Key takeaways:

- The expanded TransMountain Pipeline (TMX) has brought significant benefits to the oil sector and the economy in its first year of operation.

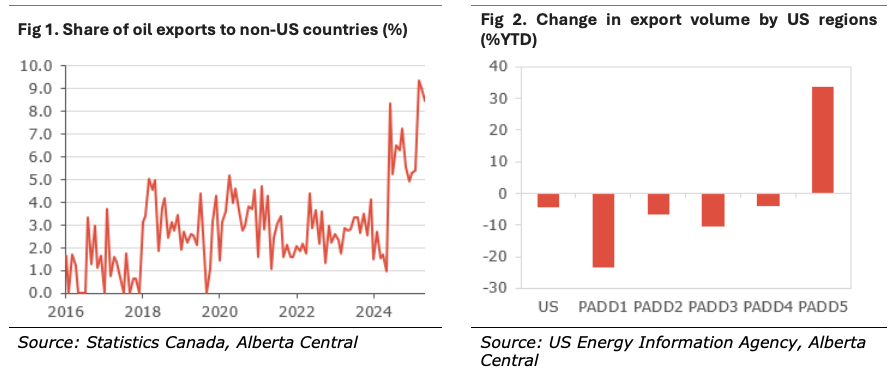

- The increase in market access has been significant, thanks to greater access to the Pacific coast. As a result, the share of oil exports to non-US countries has tripled over the past year.

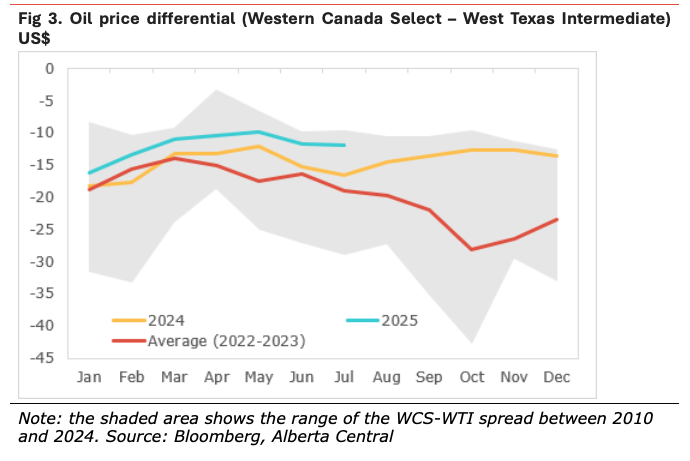

- Moreover, despite overall export oil volume to the US having declined 4% year-to-date, exports to refineries on the US West Coast are about 34% higher.

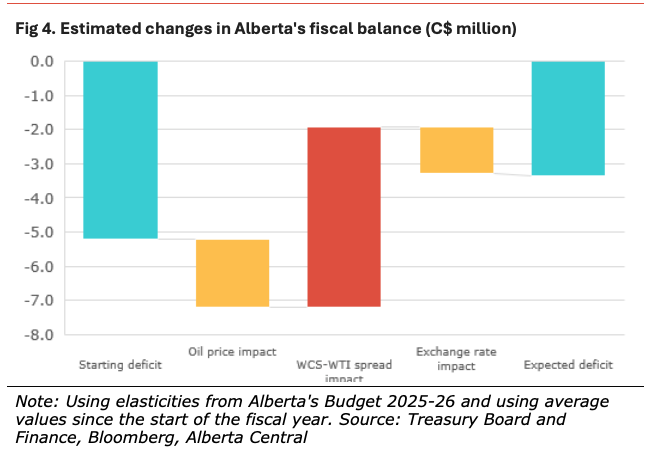

- As a result, the price differential between Western Canada Select (WCS) and West Texas Intermediate (WTI) narrowed significantly since the start of the expanded TMX, by about US$8 per barrel – much lower than historical norms.

- We estimate that this narrower oil spread has increased oil revenues by approximately US$9bn since the opening of TMX, equivalent to about $13bn in Canadian dollars. This means that the reduction in the oil discount has boosted oil revenues by about 10%, equivalent to adding more than an extra month of production.

- The narrower oil differential is also leading to a sharp increase in Alberta’s government revenues, estimated at C$4.4bn in its first year of operation. So far in FY2025-26, we estimate that the smaller-than-expected spread in the Budget will boost revenues by C$5.3bn, more than fully compensating the impact of lower WTI prices and a stronger Canadian dollar. This will lead to a narrower deficit.

- Increased revenues for oil producers thanks to TMX are also increasing governments’ corporate tax revenues by about C$2bn for the federal government and by about C$1bn for the Government of Alberta.

- In sum, we estimate that the expanded TMX pipeline has, so far, generated about C$5.4bn in extra revenues for the provincial government, equivalent to about 7% of the province’s revenues for fiscal year 2024-25.

- The additional export capacity provided by TMX has provided significant economic benefits. However, it would be a mistake to suppose that another pipeline would provide benefits in the same order of magnitude.

- The reason is that most of the benefits from TMX, so far, are the result of a narrower oil price differential. A further reduction in the spread is unlikely, given that WCS will always sell at a discount relative to WTI because of the difference in grade.

- The main benefit of the new pipeline would be to prevent a rewidening of the oil price differential, as oil production increases.

After years of delays, the expanded TransMountain pipeline (TMX) finally started operations in May 2024. With a new capacity of about 890,000 barrels per day, almost three times its original capacity, the expanded TMX significantly increased Canada’s oil export capacity and diversification and allowed Canadian oil production to continue to grow.

Back in January 2025, we wrote about the benefits the TMX pipeline brought to the Alberta and Canadian economy within the first 6 months of operation (see TMX is already showing its value). With a full year of operation, we update our estimate of the benefits and expand on its impact on the economy.

Exports diversification, both globally and within North America

One of the most immediate benefits of the TMX pipeline has been greater access to the Pacific Ocean. Currently representing about 9% of total oil export volume, it has allowed the share of oil exported to non-US countries to more than triple, with most exports going to China.

This access to the Pacific Ocean has also increased the volume of exports of Canadian oil to refineries on the West Coast of the US by almost 40%. As a result, the share of oil imported from Canada by PADD5 is more than 35% so far this year, compared to about 27% for the same period in 2024.

Significantly tighter WCS-WTI spread

This increase in diversification, both internationally and within the US, has led to a narrowing of the spread between Western Canada Select (WCS) and West Texas Intermediate (WTI) and a lack of seasonal widening last Fall. As we explained in our original report (TMX is already showing its value), WCS trades typically at a discount against the WTI because of a difference in the type of oil (heavy and sour vs light sweet) and associated higher refining costs. The expected spread should be between $10 and $15 a barrel. However, over the past 15 years, the spread between WCS and WTI has often been much wider than justified by the difference in the type of oil. The main reason for the historically wider spread is a lack of infrastructure allowing oil to flow where it is needed, leading to oversupply situations.

The opening of TMX has significantly altered how Canadian oil flows within North America, with the increase in international exports and exports to the West Coast of the US resulting in less oil being transported to other parts of the US.

Similarly, the further narrowing of the spread seen in March looks to be the result of increased utilization of the TMX pipeline. As such, the latest operating data from the Canada Energy Regulator shows that the utilization rate – this is the total oil transported relative to the capacity – rose to 89% in March, the highest since its expansion. As a result, almost 800 million barrels of oil per day were transported in March, a record high. This also coincides with a spike in the share of oil exports to countries other than the US to almost 9% from about 5% in the three months preceding March 2025. So far in 2025, while exports volume to the West Coast have increased by more than 30%, total oil exports to the US are lower by about 4%, with lower exports to every other region: East Coast (PADD1) – 23%, Midwest (PADD2) – 6.5%, Gulf Coast (PADD3) – 10%, Rockies (PADD4) – 4%.

While the result has been a modest decline in the share of Canadian oil in US refiners’ input to 25% from 26% in 2024, there are some significant differences between regions. The share of Canadian oil in refiners’ input in PADD2 declined to 72% from 77% and to 44% from 47% for PADD4. On the flip side, the share of refiners’ input in PADD5 rose to 20% from 15%.

With less oil flowing to the Midwest and the Gulf Coast of the US, the oversupply situation seen over the past 15 years has been dramatically reduced, if not eliminated for now, leading to a narrowing of the spread between WCS and WTI.

Since the opening of the expanded TMX pipeline, the WCS-WTI spread has been narrower by about $6 a barrel on average. However, this hides the significant lack of seasonal widening last Fall, with the spread narrower by $12 on average compared to the previous 2 years in September, October, November and December. Historically, the spread has never been so narrow for this period since 2011, excluding 2020.

Quantifying the benefits of TMX and a narrower spread

The reduction in the oil differential is having a positive financial impact.

Increased oil revenues

Using the same methodology used previously (see TMX is already showing its value), we estimate that the reduction in the oil discount led to greater oil revenues of about US$9bn during the first year of operation of the TMX expansion, between May 2024 and April 2025. Expressed in Canadian dollars, the extra revenues, thanks to TMX, reached about $12.6bn. This estimate does not consider the increased oil production enabled by the enhanced export capacity provided by TMX.

To add context, we estimate that the total value of oil produced in Canada over that period was about C$140bn, of which about C$120bn came from Alberta. This means that the reduction in the oil discount has boosted oil revenues by about 10%, equivalent to adding more than an extra month of production.

Increased royalty revenues

Using the elasticities provided by Alberta’s Treasury Board and Finance, the narrower WCS-WTI spread by $6 since the start of the expanded TMX has generated about $4.4bn in extra oil royalty revenues.

Moreover, since the beginning of the 2025-2026 fiscal year, the oil price differential has been significantly narrower than expected in the 2025 Budget. As such, the Budget assumes a spread of $17 over the fiscal year, while the spread has averaged about $10 so far this fiscal year.

Using the elasticities provided by Alberta’s Treasury Board and Finance, if the differential remains at $10 for the rest of the fiscal year, this will lead to an increase in royalty revenues of about C$5.3bn. However, because the price of WTI is lower and the Canadian dollar is stronger than expected in the Budget, we estimate that the deficit this fiscal year will be smaller by about $1.7bn at C$3.4bn; this is assuming that the WCS, WTI and the Canadian dollar stay at their average levels so far this fiscal year.

Increased corporate tax revenues, both federally and provincially

Suppose we assume that the C$13.6bn in extra revenue for the first year of operation of the expanded TMX pipeline is all profit (there shouldn’t be any increase in production costs since it’s simply a higher selling price). In that case, the federal government should see an increase in corporate revenues of almost C$2.0bn, given a corporate tax rate of 15% on businesses. As for the Government of Alberta, an additional C$1bn is expected, based on a corporate tax rate of 8%.

In summary, TMX generated $13.6 billion in extra revenues in its first year of expanded operation: $2.0bn in extra tax revenues for the federal government, but, most importantly, about $5.4bn in extra revenues for Alberta (that’s almost 7% of the province’s revenues for fiscal year 2024-25).

A new pipeline would not bring the same benefits

As shown, the additional export capacity provided by the TMX has provided significant economic benefits to the economy. However, it is unlikely that adding another pipeline would generate the same benefits.

The reason is that most of the benefits from TMX are the result of the narrowing of the oil spread due to the diversion of oil flows away from the US Midwest towards the Pacific Ocean. Due to the structural discount between WCS and WTI, and the quality difference, further increasing the flow of oil to the West Coast of Canada is unlikely to lead to a significant further narrowing of the price differential between WCS and WTI.

Instead, the main benefits a new pipeline would bring are:

- More optionality in transporting oil to the market at a better price.

- Greater transportation capacity to absorb increasing production.

As such, the main benefit of a new pipeline would be to prevent a rewidening of the oil price differential, which would reduce the extra revenues estimated previously.

Conclusion

In its first year of operation, the TMX pipeline has shown significant value to the Canadian and Alberta economies. Although whether these benefits justify the $34bn in cost is likely to remain a source of debate for many years to come, our analysis suggests that the benefits from TMX will outweigh the costs in the long run. Despite this, it would be a mistake to suppose that another pipeline would provide benefits in the same order of magnitude.