Economic insight provided by Alberta Central Chief Economist Charles St-Arnaud. This report includes regional details for Alberta.

Bottom line

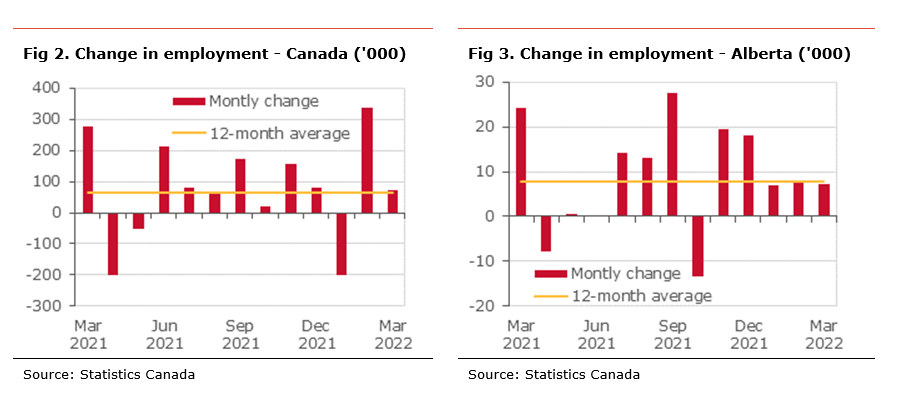

Today’s Labour Force Survey data shows that after the hit from the Omicron wave earlier this year, the labour market continues to improve. The job gains and the unemployment rate reaching a record show that the economy remains robust and that the labour market slack is mostly absorbed, despite sectoral divergences.

The situation is another reason supporting aggressive rate hikes by the Bank of Canada. We expect the BoC to increase its policy rate by 50bp at next week’s meeting and to initiate quantitative tightening (QT).

Alberta saw another gain in employment in March. The unemployment rate declined further and is at its lowest since 2018. However, this is partly the result of workers having yet to return to the labour market, as shown by the decline in the participation rate and the employment rate remaining below their pre-pandemic level. We expect the labour market in the province to continue to improve. The continued record value of oil production in recent months should broadly support the economy and the labour market.

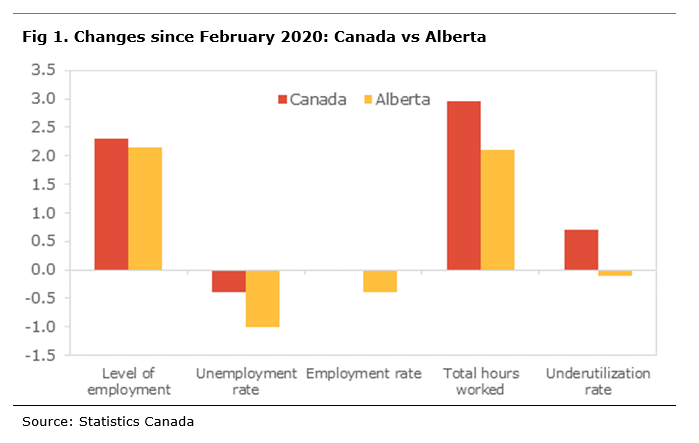

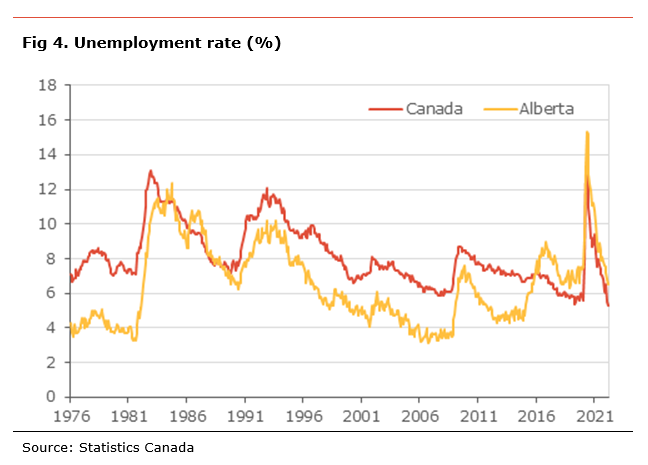

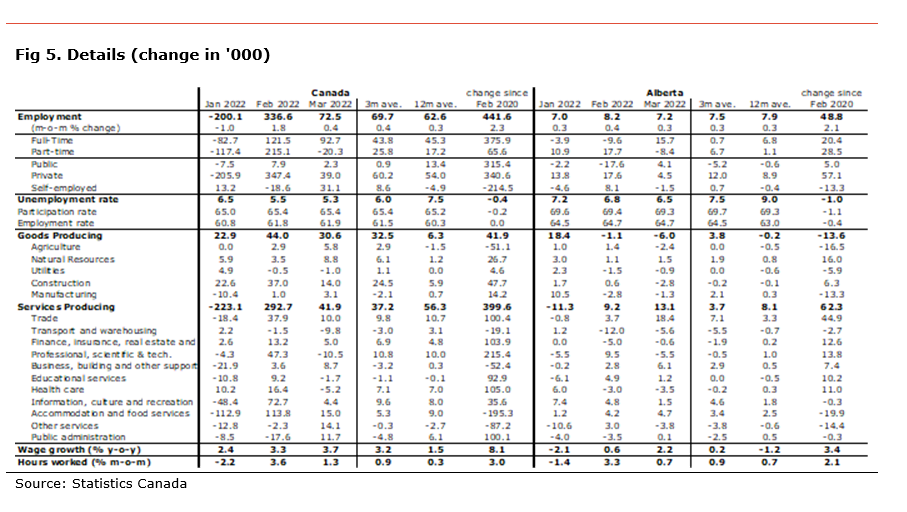

Employment increased by 72.5k in March. As a result, the level of employment is further above its pre-pandemic level (+2.3%). As a result of the rise in employment, the unemployment rate dropped to 5.3% from 5.5%, the lowest level since record started in 1976. Nevertheless, the underutilization rate, which includes those working less than 50% of their usual hours and those not in the labour force but who wanted to work, remains slightly above its pre-pandemic level at 12.1% (11.4% in February 2020). The participation rate was unchanged at 65.4%. The employment rate, the share of the population holding a job, improved to 61.8%, back at its pre-COVID level.

The details show that the job gains in February were in full-time (+93k), while there was a decline in part-time jobs (-20k). In addition, almost all of the increase in employment was in the private sector (+39k) and self-employed (+31k), while job gains in the public sector were modest (+2k).

On an industrial level, the increase in employment was in both the goods-producing sector (+31k) and the service sector (+42k).

The details in the good-producing sector show that the gains were mostly in construction (+14k). There were also smaller increases in natural resources (+9k), agriculture (+6k) and manufacturing (+3k). Employment was slightly in utilities (-1k).

The increase in the service industry was mixed, with gains in accommodation and food services (+15k), other services (+14k), public administration (+12k) and trade (+10k). Those increases were partly offset by declines in professional, scientific and technical (-10.5k), and transport and warehousing (-10k).

Despite continued gains and the overall level of employment being above its pre-COVID level, only 11 out of 16 industries have a level of employment above their pre-pandemic level. The lagging sectors are: agriculture, transport and warehousing, business, building and other support services, accommodation and food services, and other services. Despite further gains in March, accommodation and food services remains one of the worst-performing industry since the pandemic (16% below its pre-pandemic level). Employment in the agriculture sector is currently almost 17% below its pre-COVID-19 level, the worst performing industry.

In Alberta, employment increased by 7.2k in March. The level of employment is 2.1% (or 49k) above its pre-COVID level. The unemployment rate dropped to 6.5%, lower than its pre-pandemic level and the lowest since 2018. However, the decline in the employment rate can be partly attributed to a lower participation rate, which eased to 69.3% from 64.4%. Moreover, the participation rate in the province remains 1.1 percentage points (pp) below its pre-pandemic level suggesting many workers are remaining on the sidelines. The employment rate, the share of the population holding a job, remained at 64.7%, still slightly below its pre-pandemic level.

The job gains in Alberta were entirely in the service sector (+13k), while there were some losses in the goods-producing sector (-k). Every goods-producing industry saw a decline in March, with the exception of natural resources (+1.5k).

The job performance in the service sector was mixed. Most of the job gains were in trade (+18k), business, building and support services (+6k) and accommodation and food services (+5k). These increases were partly offset by losses in transportation and warehousing (-6k), professional, scientific and technical (-5.5k), and other services (-4k).

Despite continued job gains and overall employment being above its pre-COVID level, only 9 out of 16 industries have a level of employment above their pre-pandemic level. Those industries are: natural resources, construction, trade, transport and warehousing, finance, insurance and real estate, professional, technical and scientific, business, building and support services, education, and health care. Employment in the accommodation and food services sector, the worst-hit industry, remains almost 25% below its pre-COVID-19 level, underperforming the rest of the country.

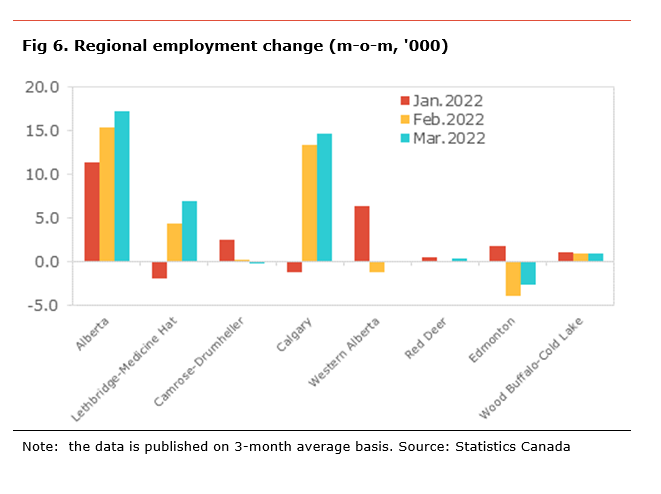

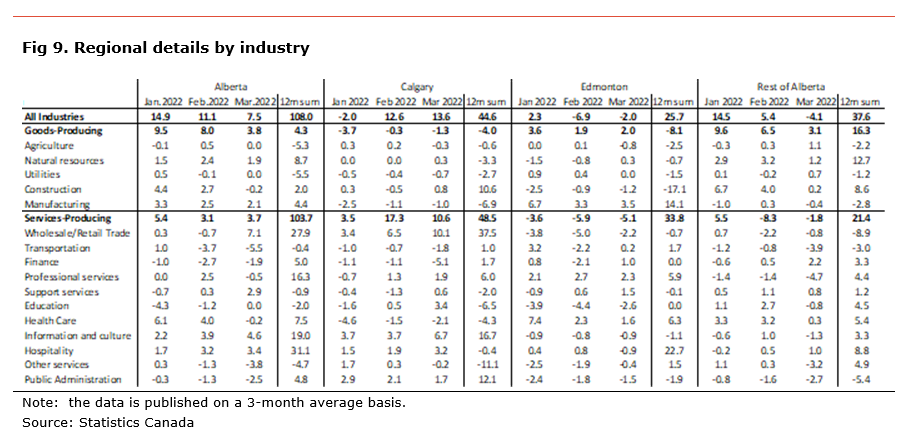

On a regional basis[1], the data is published on a three-month average basis (see table below). Over the past three months, the province gained 17.2k jobs, with most of the gains in Calgary (+14.7k). Employment also rose in Lethbridge-Medicine Hat (+7.0k), Wood Buffalo-Cold Lake (+1.0k) and Red Deer (+0.4k). It was unchanged in Western Alberta and declined in Edmonton (-2.6k) and Camrose-Drumheller (-0.1k).

Compared to the pre-pandemic levels, only Camrose-Drumheller (-9.9%) has employment below its pre-pandemic level. Conversely, Calgary (+4.7%), Edmonton (+1.9%), Red Deer (+1.5%), Western Alberta (+0.7%), Lethbridge-Medicine Hat (+0.7%) and Wood Buffalo-Cold Lake (+0.4%) all have employment above their pre-pandemic level.

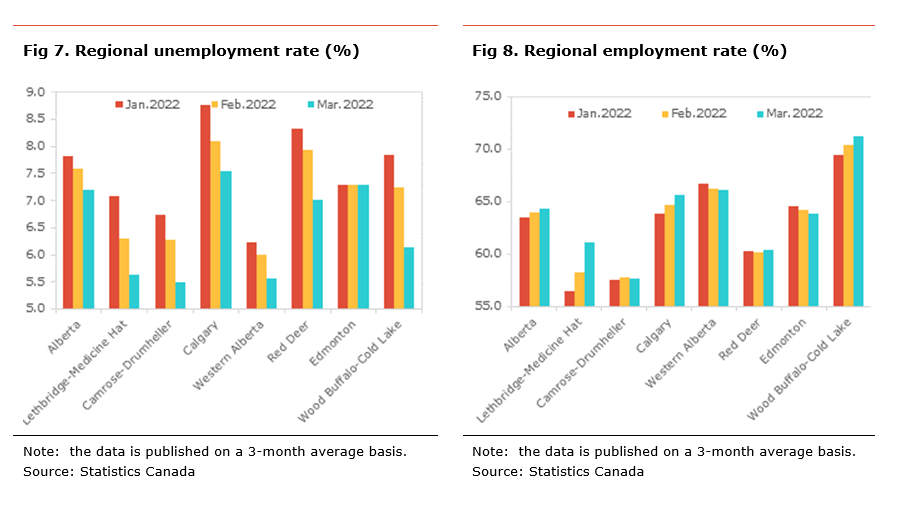

The unemployment rate for the province as a whole declined to 7.2% from 7.6%. The decrease in the unemployment rate was broad-based, with the biggest drops in Wood Buffalo-Cold Lake (-1.1pp), Red Deer (-0.9pp), Camrose-Drumheller (-0.8pp), and Lethbridge-Medicine Hat (-0.7pp). The unemployment rate is the highest in Calgary (7.6%), Edmonton (7.3%), and Red Deer (7.0%). It is the lowest in Camrose-Drumheller (5.5%), Western Alberta (5.6%), and Lethbridge-Medicine Hat (5.6%).

The employment rate for Alberta improved to 64.3% from 63.9%. It improved in Lethbridge-Medicine Hat (+2.8pp), Calgary (+1.0pp), and Wood Buffalo-Cold Lake (+0.9pp) but deteriorated in Edmonton (-0.3pp), Camrose-Drumheller (-0.1pp), and Western Alberta (-0.1pp).

[1] All the numbers are expressed as three-month average of the non-seasonally adjusted number.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.

Alberta Central member credit unions can download a copy of this report in the Members Area here.