Economic commentary provided by Alberta Central Chief Economist Charles St-Arnaud. This report includes regional details for Alberta.

Bottom line

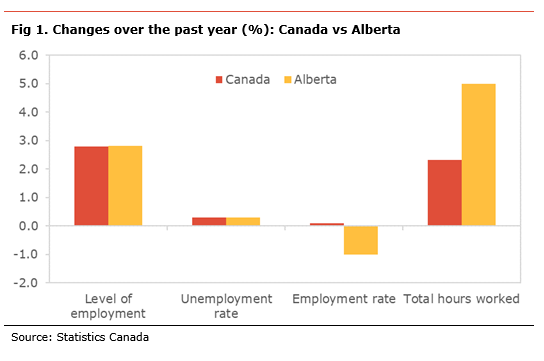

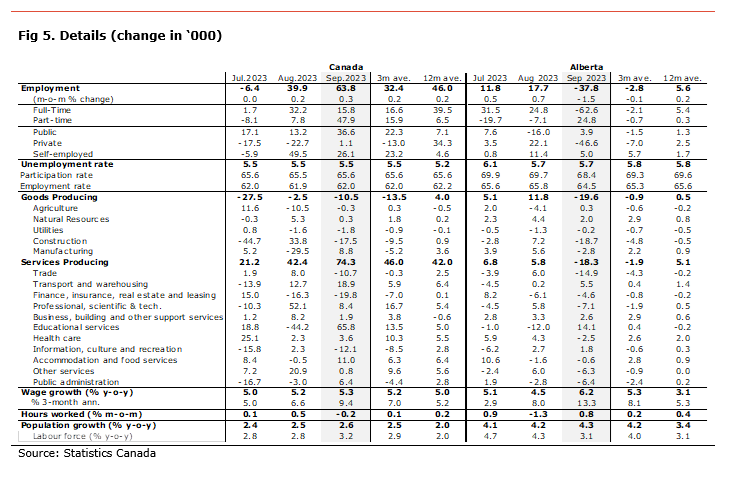

Today’s Labour Force Survey data points to a robust labour market in Canada, with stronger than expected job gains and an unemployment rate of 5.5%. However, a decline in hours worked suggests that economic activity remained modest in September.

The report also showed that wage growth rose to 5.3%. Moreover, we estimate that the 3-month annualized change of the seasonally-adjusted series jumped to 9.4%, suggesting further acceleration in wage growth in recent months.

The Bank of Canada will be concerned by the continued strong wage gains and recent sharp acceleration, especially given the disconnect to productivity growth. Moreover, the unchanged unemployment rate suggests the labour market remains very tight.

While no progress was made in September to create some slack in the labour market and stronger wage growth dynamics, the likelihood of a rate hike at the October meeting increased further. Whether the BoC decides to act in October depends heavily on the next CPI report on October 17th.

What is becoming clear is that rate cuts in early 2024 are unlikely at this point. However, as we have shown, monetary policy entered restrictive territory in late 2022 or early 2023, depending on the measure. Historical patterns suggest a downturn usually follows 5 to 7 quarters later, suggesting very weak growth late this year and early next year. (see What happened to the recession? The role of the policy stance and demographic). With inflation expected to ease accordingly, this suggests that some easing in mid-2024 is likely.

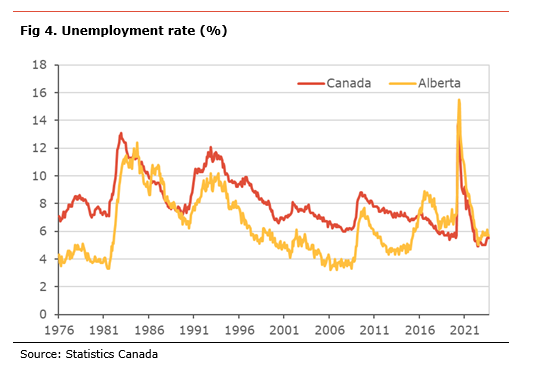

Alberta saw a big drop in employment in September of 38.7k, the most significant monthly decline since April 2020 at the height of the pandemic restrictions. Nevertheless, the unemployment rate remained unchanged due to a reduction in the participation rate. Without criticizing Statistics Canada, it seems that some of the weaknesses could be due to statictical issues in the data and volatility. However, the decline in employment is relatively broad-based, making it hard to pinpoint the problems to a particular data point. The numbers for October should provide some clarity.

Nevertheless, over the past twelve months, the Alberta labour market has been robust in terms of job gains. However, the unemployment rate in Alberta remains higher than the national measure, partly due to the strong population growth. Interestingly, wage growth in Alberta (+6.2% y-o-y) outperformed significantly the rest of the country for the first time since the pandemic(see Where’s the boom? And the rise and fall of the Alberta Advantage for some explanations).

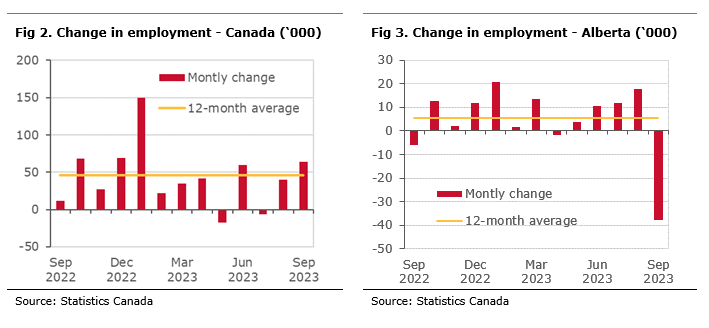

Employment rose by 63.8k in September, stronger than expectations. Despite the strong gains in employment, the unemployment rate remained unchanged at 5.5%. The stable unemployment rate was mainly due to a small increase in the participation rate to 65.6% from 65.5%. The employment rate, the share of the population holding a job, edged higher to 62.0%, as employment gains were stronger than population growth.

Wage growth for permanent workers accelerated to 5.3% y-o-y. The 3-month annualized change in wages also increased to 9.4%, suggesting that wage growth is accelerating.

The details show that the gains in September were both part-time (+47.9k) and full-time (+15.8k) jobs. In addition, the higher employment was mostly in the public sector (+36.6k) and self-employed (+26.1k), while the private sector posted a marginal increase (+1.1k). After being the main job generator over the past year, private sector jobs have declined over the past 3 months.

On an industrial level, the employment gains were mainly in the service sector (+74.3k), while goods-producing sector saw a decline (-10.5k) for a third consecutive month.

The details in the good-producing sector show that the job losses were mainly in construction (-17.5k). This was partly offset by gains in manufacturing (+8.8k). The other goods-producing sectors were little changed.

The gains in the service industry were concentrated in education (+65.8k), reversing the big loss seen in August. Statistics Canada warns that seasonal adjustment issues due to contract timing in the sector could have distorted the data. There were also solid gains in transport and warehousing (+18.9k), accommodation and food services (+11.0k), and professional, scientific and technical services (+8.4k). Losses in finance, insurance and real estate (-19.8k), information, culture and recreation (-12.1k), and trade (-10.7k) partly offset these gains.

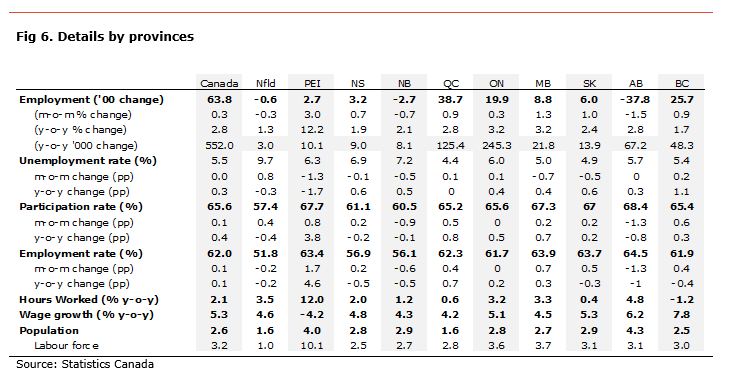

At a provincial level, the job gains were mainly seen in Quebec (+38.7k), BC (+25.7k), and Ontario (+19.9k), while Alberta saw a big decline on the month (-37.8k). The unemployment rate declined in 5 provinces in September, led by PEI (-1.3pp), Manitoba (-0.7pp), New Brunswick (-0.5pp), and Saskatchewan (-0.5pp), but it increased the most in Newfoundland (+0.8pp) and BC (+0.2pp). The unemployment rate is the highest in Newfoundland (+9.7%), New Brunswick (+7.2), and PEI (6.9%). It is the lowest in Quebec (4.4%), Saskatchewan (4.9%), and Manitoba (+5.0%).

Wages increase the most in BC (+7.8% y-o-y), Alberta (+6.2% y-o-y), and Saskatchewan (+5.3% y-o-y). It increased at a slower in PEI (-4.2% y-o-y), Quebec (+4.2% y-o-y), and New Brunswick (+4.3% y-o-y).

In Alberta, employment dropped by 37.8k in August. Despite the sharp job losses, the unemployment rate remained unchanged at 5.7%. This reflects a significant decline in the participation rate to 68.4% from 69.7%. Similarly, the employment rate, the share of the population holding a job, also declined to 64.5% from 65.8%. This is the lowest employment rate since October 2021 during the pandemic.

The job losses in Alberta were mainly in the private sector (-46.6k), while there were gains in the public sector (3.9k) and self-employed (+5.0k). Both the goods-producing sector (-19.6k) and the service sector (+18.3k) saw lower employment.

The decrease in the goods-producing industry was mainly in construction (-18.7k) and manufacturing (-2.8k), while there was a marginal gain in natural resource extraction (+2.0k).

The lower employment in the service sector was relatively broad-based, with 7 of the 11 subsectors showing a decline. The biggest job losses were in trade (-14.9k), professional, scientific and technical (-7.1k), public administration (-6.4k), and other services (-6.3k). Higher employment in education (+14.1k), and transport and warehousing (+5.5k) offset some of these losses.

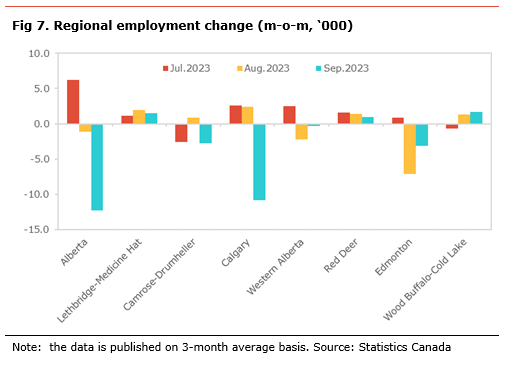

On a regional basis[1], the data is published on a three-month average basis (see table below). Over the past three months, the province lost 12.3k jobs each month on average. Almost all of the declines were in Calgary (-10.1k), Edmonton (-3.1k), and Camrose-Drumheller (-2.7k). There were some gains in Wood-Buffalo-Cold Lake (+1.7k), Lethbridge-Medicine Hat (+1.5k), and Red Deer (+0.9k).

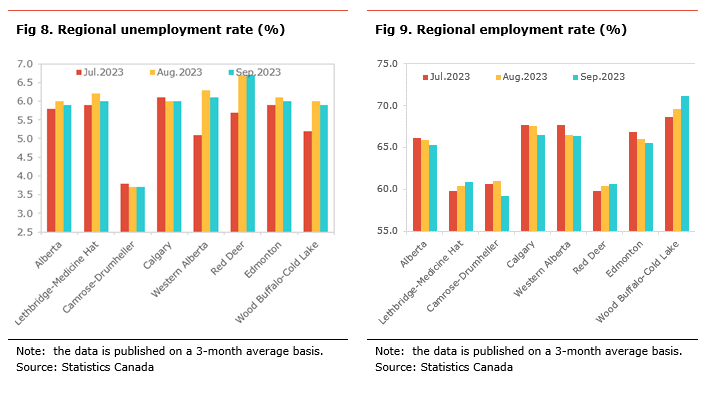

The unemployment rate for the province was slightly lower at 5.9%. The unemployment rate either eased or was unchanged in all regions, with the biggest declines in Western Alberta (-0.2pp) and Lethbridge-Medicine Hat (-0.2pp)

The unemployment rate is the highest in Red Deer (+6.7%), and Western Alberta. It is the lowest in Camrose-Drumheller (3.7%), and Wood Buffalo-Cold Lake (5.9%)

The employment rate for Alberta eased to 65.4%. The employment rate eased the most in Camrose-Drumheller (-1.9pp), Calgary (-1.0pp), and Edmonton (-0.5pp). It increased in Wood Buffalo-Cold Lake (+1.5pp), Lethbridge-Medicine Hat (+0.4pp), and Red Deer (+0.2pp).

[1] All the numbers are expressed as three-month average of the non-seasonally adjusted number.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any organization or person in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication.