Economic insight provided by Alberta Central Chief Economist Charles St-Arnaud.

Bottom line

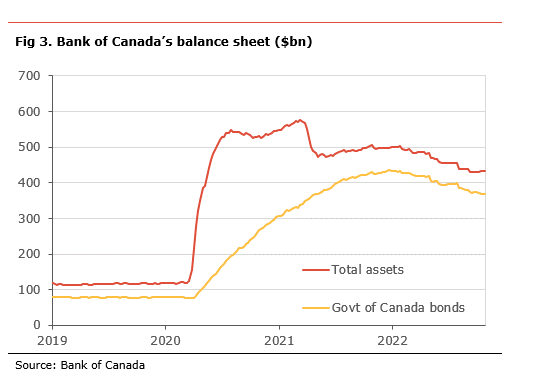

The Bank of Canada increased its policy rate by 50bp, in line with our expectations, to 3.75%, its highest level since February 2008. The central bank also announced that it would continue quantitative tightening (QT). So far this year, the BoC has increased its policy rate by 350bp, the fastest pace since the mid-1990s.

The key message in today’s decision is that the central bank remains committed to fighting inflation and is not yet done hiking interest rates. However, the BoC also signals that the pace of hikes will slow and that the amount of hikes required is becoming more data-dependent. How many rate hikes will be necessary depends on the evolution and outlook for inflation, specifically, whether we see a moderation in measures of core inflation and a narrowing of inflationary pressures in the coming months.

The slower pace of tightening was expected, as it is becoming clear that we are getting close to the terminal rate. As such, we note that at 3.75%, the policy rate is well above the BoC’s measure of neutral of between 2-3%. We believe that, as a result of high debt levels, the neutral rate is likely within the lower end of that range.

Today’s decision supports our view that the BoC will continue hiking. As such, we believe that interest rates will likely increase by another 25bp at the December meeting. However, the risk is that they could increase by more if inflation does not show further signs of abating.

The BoC increased its policy rate by 50bp to 3.70%, in line with our expectations but smaller than market expectations. It also continued its quantitative tightening policy. The statement makes it clear that the central bank considers that further rate hikes will require, saying, “the Governing Council still judges that the policy interest rate will need to rise further.” However, the biggest change is that the central bank is signalling that it is becoming more data-dependent, saying “future rate increases will be influenced by our assessments of how tighter monetary policy is working to slow demand, how supply challenges are resolving, and how inflation and inflation expectations are responding.”

Despite the recent easing in headline inflation, the BoC continues to see broad inflationary pressures. The BoC notes that “CPI inflation has declined from 8.1% to 6.9%, primarily due to a fall in gasoline prices. However, price pressures remain broadly based, with two-thirds of CPI components increasing more than 5% over the past year.” Moreover, the central bank notes that measures of core inflation have not yet slowed and that inflation expectations remain high.

The BoC continues to view that the Canadian economy is operating in excess demand. The central bank points to the very tight labour market as further evidence of the situation. The BoC expects growth to moderate in the second half of the year “to stall through the end of this year and the first half of next year as the effects of higher interest rates spread through the economy.” The central bank notes that higher interest rates are having the desired impact on the economy, as evidenced by retreating housing activity, and a softening in households and business spending.

The Boc downgraded its outlook for the Canadian economy in its Monetary Policy Report significantly. As such, its latest forecast shows the economy growing more modestly, with growth expected at 3.25% in 2022, just under 1% in 2023, and 2.0% in 2024. This compares to expectations of 3.5%, 1.8% and 2.4%, respectively, in the July MPR. As a result of lower energy prices and weaker growth, inflation is expected to by lower than in the July MPR at 6.9% in 2022, 4.1% in 2023 and 2.2 in 2024, compared to 7.2%, 4.6% and 2.3%, respectively.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.

Alberta Central member credit unions can download a copy of this report in the Members Area here.