Economic insight provided by Alberta Central Chief Economist Charles St-Arnaud.

Main takeaways

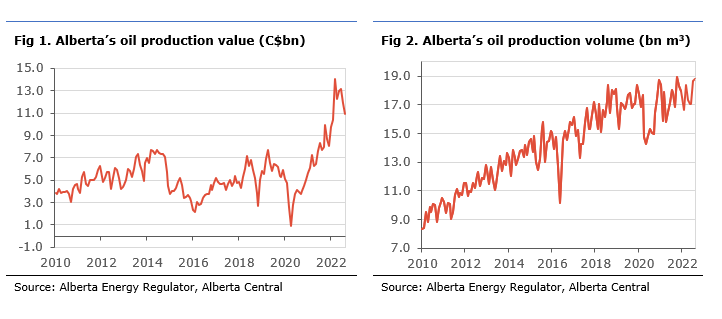

- The value of oil produced in Alberta has averaged about $12bn per month since the beginning of 2022; this is about 75% higher compared to 2014.

- This is the result of a continued increase in production volume and higher oil prices.

- However, despite record oil revenues, Alberta is not experiencing an economic boom as in the mid-2010s and late 2000s.

- The lack of boom is the direct result of a much smaller share of oil revenues staying in the province.

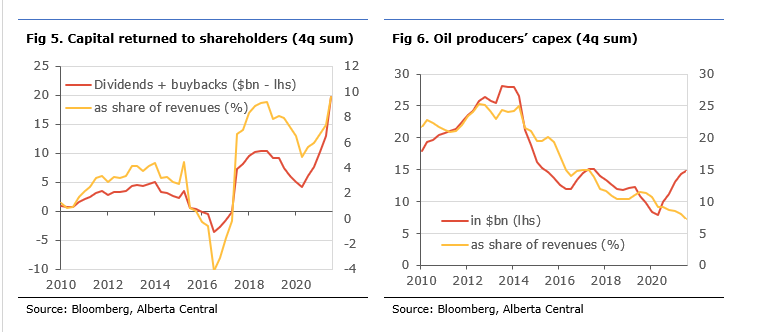

- Oil producers are returning about 10% of their revenues (about $20bn over the past year) to shareholders in dividend and share buybacks, compared to about 4% ($4.5bn) back in 2014. Moreover, only 25% of those shareholders are Canadian, meaning that most of oil revenues are leaving the country.

- In addition, oil producers are reinvesting a smaller share of revenues into their operations (about 7% of their revenues, $15bn over the past year). Back in 2014, this proportion was about 25% of revenues ($28bn).

- The type of investment is also evolving, thereby changing the economic spillover of oil and gas investment on the broader economy.

- Energy transition and a reduction in global greenhouse gas emissions are leading to a likely peak in oil demand around 2030; this means that oil producers no longer need to invest in new production capacity where the upfront costs are high and with a very long lifespan. However, these investments have significant spillovers to other industries, especially in construction and manufacturing.

- Rather, oil producers are focusing their capital expenditures on improving their efficiencies, both in terms of lower costs and greenhouse gas emissions per barrel. These types of investments have a smaller economic multiplier, hence less support for growth.

- This new reality has some important consequences for the economic outlook: 1) growth is now less sensitive to changes in oil prices, 2) weaker income growth, as economic growth is weaker and a greater share of the revenues are not staying in the province, 3) the lack of boom may also mean a small bust when oil prices drop, leading to reduced economic volatility.

- The link between the Canadian dollar and oil prices may have weakened permanently; this is because, since a greater share of revenues are being returned to shareholders, a vast majority of whom are non-Canadians, it results in big outflows from Canada or smaller inflows in the country. As a result, the positive terms-of-trade associated with higher oil prices is smaller than in previous episodes and likely explain why the Canadian dollar underperformed the increase in oil prices over the past year.

- An area where the benefit from higher oil prices remains unchanged is the government royalty revenues on oil extraction, as they depend on the value of the oil produced. This explains why royalty revenues are reaching record highs.

With oil prices and oil demand rebounding and the impact of the Russian invasion of Ukraine, oil prices have increased sharply over the past twelve months, reaching over $120 a barrel earlier this year. As a result, Alberta’s oil producers have seen record levels of revenue.

However, despite oil production and revenues reaching record levels, Alberta is far from experiencing an economic boom similar to what we saw in the mid-2010s and the 2000s. This is because the nature of the oil industry has changed, likely forever, and its impact on the economy has weakened.

Awash with cash

The value of oil produced in the province has been reaching record highs since mid-2021. We estimate that the value of oil produced in Alberta averaged about $12bn per month so far in 2022 (Fig1). This is partly the result of higher oil prices, with West Texas Intermediate (WTI) increasing from $75 mid last year to a peak of almost $125, following the Russian invasion of Ukraine in February. Despite some easing in oil prices in recent months due to concerns regarding global oil demand as the probability of a global recession rises, oil prices and revenues remain elevated.

As a comparison, during the previous boom which ended in 2015, the maximum value of monthly production was $7.7bn in June 2014. To illustrate this in another way, between August 2021 and August 2022, Alberta produced almost $140bn of oil, which is 75% higher than between August 2013 and August 2014 when about $80bn worth of oil was produced. During that period in 2014, WTI oil prices averaged $100 and Western Canadian Select (WCS) was around $77.

The increase in oil prices is not the only reason why the value of oil production is reaching record highs. Oil production volumes in Alberta have been constantly rising in recent years, if we exclude the early months of the pandemic when producers cut production drastically in response to the collapse in oil prices. According to the latest data from Alberta Energy Regulator, oil production in volume reached 18.8 million cubic meters (118.5 million barrels) in August 2022 (Fig 2). This is about a third higher than it was back in 2014 when production in August that year was 13.8 million barrels (87.1 million barrels).

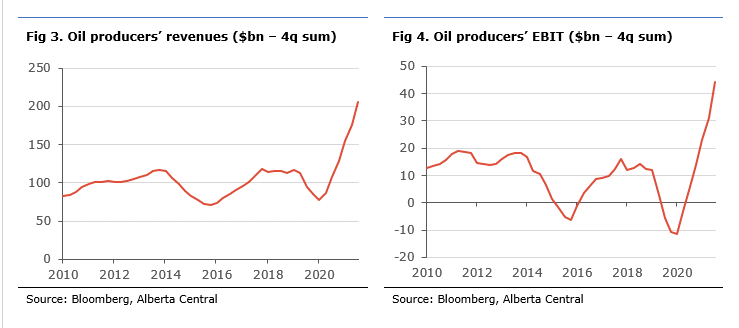

Using available financial data from some of the big oil producers in Alberta, namely Suncor, Cenovus, Canadian Natural Resource, Imperial Oil, and Meg Energy, we estimate that these producers have cumulatively made $64.4bn in revenues and $17.8bn in earnings before interest and tax (EBIT) in 2022Q2. Over the past year, these companies earned $205.5bn in revenues and $44.3bn in EBIT, the highest level for a one-year period (Fig 3 and 4). As a comparison, prior to the downturn in 2015, these same producers had an EBIT of $4.5bn per quarter on average, a quarter of current earnings.

Less oil revenues are staying in the province

With oil producers awash with cash and making more money than at any other time in the past, one would expect a boom in the oil industry with a strong positive spillover to the rest of the Alberta economy. However, Calgary, Edmonton and the rest of the province do not feel like boom towns and economic activity is not as effervescent as back in 2013-2014 before the drop in oil in 2015.

This is because oil producers are using their revenues in very different ways compared to back in 2014. Part of these changes are due to the pandemic and the impact of the drop in oil prices in 2020, as part of current revenues are being redirected to repay the debt accumulated during the pandemic when oil prices collapsed.

In addition, a greater share of oil producers’ earnings is being returned to shareholders. Using the same group of companies as previously, we estimate that these companies have paid a little more than $6bn in dividends over the past year and have repurchased almost $14bn of shares, returning a total of almost $20bn to shareholders (Fig 5). This represents almost 10% of their revenues, the highest proportion in recent years. Back in 2014, these oil producers were returning – at most – $5bn to shareholders per year, about 4% of their revenues.[1].

As a result, of the $20bn in revenues for these firms, about $15bn was sent to foreign investors.

This means that the positive terms of trade improvement coming from increasing oil prices has been partly offset by greater outflows of money being returned to shareholders. This likely explains why the Canadian dollar has not appreciated as much as would have been expected over the past year, despite the sharp rise in the price of oil.

Moreover, of the remaining 25% of shareholders that are Canadian residents, it is very likely that less than half live in Alberta. This means that, at most, only around $2.5bn of the $20bn in revenues has been returned to investors in Alberta.

Another reason why less of the revenues are staying in the province is that these same companies are also reinvesting a smaller proportion of their revenues in capital expenditures compared to 2014. We estimate that, over the past 12 months, only 7% of revenues has been spent on capital expenditures for a value of about $15bn (Fig 6). In 2014, these companies were spending about 25% of revenues on capital expenditures or about $28bn, almost double the current amount.

Our findings are very similar to those from a recent TD Bank study, reported in the July edition of the Bank of Canada’s Business Outlook Survey, that shows capital expenditures are expected to be only 40% as a share of cash in 2022. As a contrast, back in 2013, 2014 and 2015, that proportion was around 140%.

Energy transition is already permanently changing the oil industry

The lack of investment suggests that oil producers do not see the same need for reinvestment as they did back in the mid-2010s. It also suggests that these producers believe that shareholders could obtain a better return on their capital elsewhere.

Part of the reason behind this change is the global decarbonization effort and the transition away from fossil fuels. With the world engaged in reducing its carbon emissions, we are seeing a shift in consumption away from fossil fuels. As a result, many oil specialists, including the International Energy Agency, are forecasting a peak in oil demand around 2030, after which global oil demand is expected to decline slowly.

However, many of these forecasts were done before the current sharp rise in oil prices. The war in Ukraine and the associated surge in energy prices may be a game changer and accelerate the transition effort away from fossil fuel, despite some short-term reliance on more polluting sources like coal. This is because: 1) high prices make alternative energy sources more economically appealing, and 2) for many countries, energy security will likely mean producing more locally and not depending on foreign partners as suppliers. This could lead to the expansion of wind, solar, geothermal, and nuclear power in many countries. An example of how the war in Ukraine could be a game changer is the likelihood that the German Green party could withdraw its long-held opposition to the expansion of nuclear power.

In such a context, the need to increase production, despite being highly profitable, is low. It is important to stress that this doesn’t mean that the oil industry and the need for Canadian oil will disappear, just that less of it will be needed in the future. In other words, there is no longer a need for growth the industry.

There is also realization in the industry that, to be the last supplier of oil, one will need to not only be the cheapest producer per barrel, but also the producer with the lowest carbon footprint per barrel. This translates into different needs and types of investment required by the industry.

In previous booms, when oil prices surged and demand for oil was rising, oil companies were rushing to increase production. This involved the development of new production projects, like oil sands mines. However, these projects have very steep upfront fixed costs, about $40bn, and a very long lifespan, around 30-40 years. With oil demand decreasing, there is a lot of uncertainty as to whether this production will be needed in the long term.

As a result, oil producers are investing in improving efficiencies. This means finding ways of squeezing extra barrels for the same amount of inputs from current facilities, reducing the cost per barrel produced, and cutting the amount of greenhouse gas emissions per barrel via carbon capture or more efficient extraction methods.

A decline in the economic multiplier

The change in types of investment by oil producers also changes the economic multipliers (i.e. spillover effect) that capital expenditures by the industry are having on the broader economy.

In the case of a new oil sands mine, as workers need to be hired to clear the land and build roads and other infrastructures, this increases the level of activity in the construction sector. As some of the building materials, machinery and equipment are produced in the province, this raises activity in the manufacturing, wholesale and retail sectors. The development, planning and design of the project requires knowledge from engineering firms and other specialized firms, boosting the professional, scientific and technical sector.

We estimate that between 1990 and 2020, a 1 percentage point increase in capital expenditures by the oil and gas sector led to a rise in economic activity in the construction sector of 0.33 percentage points, 0.21 percentage points in the manufacturing sector, 0.15 percentage points in wholesale trade and 0.10 percentage points in the professional, scientific and technical sector (Fig 7). Overall, it is estimated that a 1 percentage point increase in capital expenditure by the oil and gas industry pushed growth higher by about 0.07 percentage points, all else equal.

However, with investment now being focused on efficiency gains and carbon reduction, the impact of oil and gas capital expenditures on the economy has likely diminished, because there are smaller spillovers to other industries. This is because, as this type of investment is more capital intensive, it requires less workers than when developing, for example, a new oil sand mine; less construction workers are needed because there is simply less construction work. Similarly, these companies require less input from other sectors. Moreover, since much of the machinery and equipment are made outside of the province, more spending is going outside of the province.

Overall, this means that for each dollar spent on capex currently, a smaller share is staying in the province.

Impact on economic outlook

This new reality has some important consequences for the economic outlook:

- Growth will be less sensitive to oil prices. As such, rising oil prices will lead to a much smaller tailwind on the economy and to slower growth than what the province would have expected otherwise.

- Weaker income growth. Slower growth and a greater share of revenues leaving the province will mean that national income will grow more slowly than in the past when oil prices increased. This will lead to less wealth being broadly generated in the economy.

- The lack of boom when oil prices surged will also mean a smaller bust when oil prices decline. As such, it will likely mean a reduction of the volatility of economic outcomes in the future. As we have shown in What Does Economic Diversification Mean for Alberta?, the oil sector is responsible for a third of the growth volatility and 60% of the income volatility in Alberta.

- The link between the Canadian dollar and oil prices may have weakened permanently. It has been noted over the past year that the Canadian dollar has not appreciated as much as it would have been expected. This is a result of a greater share of revenues being returned to shareholders, a vast majority of whom are non-Canadians, generating big outflows from Canada or smaller inflows into the country. As a result, the positive terms-of-trade associated with higher oil prices is smaller than in previous episodes.

- An area where the benefit from higher oil prices has not changed is government royalties on oil extraction. This is because that revenue depends on the value of oil produced. However, other areas of government revenues, such as personal and business taxes, are likely to be weaker because of the smaller increase in national income.

[1] The details of the foreign ownership are as follow: Suncor 60%, Cenovus 86%, MEG 73%, CNRL 73%, Imperial 94%.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.

Alberta Central member credit unions can download a copy of this report in the Members Area here.