Economic insight provided by Alberta Central Chief Economist Charles St-Arnaud

Bottom line

The Canadian economy saw strong growth to end 2021. The details show that about two-thirds of the increase in economic activity was mainly the result of businesses rebuilding their inventories. The restrictions to slow the spread of Omicron late in 2021 had only a small temporary impact on overall economic activity and remained concentrated on client-facing industries. Continued strength in the housing market was also a source of support to growth in the fourth quarter.

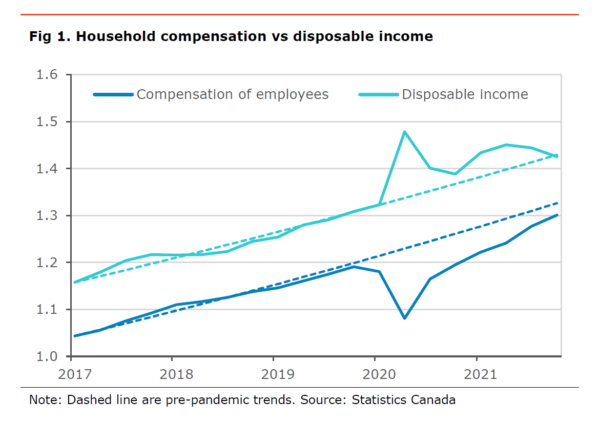

While employee compensation continued to improve, disposable income declined and is rapidly returning to its pre-pandemic trend, as government transfers are reduced. As a result, the savings rate, while remaining high, is rapidly returning to its pre-pandemic level.

We expect economic activity to remain robust in the coming quarters, supported by continued normalization in household consumption patterns, business investment and an improvement in supply chain issues. How strong consumer spending will be will depend on households’ willingness to spend the money saved during the pandemic; especially with disposable income having returned to its pre-pandemic trend, inflation erodes households’ purchasing power and higher interest rates lead to higher debt-service payments.

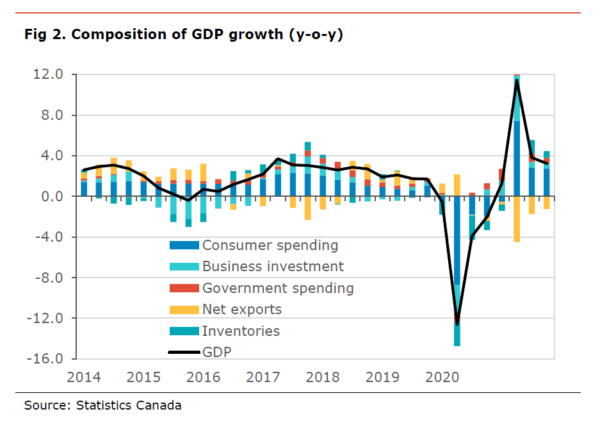

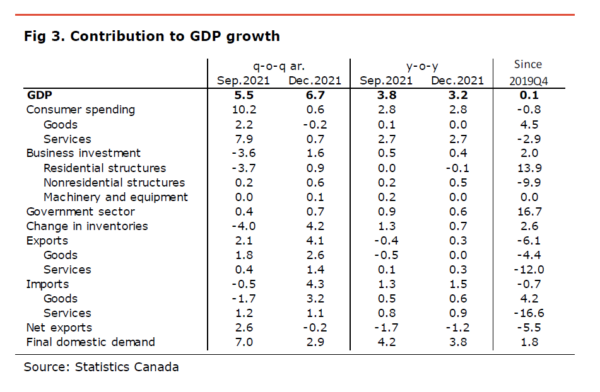

The Canadian economy accelerated in the fourth quarter of 2021, surging by 6.7% q-o-q annual rate (ar) (+3.2% y-o-y). This followed a sharp increase of 5.5% q-o-q ar. in the third quarter of 2021. As a result, economic activity stands marginally above its pre-pandemic level (+0.1%).

In terms of details, a large proportion of the rise in economic activity can be attributed to a rebuilding in inventories in many sectors of the economy, with inventory accumulation accounting for 4.2 percentage points (pp) of the growth on the quarter. Final domestic remained robust contributing 2.9pp to growth in the fourth quarter, with strength in business investments, consument spending and government spending.

Household spending increased a modest 1.0% q-o-q ar, contributing only 0.6 percentage points (pp) to growth. This followed a surge in spending in the third quarter as a result of the reopening of the economy over the summer months. Most of the increase in spending in Q4 was in services, especially transportation services and housing cost, while spending on goods declined slightly.

Residential investment rose by 2.5% q-o-q ar., contributing 0.9pp to growth. The increase in activity was mainly the result of an increase in ownership transfer costs, resulting from the rebound in housing resale activity. New residential construction activity continued to be a drag on growth. Renovation activity increased slightly after a sharp decline in the third quarter.

Business investment excluding housing increased 6.7% q-o-q ar. on the quarter, contributing 0.7pp to growth. Business investment in machinery and equipment increased 4.7% q-o-q ar., while investment in non-residential structure rose 11.0% q-o-q ar.

International trade rebounded in the fourth quarter but the external sector was a small net drag to the economy in the fourth quarter, subtracting 0.2pp to growth. Exports increased 13.4% q-o-q ar. in Q4. led by a rise in exports of services and motor vehicles and parts. On the other hand, imports rose 14.4% q-o-q ar. The increase in imports was primarily driven by consumer goods, likely to replenish inventories.

Canada’s terms-of-trade improved slightly in Q4 (+1.0% q-o-q) mainly as a result of continued increase in crude prices. The terms-of-trade remains close to a record high, providing a boost to income growth on the quarter. This impact of the terms-of-trade on income will positively affect Alberta and other oil-producing provinces.

On the income side, household disposable income decreased by 1.3% q-o-q., the second consecutive decline. The lower disposable income was due to a reduction in government transfers (-11.9% q-o-q), due to further fewer households receiving COVID-related benefits and a reduction in the generosity of those programs. Employees’ compensation rose 1.9% q-o-q as more people returned to work. With consumer spending growing faster than disposable income, the household saving rate declined to 6.4% from 9.0%, still well above its pre-pandemic level.

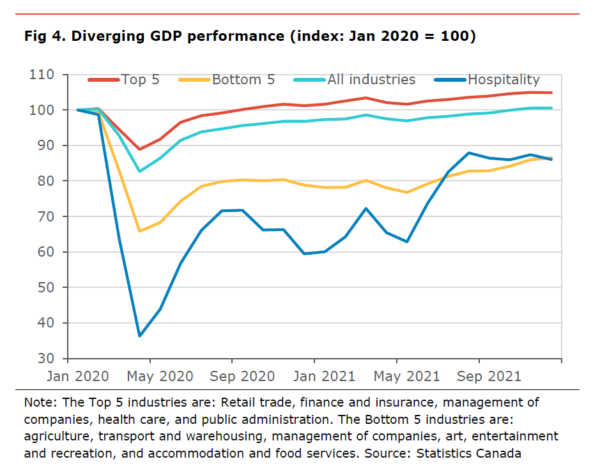

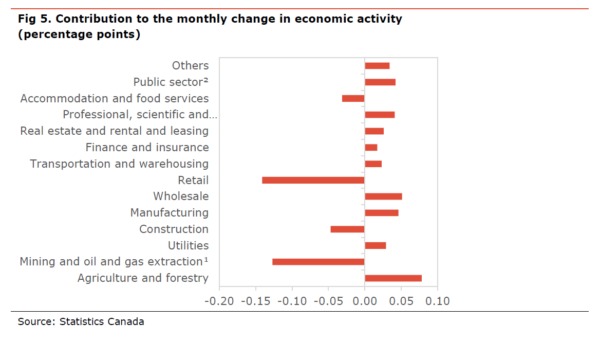

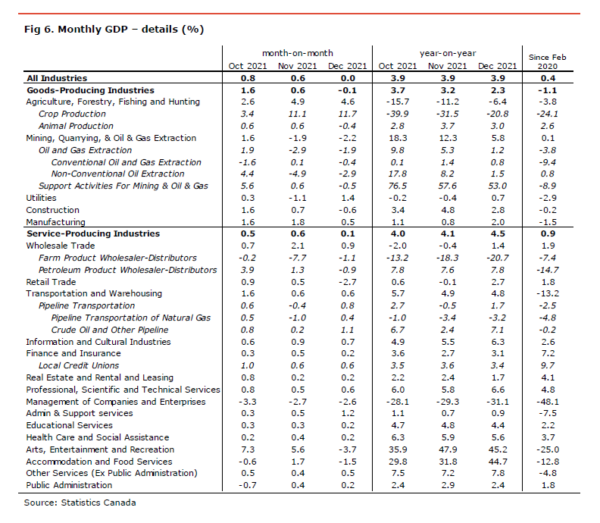

The monthly GDP for December was essentially flat (+3.9% y-o-y), as new restrictions to slow the spread of Omicron led to lower activity in client-facing industries. The detail shows 14 of 20 industrial sectors posted gains in December.

The level of economic activity remains 0.4% above its pre-pandemic level. Only 10 out of 20 industrial sectors have economic activity above pre-pandemic levels, while others, like the food and accommodation, remain about 25% below their pre-pandemic level. Nevertheless, the preliminary estimate for January suggests that activity likely rose by 0.2% m-o-m.

The goods-producing sector eased 0.1% m-o-m (+2.3% y-o-y), mainly due to a reduction in activity in mining, oil and gas, and in construction. Those declines were partly offset by increases in manufacturing, agriculture and utilities. The service sector increased by 0.1% m-o-m (+4.5% y-o-y). While most services industries saw an increase, the reintroduction of restrictions to slow the spread of Omicron led to a decline in retail trade, management companies, arts, entertainment, recreation, and accommodation and food services.

For Alberta, there is no specific data in the report. However, we can make an assessment based on activity in some key industries specific to Alberta. The level of activity decreased on the month in oil and gas extraction, support activity for the mining, oil and gas sector and in client-facing industries. However, activity in most other sectors. Overall, it suggests activity in the province was likely only marginally lower in October.

The continued improvement in the terms-of-trade in Q4, as oil prices remain increase, suggests continued support to income growth for both individuals and businesses in Alberta. This is in line with our observation that the value of the oil produced in Alberta is reaching record levels.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.

Alberta Central member credit unions can download a copy of this report in the Members Area here.