Economic commentary provided by Alberta Central Chief Economist Charles St-Arnaud.

Bottom line

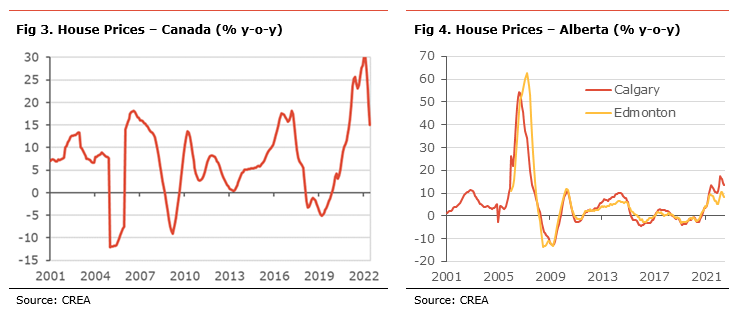

National house prices declined for a fourth consecutive month. Since the start of the correction, prices nationally have fallen by slightly more than 3%. However, the correction has been bigger in some markets, especially those that saw the largest post-pandemic gains. Rising interest rates since the start of the year have clearly had a cooling impact on the housing market and the June data does not yet account for the impact of the more recent super-sized 100bp increase in July.

In Alberta, housing market activity eased but remained elevated by historical standards. In recent months, we note that activity has increased the most in oil and gas producing regions, while it has slowed in the metropolitan areas. The continued improvement in the oil sector, with the value of oil production reaching records in recent months, will be a tailwind on household income and the recovery, providing some support to the housing market in the coming months. In addition, signs of increased migration and buyers from other provinces will also support activity and prices compared to elsewhere in the country.

Low interest rates have been one of the main drivers of the housing market, supporting affordability. The moderation in activity since the Bank of Canada started to raise rates in March points to further weakness this year, especially with the policy rate having increased 225bp since the beginning of the year and likely to rise by another 100bp before the end of year. (see). However, continued lack of supply in many regions and increased immigration are expected to continue to provide some support.

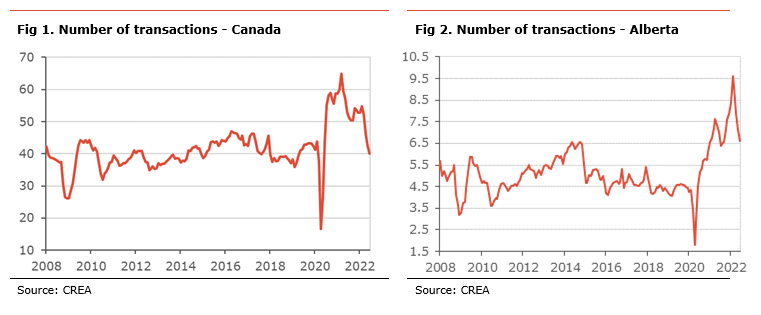

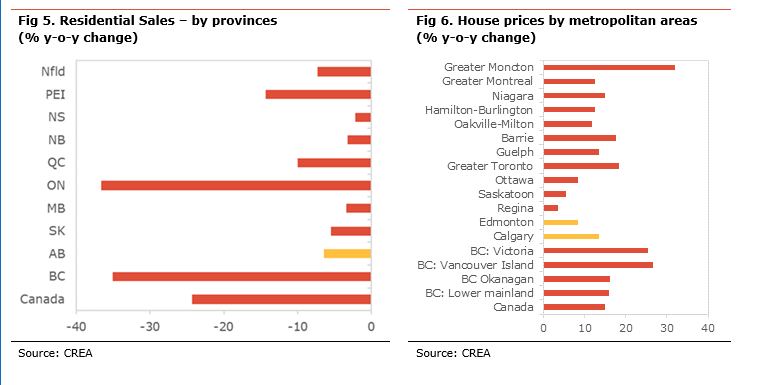

Activity in the Canadian housing market decreased by 5.6% m-o-m seasonally-adjusted in June, the fourth consecutive month of decline. The number of transactions, at 40.1k, is about 2% lower than on average in 2019. It is important to note that all the year-on-year comparisons are distorted by the sharp boom in activity a year ago and, as a result, we will focus on the changes compared to 2019. Activity declined the most on the month in BC, Ontario and Newfoundland, while it increased in New Brunswick and Manitoba. In Alberta, the number of transactions decreased 7.3% m-o-m in June, the fourth consecutive month of decline. Nevertheless, activity remains and is about 49% higher than in 2019.

Despite the correction nationally, most provincial market remains well above the level seen pre-pandemic, supported by continued strong demand. Compared to the average level of 2019, the number of transactions is above its pre-pandemic level the most in Newfoundland (+75%), Alberta (+49%), Saskatchewan (+43%), New Brunswick (+25%), and Manitoba (+15%). However, activity is below the 2019 average by 21% in Ontario.

New listings increased by 4.1% m-o-m seasonally-adjusted in June. All provinces saw a rise in new listings, except for Newfoundland (-5.3% m-o-m). New listings increase the most in Manitoba (+13.9%), New Brunswick (+13.5% m-o-m), and Quebec (+12.3%). In Alberta, they rose by 0.6% m-o-m).

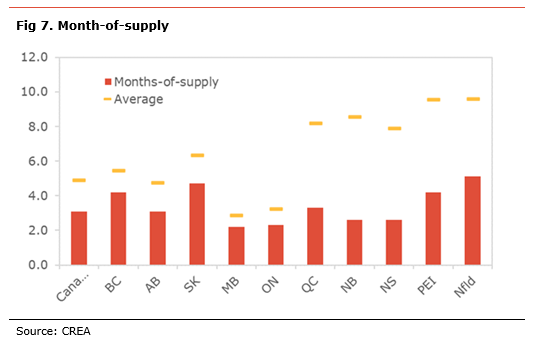

With sales activity weaker than listings in most regions, the month-of-supply measure[1] eased to 3.1 nationally, still below its pre-pandemic level. Based on this measure, all provinces have seen an increase in inventories, but still below its 2019 levels. Compared to the lowest level of inventory over the past two years, the month-of-supply has increased the most in BC (+2.4 months), PEI (+2.0 months), and Ontario (+1.6 months). The main seller’s markets in Canada are New Brunswick, Quebec, Nova Scotia and PEI. With a month-of-supply at 3.1, Alberta’s housing market remains much tighter than before the pandemic.

With sales performances moderating and increasing inventories, the MLS House Price Index declined by 1.9% m-o-m, its third consecutive month of decline and the sharpest monthly decrease. Compared to last year, house prices rose nationally by 15.1%, still fast by historical standards. The biggest monthly declines were in Niagara (-4.0% m-o-m), Oakville-Milton (-3.9% m-o-m), Hamilton-Burlington (-3.6% m-o-m), and Barrie (-3.5% m-o-m). The price increase on the month only in Saskatoon (+1.1% m-o-m), Victoria (+1.1% m-o-m), and Vancouver Island (+0.1% m-o-m).

On a y-o-y basis, the most significant increases were in Moncton (+32% y-o-y), Vancouver Island (+27% m-o-m), Victoria (+26%), and Toronto (+18%).

Compared to their recent peak, prices have declined the most in Oakville-Milton (-13%), Hamilton-Burlington (-9%), Guelph (-7.5%), and Barrie (-6%).

In Alberta, benchmark prices were flat m-o-m and rose by 13.6% y-o-y in Calgary, while they declined 0.2% m-o-m and increased +8.4% y-o-y in Edmonton. Edmonton continued to have some of the weakest price increases in the country. Both cities are showing clear signs of slowing in recent months.

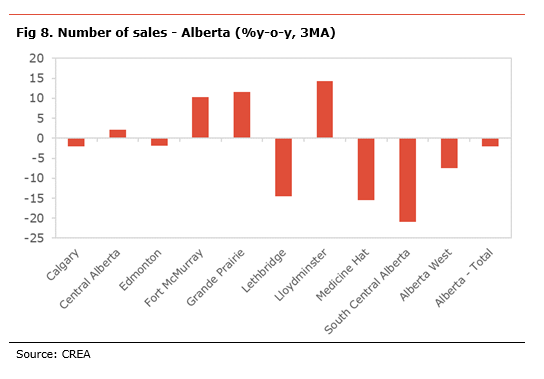

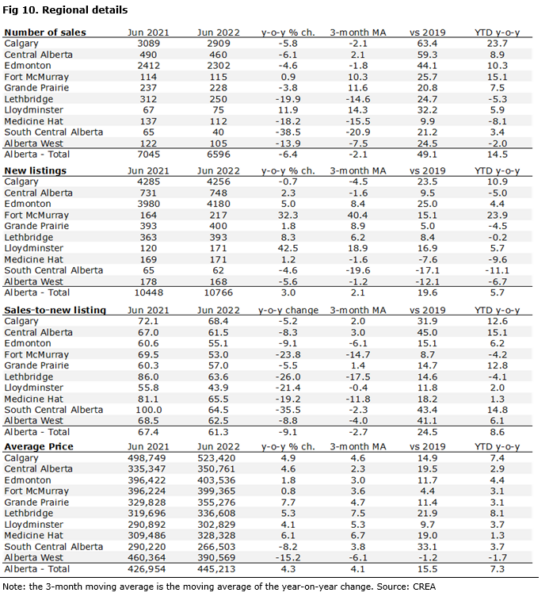

In Alberta, despite a moderation in activity in June, the housing market remains robust, with the level of transactions still well above their pre-pandemic level. The number of transactions is higher than last year’s same month in many regions. (see table below for details). Compared to the average level of transactions in 2019, activity in the province increased by 49%, led by Calgary (63%), Central Alberta (+59%), Edmonton (+44%), Lloydminster (+32%), Fort McMurray (+26%), and Lethbridge (25%). Activity is the weakest in Medicine Hat (+10%) but still well above its pre-pandemic level.

New listings rose on the month at the provincial level. Compared to the average level of new listings in 2019, new supply in the province increased by 20%, led by Calgary (+24%), Edmonton (+25%) and Lethbridge (+17%). New supply is the weakest in South Central Alberta (-17%), Alberta West (-12%), and Medicine Hat (-8%).

With sales weaker than new listings, many regions have seen an easing of their housing markets. The primary seller’s markets are Central Alberta, Calgary, Medicine Hat, Lethbridge, and South Central Alberta. The main buyer’s markets are Fort McMurray, Edmonton, Grande Prairie and Lloydminster.

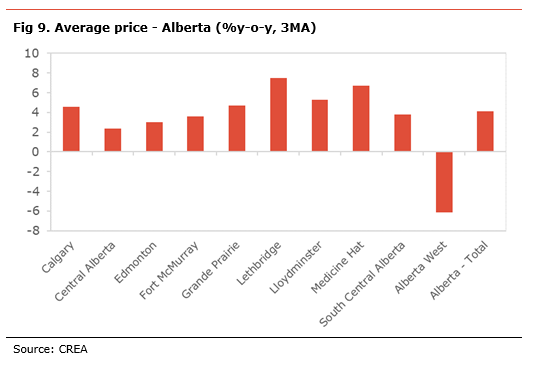

With an easing of the housing markets, average house prices have risen in almost all regions on a 3-month moving average of year-on-year, but at a slower pace. The most significant increase are in Lethbridge (+7.5%), Medicine Hat (+6.7%), Grande Prairie (+4.7%), and Calgary (4.6%).On the flip side, Alberta West (-6.1%) saw a decline in average house prices over the same period.

[1] The month of supply measures how many months is would take at current sales volume and without an increase in listings to bring inventories to 0.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.