Economic insight provided by Alberta Central Chief Economist Charles St-Arnaud.

Bottom line

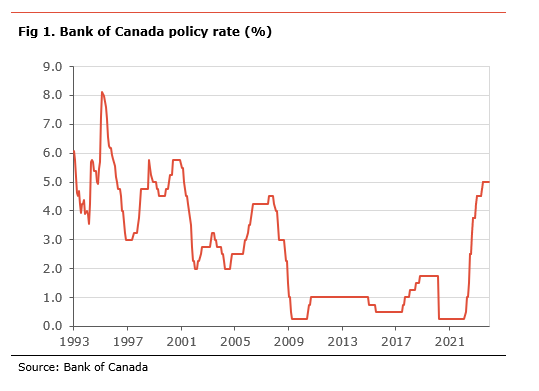

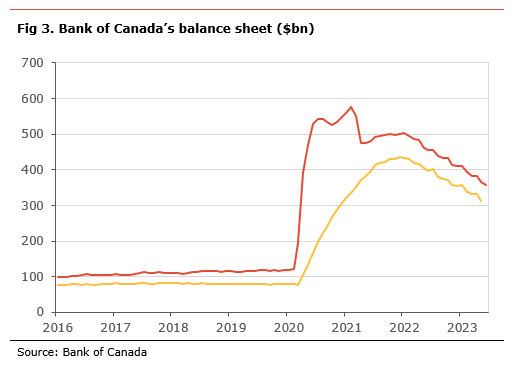

The Bank of Canada kept its policy rate to 5.00% and will continue quantitative tightening (QT), in line with our expectations.

The key message in today’s decision is that the BoC, while there are signs of excess demand in the economy, remains concerned that underlying inflationary pressures remain persistent. As such, the BoC points to solid wage growth and elevated momentum in measures of core inflation. The Bank expects that continued slower growth will continue to ease price pressures.

The BoC does not provide any forward guidance on whether further rate hikes could be necessary or whether it believes it will keep rates on hold for an extended period, suggesting that the BoC will be data-dependant. As such, the Bank continues to make it clear that the outlook for the policy rate will depend on inflation.

Nevertheless, it remains clear that if there were a tug-of-war between economic activity and fighting inflation, the BoC would choose the fight against inflation. With this in mind, while we believe that the BoC is likely on the sideline for the rest of the year, further rate increases this year cannot be fully ruled out, even if the probability is low in our view, if inflation was to prove more persistent than expected.

The BoC leaves its policy rate at 5.00%, as expected. It also continued its quantitative tightening policy. In its statement, the BoC says that “recent evidence that excess demand in the economy is easing” and “the lagged effects of monetary policy” were the main justification to keep rates unchanged despite “little recent downward momentum in underlying inflation.” The central Bank did not provide any guidance as to whether it believes further hikes will be needed or whether we are entering a period where interest rates will be kept unchanged for some time. However, the Bank reiterated that it would be evaluating whether “the evolution of excess demand, inflation expectations, wage growth and corporate pricing behaviour are consistent with achieving the inflation target.” The BoC also makes it clear that it “remains resolute in its commitment to restoring price stability for Canadians,” suggesting that it stands ready to act decisively if inflationary pressures do not ease and remain stubbornly sticky.

The BoC sees global inflation easing, but core inflation remains elevated in many countries. The Bank notes that growth in the US has been stronger than expected, thanks to robust consumer spending, while the Chinese economy has seen a significant deceleration, and the growth in the Euro Area is mixed, with strength in the service sector offsetting some of the weakness in manufacturing.

The Canadian economy was than expected in Q2, and “has entered a period of weaker growth that will help relieve price pressures.” The lower growth is coming from weakening consumer spending, a decline in housing activity and the impact of the forest fires. The BoC notes that most of the growth in domestic demand was from government spending. It also observed that while some slack is starting to form in the labour market, wage growth remains elevated.

The BoC expects inflation to drift higher in coming month due to gasoline prices, while the momentum in measure of core inflation have remained around 3.5%. The Bank is clearly concern of the lack of downward momentum in underlying price pressures in recent months and that the longer it persist the more likely it could become entrenched in inflation expectations.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.