Economic commentary provided by Alberta Central Chief Economist Charles St-Arnaud.

Bottom line

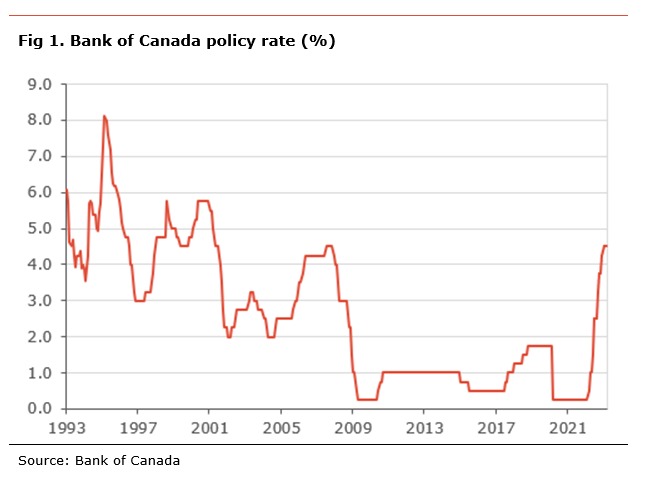

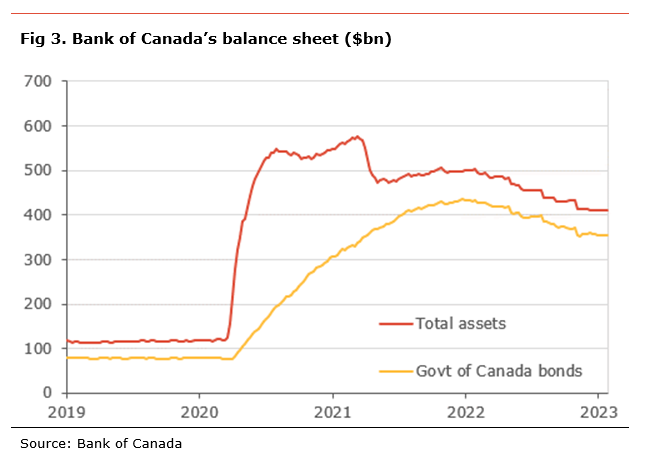

The Bank of Canada kept its policy rate unchanged at 4.50%, in line with our expectations. The central bank will also continue quantitative tightening (QT). Over the past year, the BoC has increased its policy rate by 425bp, the fastest pace since the mid-1990s.

The key message in today’s decision is that the Canadian economy is more resilient than previously expected and that the central bank may be less certain that rates will stay on hold for some time. As such, the statement suggests that the BoC is less certain that monetary policy is restrictive enough. As such, the removal of the conditional commitment, put in place in March, suggests that the BoC sees an increased probability that its next move could be a hike.

This suggests the BoC could hike later this year if underlying inflationary pressures prove stickier or if growth continues to be more resilient than expected. However, the recent banking turmoil in the US and Europe is likely leading to some caution.

Today’s decision supports our view that the BoC is likely done with its tightening. However, the risks remain tilted towards another hike if inflation proves sticky and the labour market remains tight, leading to elevated wage growth.

The BoC kept its policy rate unchanged at 4.50%, in line with our expectations. It also continued its quantitative tightening policy. The statement shows that the BoC may be becoming uncertain as to whether the level of interest rate is appropriate. As such, the central bank removed its conditional commitment to leaving rates unchanged “conditional on economic developments evolving broadly in line with the MPR outlook” and added that it “continues to assess whether monetary policy is sufficiently restrictive to relieve price pressures and remains prepared to raise the policy rate further”. Those two changes suggest that the BoC sees the probability of further rate hikes has increased since the March meeting.

Overall, the BoC sees the economic developments globally and nationally have been stronger than the outlook in the January MPR. Globally, the BoC notes that “global economic growth has been stronger than anticipated”, but also adds that “inflation in many countries is easing in the face of lower energy prices, normalizing global supply chains, and tighter monetary policy.” Global growth was revised higher for 2023 in the April MPR.

The BoC notes that, in Canada, “demand is still exceeding supply and the labour market remains tight”. As such the BoC note that growth in the first quarter of 2023 is likely to be stronger than expected in January. The central bank notes that, despite easing in labour shortages, wage growth remains elevated compared to productivity. Strong population growth is also supporting the economy.

The BoC expects GDP growth “to be weak through the remainder of this year before strengthening gradually next year”. The restrictive monetary policy is expected to impact consumption, as household renew their lending at higher rates, while “softening foreign demand is expected to restrain exports and business investment. Gprwth is expected at 1.4% in 2023 (revised higher), 1.3% in 2024 (revised lower) and 2.5% for 2025.

The BoC took note that inflation is easing and expect to reach 3% by mid-year and 2% by end-2024. However, it notes that inflation may be sticky and that bringing inflation back to 2% may be tricky because “nflation expectations are coming down slowly, service price inflation and wage growth remain elevated, and corporate pricing behaviour has yet to normalize”.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.