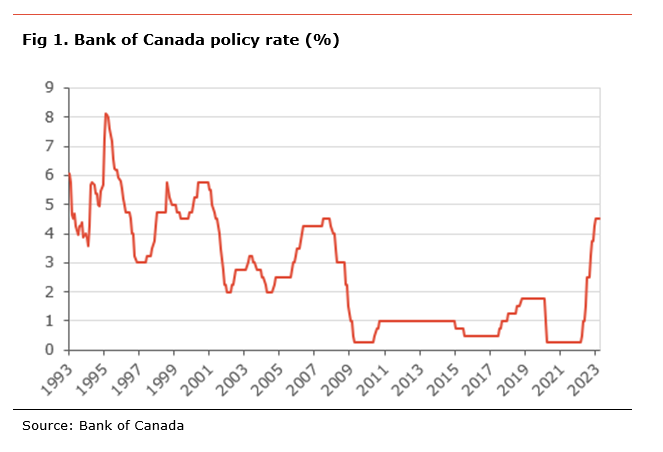

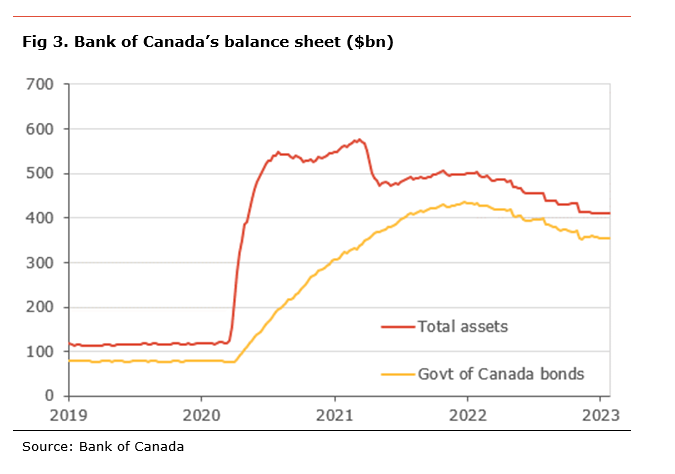

The Bank of Canada kept its policy rate unchanged at 4.50%, in line with our expectations. The central bank also announced that it would continue quantitative tightening (QT). Over the past year, the BoC has increased its policy rate by 425bp, the fastest pace since the mid-1990s.

The key message in today’s decision is that the central bank expects interest rates to remain on hold for some time. However, it clearly states that it remains ready to hike again, if inflation does not ease as expected, continuing to show a strong commitment to restoring price stability. This suggests the BoC could hike later this year if underlying inflationary pressures prove stickier. On that, the BoC notes that while recent dynamics in measures of core inflation have moderated closer to its objective, further easing will be required.

Today’s decision supports our view that the BoC is likely done with its tightening. However, the risks are tilted towards another hike if inflation proves sticky and the labour market remains tight, leading to elevated wage growth.

The BoC kept its policy rate unchanged at 4.50%, in line with our expectations. It also continued its quantitative tightening policy. The statement shows that interest rates are likely to remain on hold for some time, with the BoC saying that the “it expected to hold the policy interest rate at its current level, conditional on economic developments evolving broadly in line with the MPR outlook”. However, the BoC also notes that it remains “prepared to increase the policy rate further if needed to return inflation to the 2% target”, suggesting that it will not refrain from acting if inflation does not ease as much as expected.

Overall, the BoC sees the economic developments globally and nationally are broadly in line with the outlook in the January MPR. Globally, the BoC notes that “global growth continues to slow, and inflation, while still too high, is coming down due primarily to lower energy prices.” It notes, however, that growth and inflation in the US and Europe are somewhat higher than expected, while the strong recovery in China is a source of upside risks to commodity prices.

The BoC note that despite weaker than expected growth in Canda in 2022Q4, due to a sizeable decline in inventory investment, “the labour market remains very tight”. As such the BoC note that wage growth remains elevated, despite a decline in labour productivity in recent quarters.

The BoC took note that inflation is easing thanks to slower prices increases for energy, durable goods and some services. However, it notes that core inflation and its 3-month measure “Both will need to come down further, as will short-term inflation expectations, to return inflation to the 2% target.

The BoC remove its view that “the economy remains in excess demand”, a phrase it had used for some meetings. This suggests that after the weak growth in 2022Q4, the BoC views the economy as more balanced.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.