Economic commentary provided by Alberta Central Chief Economist Charles St-Arnaud. This report includes regional details for Alberta.

Bottom line

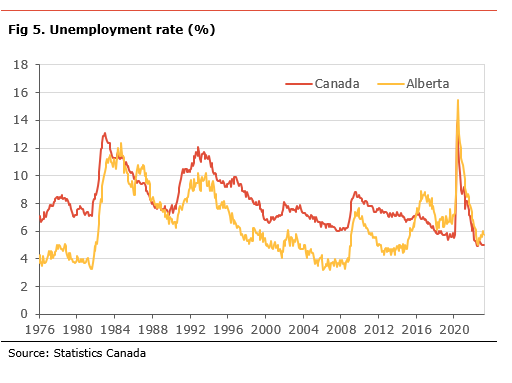

Today’s Labour Force Survey data suggest the labour market in Canada remains robust and resilient. The low unemployment rate continues to signal that the labour market remains very tight, something the Bank of Canada is closely monitoring. Moreover, the report also shows that wage growth remains above 5% and higher than inflation, with average wages increasing by 5.2% y-o-y.

A robust labour market and strong wage growth are a challenge for the Bank of Canada. As we have explained on numerous occasions, the BoC needs to slow growth and create some excess capacity in the economy to fight inflation. This will likely lead to a rise in the unemployment rate and job losses. With this in mind, continued strength and tightness in the labour market may not be a welcomed outcome for the BoC. Moreover, the central bank is becoming increasingly concerned with the disconnect between strong wage growth and weak labour productivity.

The continued resilience of the labour market and the strength in the economy in the early part of 2023 raises the odds that the BoC may need to increase its policy rate. However, whether the BoC hikes further depends on inflation and the growth outlook. Moreover, the recent banking woes in the US and Europe suggest caution is warranted, as the Boc may need to balance fighting against inflation and increased financial stability risks.

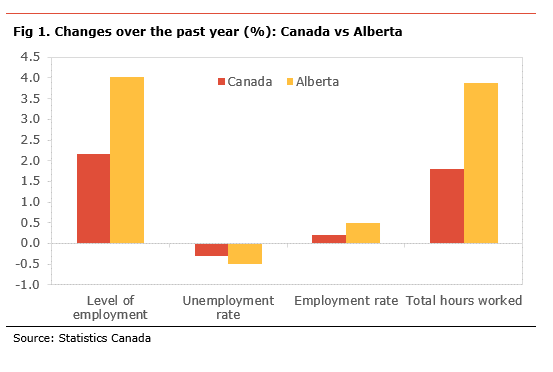

Alberta saw a strong gain in employment in March and the unemployment rate moderated to 5.7%. Over the past twelve months, the Alberta labour market has outperformed the rest of the country. However, the unemployment rate in Alberta remains higher than the national measure. As a result, we observe some continued underperformance in wage growth in Alberta at 1.8% y-o-y, compared to 5.2% y-o-y in the rest of Canada.

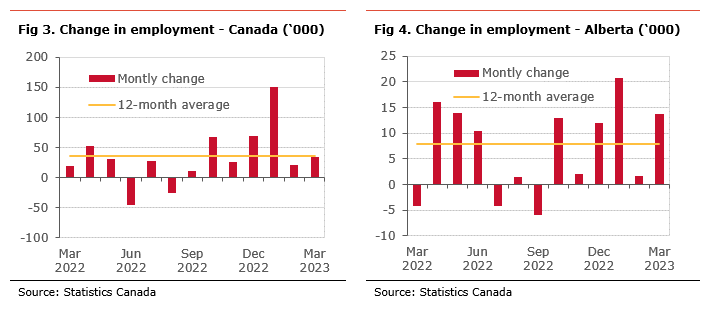

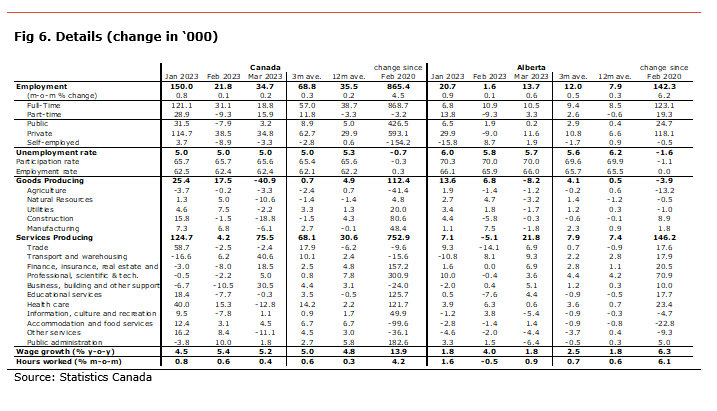

Employment increased by 34.7k in March and continues to be stronger than expectations. The unemployment rate remained at 5.0% and the participation rate eased slightly to 65.6% from 65.7%. The participation rate is still 0.3 percentage points (pp) lower than before the pandemic, as workers left the labour force. If the participation was the same as before the pandemic, the unemployment rate would be 5.4%. The employment rate, the share of the population holding a job, was unchanged at 62.4%, slightly above its pre-COVID level. Wage growth decelerated to 5.2% y-o-y from 5.4% y-o-y, remaining above 5%.

The details show that the job gains in March were both in full-time (+18.8k), and part-time (+15.9k) jobs. In addition, the rise in employment was mostly in the private sector (+34.8k), while it increased marginally in the public sector (+3.2k) and eased slightly for self-employed (-3.3k).

On an industrial level, all the increase in employment was in the service sector (+75.5k), while there was a decline in the goods-producing sector (-40.9k).

The details in the good-producing sector show that the job losses were broad-based, led by construction (-18.8k), natural resources (-10.6k), and manufacturing (-6.1k).

The increase in the service industry came mainly from gains in transportation and warehousing (+40.6k), business, building, and other support services (+30.5k), and finance, insurance, and real estate (+18.5k). These gains were partly offset by losses in health care (-12.8k) and other services (-11.1k).

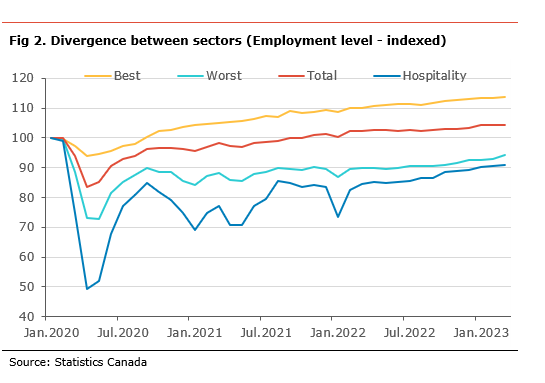

Despite continuous gains in employment and the overall level of employment being above its pre-COVID level by 4.5 percentage points, only 10 out of 16 industries have a level of employment above its pre-pandemic level. The lagging sectors are: agriculture, trade, transport and warehousing, business, building and other support services, accommodation and food services, and other services. Employment in the accommodation and food services is still about 8% below its pre-COVID-19 level.

In Alberta, employment increased by 13.7k in March. With the robust gain in employment, the unemployment rate edged lower to 5.7% from 5.8%, while the participation rate was unchanged at 70.0%. The participation rate in the province is still 1.1 percentage points (pp) below its pre-pandemic level suggesting many workers are remaining on the sidelines. If the participation rate was at the same level as before the pandemic, the unemployment rate in the province would be 7.1%. The employment rate, the share of the population holding a job, inched higher to 66.0%, marginally above its pre-pandemic level.

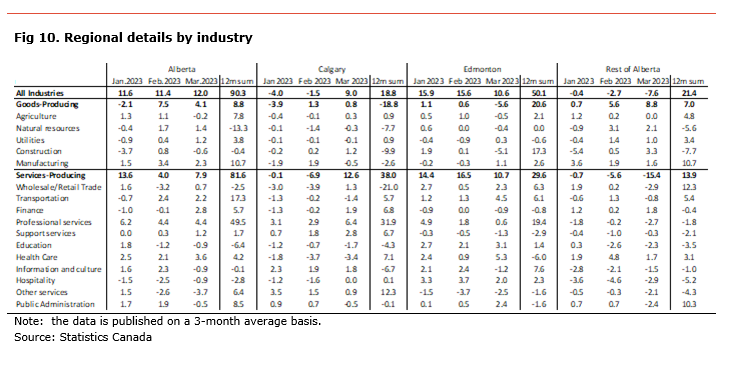

The job gains in Alberta were mainly in the service sector (+21.8k), while there were losses in the goods-producing sector (-8.2k). The decline in the goods-producing industry was broad-based and led by natural resources (-3.2k), manufacturing (-1.8k), utilities (-1.7k), and agriculture (-1.2k). The increase in the service sector was mainly in transport and warehousing (+9.3k), finance, insurance and real estate (+6.9k), trade (+6.9k), and building, business and other support (+5.1k). These gains were partly offset by losses in public administration (-6.4k), information, culture and recreation (+5.4k), and other services (-4.4k).

Despite the overall employment being above its pre-COVID level by 6.2pp, only 10 out of 16 industries have a level of employment above their pre-pandemic levels. The lagging industries are: agriculture, natural resources, utilities, information, culture and recreation, accommodation and food services, and other services. Employment in the accommodation and food services sector, the worst-hit industry, remains more than 15% below its pre-COVID-19 level, underperforming the rest of the country.

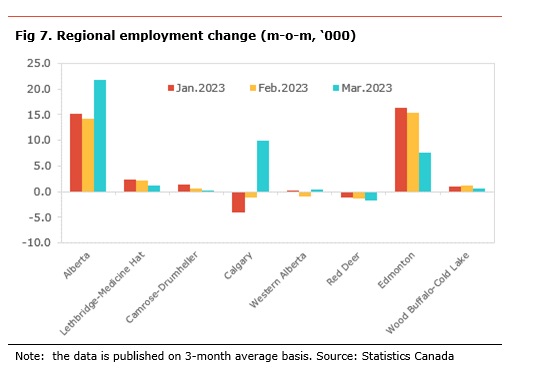

On a regional basis[1], the data is published on a three-month average basis (see table below). Over the past three months, the province gained 21.8k jobs each month on average. Most of the gains were in Calgary (+10.0k), ending seven consecutive months of decline, Edmonton (+7.6k). Red Deer was the only region seeing a decline in employment (-1.7k), a third consecutive month of decline.

Over the past twelve months, employment in the province increased 94.1k, led by Edmonton (+47.2k), Calgary (+21.2k) and Camrose-Drumheller (+14.9k). All the other regions saw only marginal gains over the period.

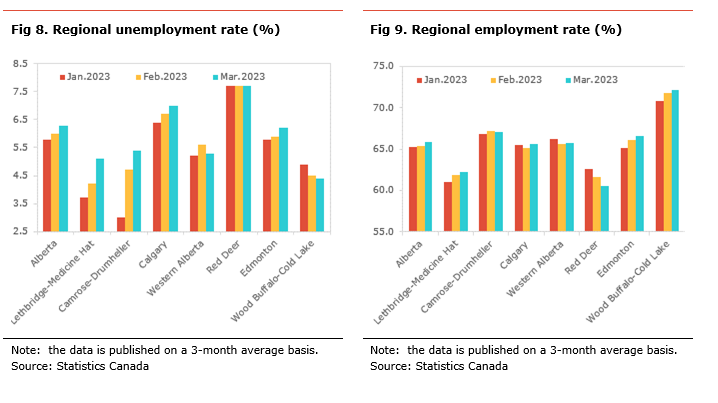

The unemployment rate for the province inched higher to 6.3%, with increases in most regions. The higher unemployment rate was led by Lethbridge-Medicine Hat (+0.9pp), Camrose-Drumheller (+0.9pp), Calgary (+0.3pp), and Edmonton (+0.3pp). The unemployment rate declined in Western Alberta (-0.3pp) and Wood Buffalo-Cold Lake (-0.1pp). It is important to note that the rise in the unemployment rate is partly the result of a higher participation rate in Camrose-Drumheller and Lethbridge-Medicine Hat.

The unemployment rate is the highest in Red Deer (+7.7%), Calgary (+7.0%) and Edmonton (6.2%). It is the lowest in Wood Buffalo-Cold Lake (4.4%), Lethbridge-Medicine Hat (5.1%), Western Alberta (5.3%), and Camrose-Drumheller (5.4%).

The employment rate for Alberta rose to 65.8% from 54.4. The employment rate rose the most in Calgary (+0.5pp), Edmonton (+0.4pp), and Wood Buffalo-Cold Lake (+0.4pp). It decreased in Red Deer (-1.1pp).

[1] All the numbers are expressed as three-month average of the non-seasonally adjusted number.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.